Cardano exhibits a historically strong December performance, outperforming Bitcoin and Ethereum in average and median returns. ADA’s price is currently near the lower end of its 2025 range, presenting a potential buying opportunity if historical patterns hold.

What to Know:

- Cardano exhibits a historically strong December performance, outperforming Bitcoin and Ethereum in average and median returns.

- ADA’s price is currently near the lower end of its 2025 range, presenting a potential buying opportunity if historical patterns hold.

- While past performance is not a guarantee, the confluence of historical data and current market positioning suggests a constructive outlook for Cardano in December.

Cardano (ADA) enters December with intriguing historical performance data, suggesting a potential for significant gains. While past performance is never a guarantee, these patterns are closely watched by institutional investors seeking to identify asymmetric opportunities. The question now is whether these historical trends can offer insights into future price action, particularly as market participants position themselves for the new year.

Historical December Performance

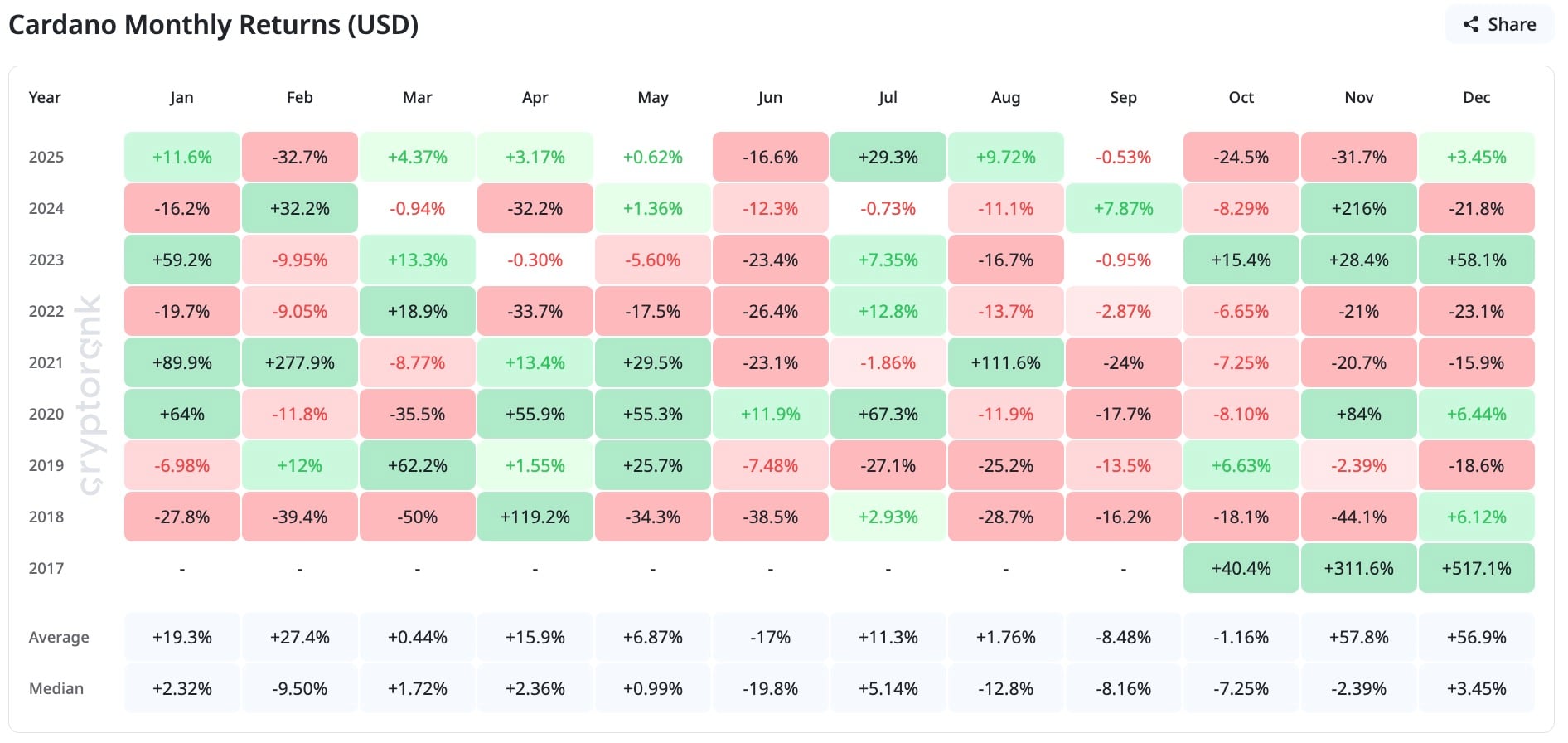

CryptoRank data reveals that Cardano has historically demonstrated impressive December returns, with an average gain of approximately +56.9% and a positive median of +3.7%. This contrasts favorably with Bitcoin and Ethereum, which have lower average and median December returns. The significance of a higher median return suggests greater consistency in positive performance across different market conditions. For institutional investors, this consistency can be more appealing than assets with high average returns but negative medians, such as XRP, which indicates a more binary, boom-or-bust distribution.

Price Chart Positioning

Cardano’s current price chart shows it trading near the lower end of its 2025 range, following a period of price compression that has essentially erased the late-2024 spike. This positioning is notable because ADA tends to perform well in the months following a market cooldown, with December often marking a shift from selling pressure to renewed speculative interest. This pattern aligns with broader market cycles where assets consolidate after periods of high volatility, setting the stage for potential rallies. Savvy investors often view such setups as opportunities to accumulate positions before a potential breakout.

Market Sentiment and Macro Conditions

The potential for Cardano to repeat its historical December performance hinges on prevailing market sentiment and broader macro conditions. If the overall crypto market remains stable or improves, and if there are no significant negative macro events, ADA could indeed emerge as one of December’s top performers. However, it’s crucial to acknowledge that unforeseen events can always disrupt market trends. Factors such as regulatory developments, unexpected economic data, or shifts in investor sentiment could all influence ADA’s price action.

