Grayscale is poised to launch the first U.S. spot ETF for Chainlink, converting its existing private trust into a publicly traded fund. This launch occurs amid a broader trend of increasing regulatory acceptance and institutional interest in crypto-linked ETFs, particularly those focused on altcoins.

What to Know:

- Grayscale is poised to launch the first U.S. spot ETF for Chainlink, converting its existing private trust into a publicly traded fund.

- This launch occurs amid a broader trend of increasing regulatory acceptance and institutional interest in crypto-linked ETFs, particularly those focused on altcoins.

- The new Chainlink ETF will compete directly with other asset managers like Bitwise, potentially driving down fees and increasing accessibility for both retail and institutional investors.

Grayscale is set to introduce the first U.S. spot exchange-traded fund (ETF) for Chainlink (LINK), marking a significant step in the integration of digital assets into traditional financial markets. This move, converting Grayscale’s existing Chainlink private trust into a fully listed ETF, will provide U.S. investors with direct exposure to LINK through a regulated market vehicle. As regulatory adjustments ease resistance to crypto investment products, this launch underscores the growing institutional acceptance of digital assets.

ETF Launch Timeline and Market Context

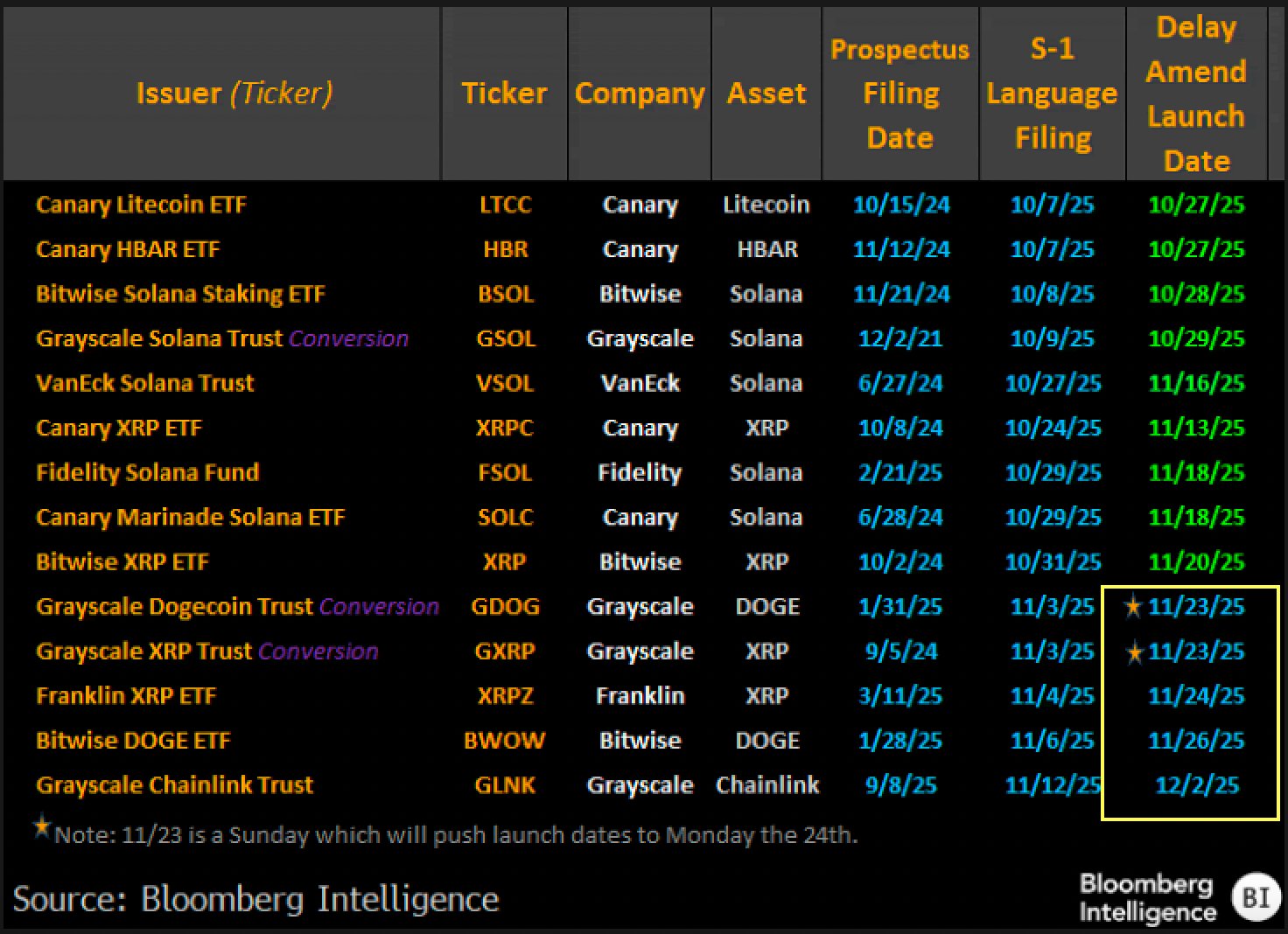

The expected launch aligns with projections indicating near-term approval, driven by internal listings data. Senior analysts anticipate a surge of new crypto-linked ETFs in the U.S. market over the next six months, potentially including multiple spot crypto ETFs in the coming days. This acceleration follows a year of regulatory adjustments, signaling a shift toward mainstream adoption of digital-asset funds.

