BlackRock & Fidelity Rumored XRP ETF Filings — CoinShares’ Exit Clears the Runway Something big is shifting behind the scenes of the XRP ETF race — and honestly, the timing is way too perfect to ignore. On November 28th, CoinShares quietly withdrew its XRP ETF filing (Form S-1, SEC Rule 477).

BlackRock & Fidelity Rumored XRP ETF Filings — CoinShares’ Exit Clears the Runway

Something big is shifting behind the scenes of the XRP ETF race — and honestly, the timing is way too perfect to ignore.

On November 28th, CoinShares quietly withdrew its XRP ETF filing (Form S-1, SEC Rule 477). No shares were ever sold. No transaction ever went through. They simply stepped out of line and walked away.

Most people will glance at this and shrug. But if you’re paying attention, this move says a lot more than what’s written on paper.

And yes — it’s massively bullish.

A Withdrawal Isn’t Weakness… It’s Positioning

CoinShares didn’t “fail.” They didn’t get denied. They voluntarily pulled the filing at a moment when two industry giants — BlackRock and Fidelity — are rumored to be preparing their own XRP ETF submissions.

That’s not a coincidence.

That’s a signal.

When heavyweight asset managers start circling a market, the smaller players know exactly what happens next: the liquidity, attention, and institutional flows shift toward the biggest brands in the room.

CoinShares likely saw the writing on the wall:

- Why fight BlackRock and Fidelity for attention?

- Why compete for liquidity the giants will inevitably dominate?

- Why launch into a market that’s about to be redefined by trillion-dollar institutions?

If you’re CoinShares, you step aside, focus on your Nasdaq merger, and come back later under better conditions.

But for XRP holders?

This is exactly what you want to see.

Why Would BlackRock & Fidelity File Now?

Let’s be blunt: BlackRock doesn’t chase noise. Fidelity doesn’t gamble on hype. These firms move when two conditions line up.

1. Regulatory clarity

The XRP vs. SEC case delivered something institutions have been waiting a decade for:

a ruling that XRP itself is not a security.

ETFs require clear classification. XRP finally has it.

2. Liquidity + infrastructure are ready

Spot ETFs need constant settlement, custody, and reliable liquidity providers. Ripple’s institutional partnerships are now mature enough to support large-scale products.

3. Timing the macro cycle

Institutions don’t buy tops. They position early — before the wave hits. With XRP consolidating for over a year while exchange balances shrink, this is the exact moment big players move quietly.

4. ETF momentum is in full swing

Bitcoin ETFs opened the door. Ethereum ETFs normalized the process. Now the market is ready for the next major real-world asset.

Enter XRP.

The Hidden Bombshell: The Supply Shock Problem

Here’s the part nobody is ready for…

XRP does not have infinite liquid supply available for ETFs.

Not even close.

We already know:

- OTC desks are reporting thin inventory.

- Ripple’s programmatic sales are not occurring.

- CEX balances continue to drop.

- Long-term wallets (5–10+ years) are hitting all-time highs.

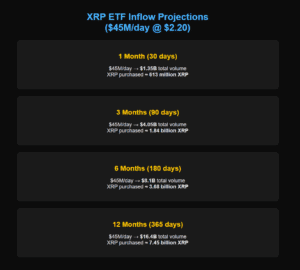

If BlackRock and Fidelity launch XRP ETFs, every dollar coming into the funds must be backed by real XRP. Based on current pricing, inflow scenarios look like this:

- 30 days: 613 million XRP

- 90 days: 1.84 billion XRP

- 180 days: 3.68 billion XRP

- 1 year: 7.45 billion XRP

That’s the kind of demand that cleans out OTC supply, drains exchange liquidity, and forces price to revalue violently upward.

This is why big players want to file now — before the rest of the market realizes the supply imbalance.

CoinShares Stepping Out Is Actually Bullish

People see “withdrawal” and think bearish. But this move does the opposite — it clears the air.

CoinShares stepping aside means:

- Less competition in the SEC approval queue

- More room for major issuers to dominate

- A smoother path for the first flagship XRP ETF

- Higher institutional confidence

If BlackRock or Fidelity truly enter this race, they won’t just launch an ETF — they’ll define the XRP ETF market for years to come.

And when trillion-dollar institutions need XRP in size?

The supply shock becomes inevitable.

CoinShares didn’t leave because the XRP ETF idea was weak. They left because the game is about to change — and the biggest players in finance are positioning themselves.

If BlackRock and Fidelity file, the question won’t be “Who gets approved?”

It’ll be: Who can buy enough XRP before everyone else wakes up?

Related: XRP Price: $12M Max Pain for Bears

Quick Summary

BlackRock & Fidelity Rumored XRP ETF Filings — CoinShares’ Exit Clears the Runway Something big is shifting behind the scenes of the XRP ETF race — and honestly, the timing is way too perfect to ignore. On November 28th, CoinShares quietly withdrew its XRP ETF filing (Form S-1, SEC Rule 477).

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.