Derivatives and Liquidity Dynamics

Institutional interest in Cardano is also reflected in the derivatives market, where increased trading volume and open interest can provide insights into investor sentiment and potential price movements. Monitoring the liquidity of ADA across various exchanges is also crucial, as higher liquidity tends to reduce price volatility and facilitate larger trades without significant slippage. These factors are particularly important for institutional investors who require deep and liquid markets to execute their strategies effectively.

Regulatory Landscape and Adoption

The regulatory landscape surrounding cryptocurrencies continues to evolve, and any significant developments could impact Cardano’s price and adoption. Clarity in regulations tends to foster institutional adoption, while uncertainty can create headwinds. Additionally, the ongoing development and adoption of Cardano’s blockchain technology, including its smart contract capabilities and decentralized applications (dApps), will play a crucial role in its long-term success. Increased adoption and real-world use cases can drive demand for ADA and support its price appreciation.

Historical Parallels and Future Outlook

Drawing parallels to previous market events, such as the launch of Bitcoin ETFs, can provide context for potential future scenarios. The introduction of ETFs has historically led to increased institutional participation and price appreciation for the underlying asset. If Cardano were to be included in a similar investment vehicle, it could experience a significant influx of capital. Looking ahead, the combination of historical performance, current market positioning, and potential catalysts suggests a cautiously optimistic outlook for Cardano in December.

In conclusion, Cardano’s historical December performance, coupled with its current price positioning, presents an intriguing opportunity for investors. While there are no guarantees in the market, the data suggests that ADA could be poised for a constructive end to the year. As always, investors should conduct their own due diligence and consider their risk tolerance before making any investment decisions.

Related: XRP Targets $2.33 After Breakout

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

Cardano exhibits a historically strong December performance, outperforming Bitcoin and Ethereum in average and median returns. ADA’s price is currently near the lower end of its 2025 range, presenting a potential buying opportunity if historical patterns hold.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.