The timing of this launch is critical, as it reflects a broader trend of regulators becoming more comfortable with crypto investment products. We’ve seen a similar pattern in the past with other asset classes, where initial skepticism gives way to acceptance as the market matures and regulatory frameworks become clearer. This shift is crucial for attracting institutional investors, who often require the security and compliance that regulated investment vehicles provide.

Structure of Grayscale’s Chainlink ETF

Grayscale’s Chainlink ETF will be structured by converting its original LINK trust, operational since late 2020, into a publicly traded instrument. The fund will track the spot price of LINK and may incorporate staking-related returns where regulations permit. This positions Grayscale in direct competition with other asset managers planning their own Chainlink ETFs, potentially attracting both retail and institutional investors seeking exposure to the oracle-focused token.

The structure of the ETF is designed to provide a straightforward and regulated way for investors to gain exposure to Chainlink. By tracking the spot price and potentially incorporating staking rewards, the ETF aims to mirror the performance of the underlying asset as closely as possible. This is particularly appealing to institutional investors who may be restricted from holding digital assets directly but can invest in them through regulated vehicles like ETFs.

Altcoin ETFs Gain Traction

The Chainlink ETF arrives amid increasing interest in altcoin-focused ETFs, with funds tied to Solana, XRP, and Dogecoin recently debuting. Early performance highlights strong investor demand, with significant net inflows recorded on the inaugural days of these ETFs. This momentum is further fueled by additional XRP and Dogecoin ETFs launching, reflecting growing investor appetite for regulated exposure to altcoins.

The success of these altcoin ETFs demonstrates a clear demand for diversified crypto exposure beyond Bitcoin and Ethereum. Investors are increasingly looking to allocate capital to smaller, more specialized crypto assets that offer unique value propositions. The performance of these ETFs in their early days will be closely watched as an indicator of the broader market’s appetite for altcoin exposure.

Implications for Liquidity and Market Structure

The introduction of a Chainlink ETF could significantly enhance liquidity for LINK, attracting a broader range of investors and increasing trading volumes. This could lead to tighter spreads and more efficient price discovery, benefiting both retail and institutional participants. The ETF structure also provides a standardized and regulated way for investors to access LINK, potentially reducing the barriers to entry and increasing overall market participation.

Increased liquidity and market efficiency are crucial for the long-term health of the Chainlink ecosystem. By making it easier for investors to buy and sell LINK, the ETF could contribute to a more stable and liquid market, reducing the potential for price manipulation and increasing investor confidence. This, in turn, could attract more institutional capital and further validate Chainlink’s position as a leading oracle network.

Regulatory and Competitive Landscape

The competitive landscape among asset managers launching Chainlink ETFs is expected to intensify, potentially driving down fees and increasing innovation in product offerings. Regulatory scrutiny will likely remain high as these products gain traction, ensuring investor protection and market integrity. The success of these ETFs will depend on their ability to navigate the evolving regulatory environment and provide investors with a secure and cost-effective way to access Chainlink.

The regulatory environment for crypto ETFs is constantly evolving, and asset managers must stay ahead of the curve to ensure compliance and maintain investor confidence. As more crypto ETFs come to market, regulators will likely increase their oversight and scrutiny, focusing on issues such as custody, valuation, and market manipulation. The ability to navigate this regulatory landscape will be a key differentiator for asset managers in the crypto ETF space.

The launch of a Chainlink ETF by Grayscale represents a significant milestone in the integration of digital assets into mainstream finance. As regulatory acceptance grows and institutional interest increases, these types of products are likely to play an increasingly important role in the crypto market structure. The success of this ETF will depend on its ability to provide investors with a secure, regulated, and cost-effective way to access Chainlink, while also navigating the evolving regulatory landscape.

Related: Chainlink Gain Overshadows XRP

Source: Original article

Quick Summary

Grayscale is poised to launch the first U.S. spot ETF for Chainlink, converting its existing private trust into a publicly traded fund. This launch occurs amid a broader trend of increasing regulatory acceptance and institutional interest in crypto-linked ETFs, particularly those focused on altcoins.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.