Bitcoin experienced a significant drop, hitting a seven-month low before showing signs of recovery. Altcoins displayed mixed performance, with some, like BCH and WLFI, surging while others, such as ZEC, declined sharply.

What to Know:

- Bitcoin experienced a significant drop, hitting a seven-month low before showing signs of recovery.

- Altcoins displayed mixed performance, with some, like BCH and WLFI, surging while others, such as ZEC, declined sharply.

- Market sentiment remains cautious as investors monitor Bitcoin ETF outflows and potential shifts in Federal Reserve policy.

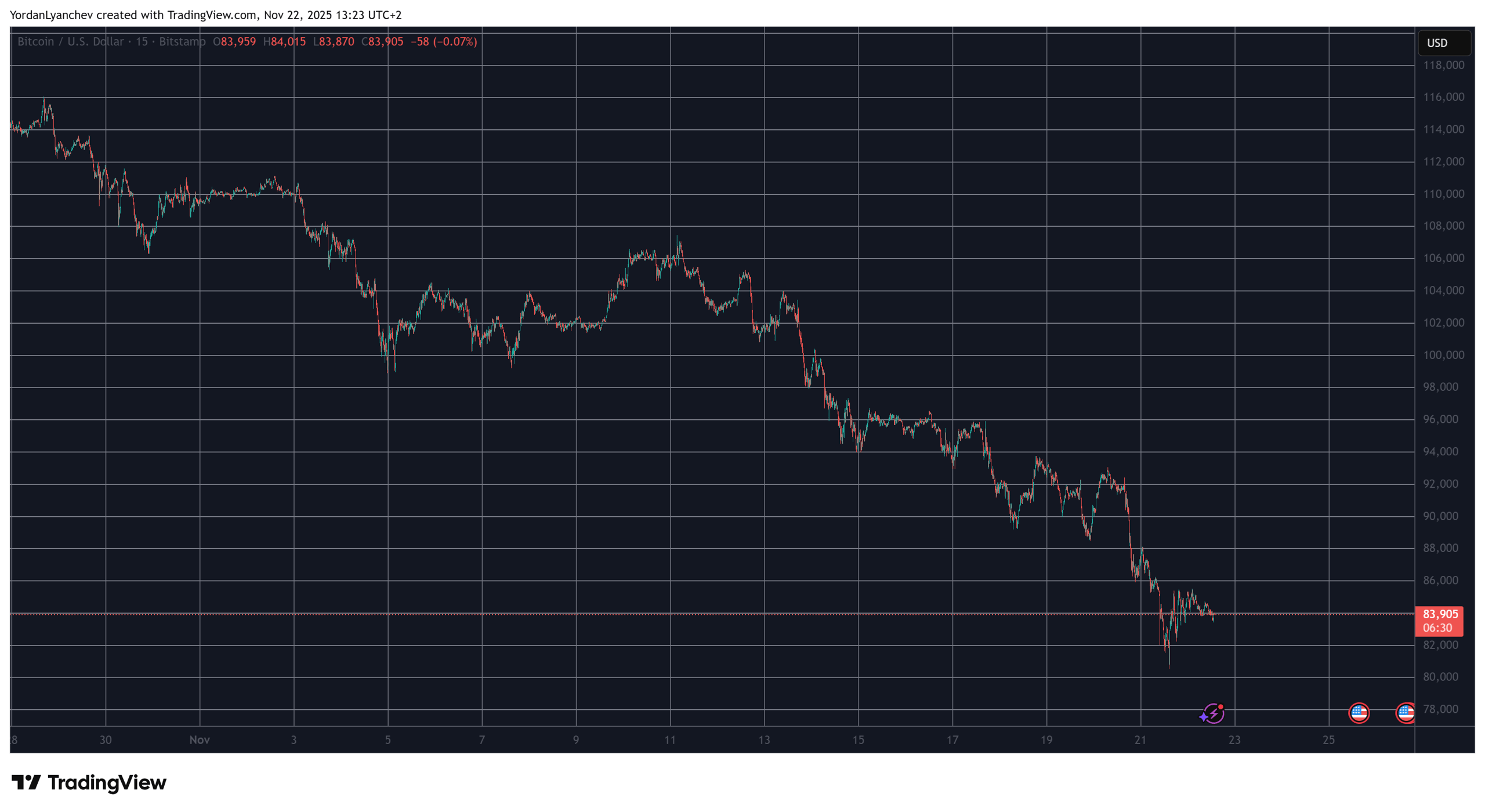

Bitcoin’s price volatility continues to capture the attention of investors and traders alike. The leading cryptocurrency experienced a sharp decline, reaching lows not seen in seven months, before staging a modest recovery. This price action underscores the inherent risks and opportunities within the digital asset market.

Bitcoin’s recent slump below $81,000 was influenced by several factors, including large-scale sell-offs by early investors and increasing outflows from spot Bitcoin ETFs. However, hints from the New York Fed about potential interest rate cuts triggered a temporary price rebound, highlighting the market’s sensitivity to macroeconomic news. Despite the recovery, Bitcoin’s market capitalization remains below $1.7 trillion, indicating lingering caution among investors.

While Bitcoin navigates these turbulent waters, altcoins are charting their own courses, with some experiencing notable gains. BCH and WLFI have seen double-digit percentage increases, reflecting specific developments or positive sentiment around those projects. Conversely, ZEC has faced a significant downturn, illustrating the diverse and often unpredictable nature of the altcoin market.

The recent market activity serves as a reminder of the importance of staying informed and adapting to changing conditions in the crypto space. As Bitcoin attempts to consolidate its position and altcoins carve out their niches, traders should closely monitor market trends, regulatory developments, and macroeconomic indicators to make informed decisions. The interplay between established cryptocurrencies like Bitcoin and emerging altcoins presents a dynamic landscape for those seeking opportunities in this evolving asset class.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

Bitcoin experienced a significant drop, hitting a seven-month low before showing signs of recovery. Altcoins displayed mixed performance, with some, like BCH and WLFI, surging while others, such as ZEC, declined sharply. Market sentiment remains cautious as investors monitor Bitcoin ETF outflows and potential shifts in Federal Reserve policy.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.