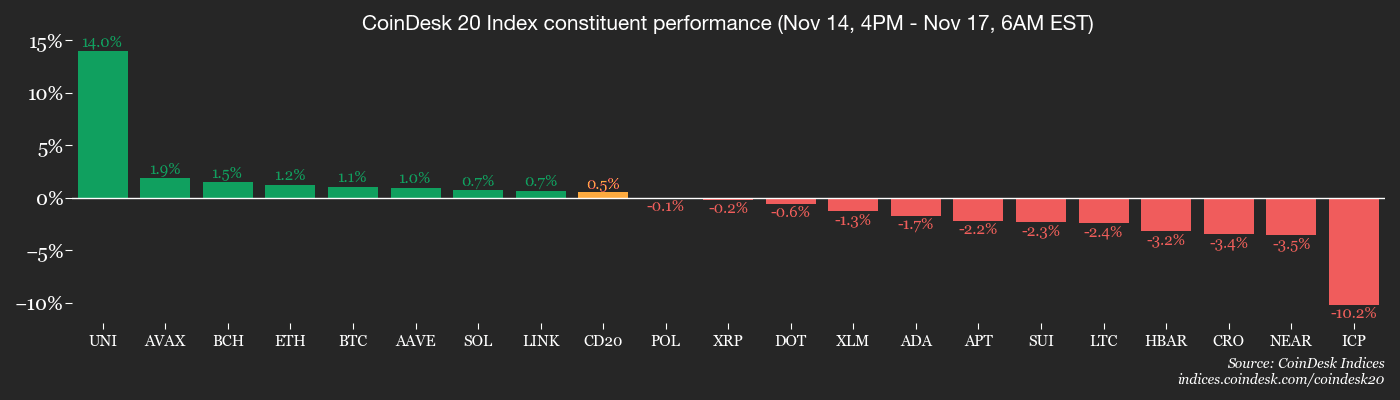

Broader crypto market sentiment is mixed, with privacy coins showing weakness while major cryptocurrencies demonstrate resilience. U.S. regulatory developments regarding ETFs, stablecoins, and exchange oversight could significantly influence investor sentiment.

What to Know:

- Broader crypto market sentiment is mixed, with privacy coins showing weakness while major cryptocurrencies demonstrate resilience.

- U.S. regulatory developments regarding ETFs, stablecoins, and exchange oversight could significantly influence investor sentiment.

- Japanese government bond yields are rising, potentially impacting Treasury yields and risk assets like crypto.

The cryptocurrency market presents a mixed picture as some altcoins face selling pressure while Bitcoin and other major cryptocurrencies hold their ground. XRP, along with Bitcoin and Ethereum, have shown stability, recovering from recent dips. Investors are closely watching these trends to gauge the overall health and direction of the crypto market.

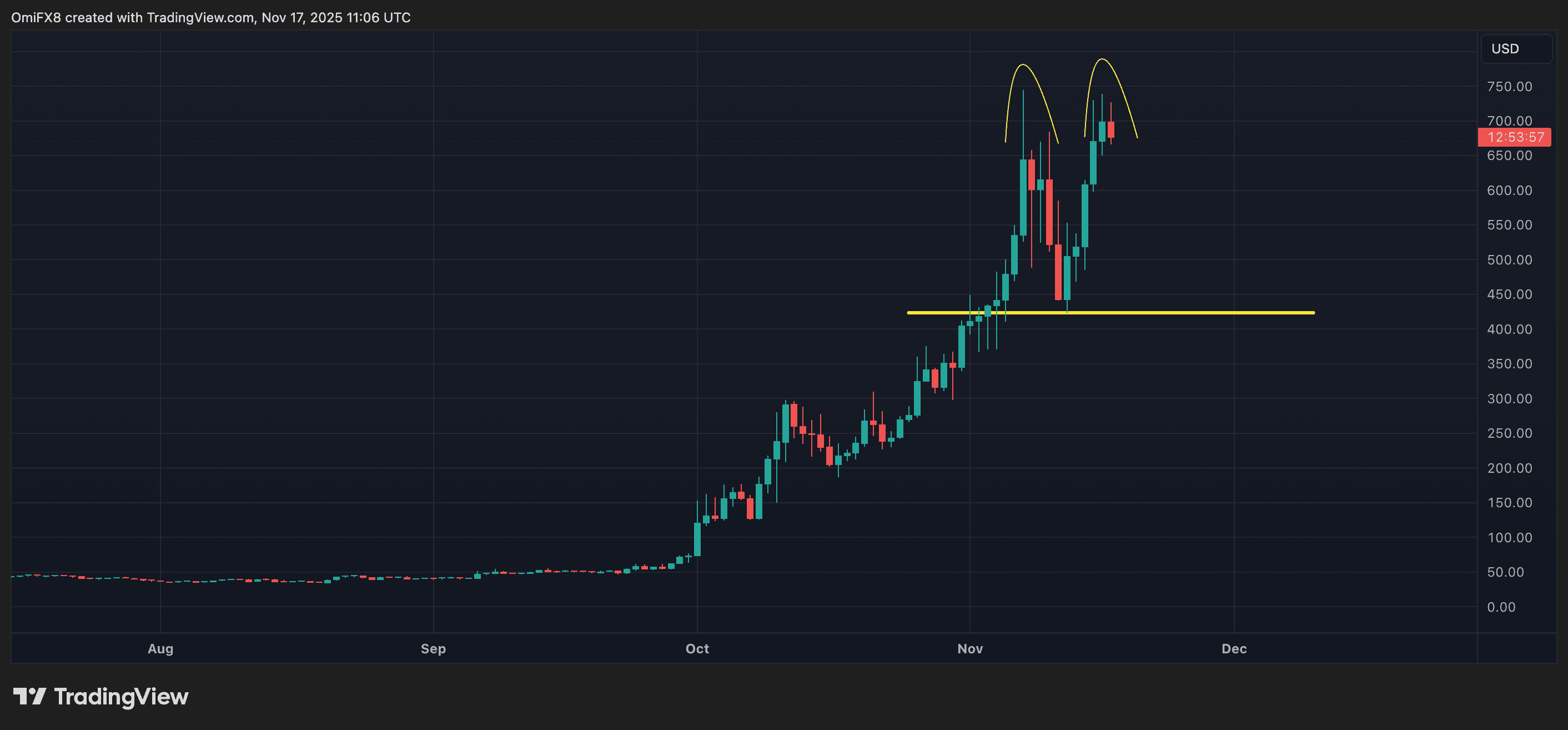

Despite caution in some areas, DeFi and smart contract-focused tokens are showing strength, indicating continued interest in these sectors. Zcash, after a substantial surge, is showing signs of a potential bearish reversal, which could signal broader market shifts. Monitoring the performance of these assets can provide insight into evolving market dynamics.

Ryan Lee, the chief analyst at Bitget urged traders to monitor U.S. regulatory developments, particularly around exchange-traded funds (ETFs), stablecoin payment frameworks and exchange oversight. These could swiftly shift investor sentiment back to a risk-on stance, Lee said.

Developments in traditional markets, such as the rise in Japanese government bond yields, could impact crypto markets by influencing Treasury yields and risk asset appetite. Investors should remain vigilant as these macroeconomic factors can introduce volatility and affect overall market sentiment. The potential for a fiscal crisis in Japan adds another layer of uncertainty.

The cryptocurrency market is navigating a complex landscape with both opportunities and challenges. Monitoring regulatory developments, macroeconomic trends, and the performance of key assets will be crucial for investors looking to capitalize on emerging opportunities and mitigate potential risks. As the market continues to evolve, staying informed and adaptable will be key to success.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

Broader crypto market sentiment is mixed, with privacy coins showing weakness while major cryptocurrencies demonstrate resilience. U.S. regulatory developments regarding ETFs, stablecoins, and exchange oversight could significantly influence investor sentiment. Japanese government bond yields are rising, potentially impacting Treasury yields and risk assets like crypto.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.