Bitcoin’s “apparent demand” metric has turned positive, reaching a three-month high, signaling increased buying interest from long-term holders. U.S.-listed Bitcoin spot ETFs experienced a significant net inflow, indicating renewed institutional interest in Bitcoin exposure.

What to Know:

- Bitcoin’s “apparent demand” metric has turned positive, reaching a three-month high, signaling increased buying interest from long-term holders.

- U.S.-listed Bitcoin spot ETFs experienced a significant net inflow, indicating renewed institutional interest in Bitcoin exposure.

- Despite positive demand signals, derivatives markets show caution, with funding rates remaining subdued, suggesting a measured approach to risk among traders.

The crypto market is showing signs of renewed strength as Bitcoin bounces back, supported by positive shifts in demand metrics. Altcoins like Ether, XRP, and Solana are also seeing positive movement, reflecting a broader market recovery. The focus now shifts to understanding the underlying factors driving this resurgence and its potential sustainability.

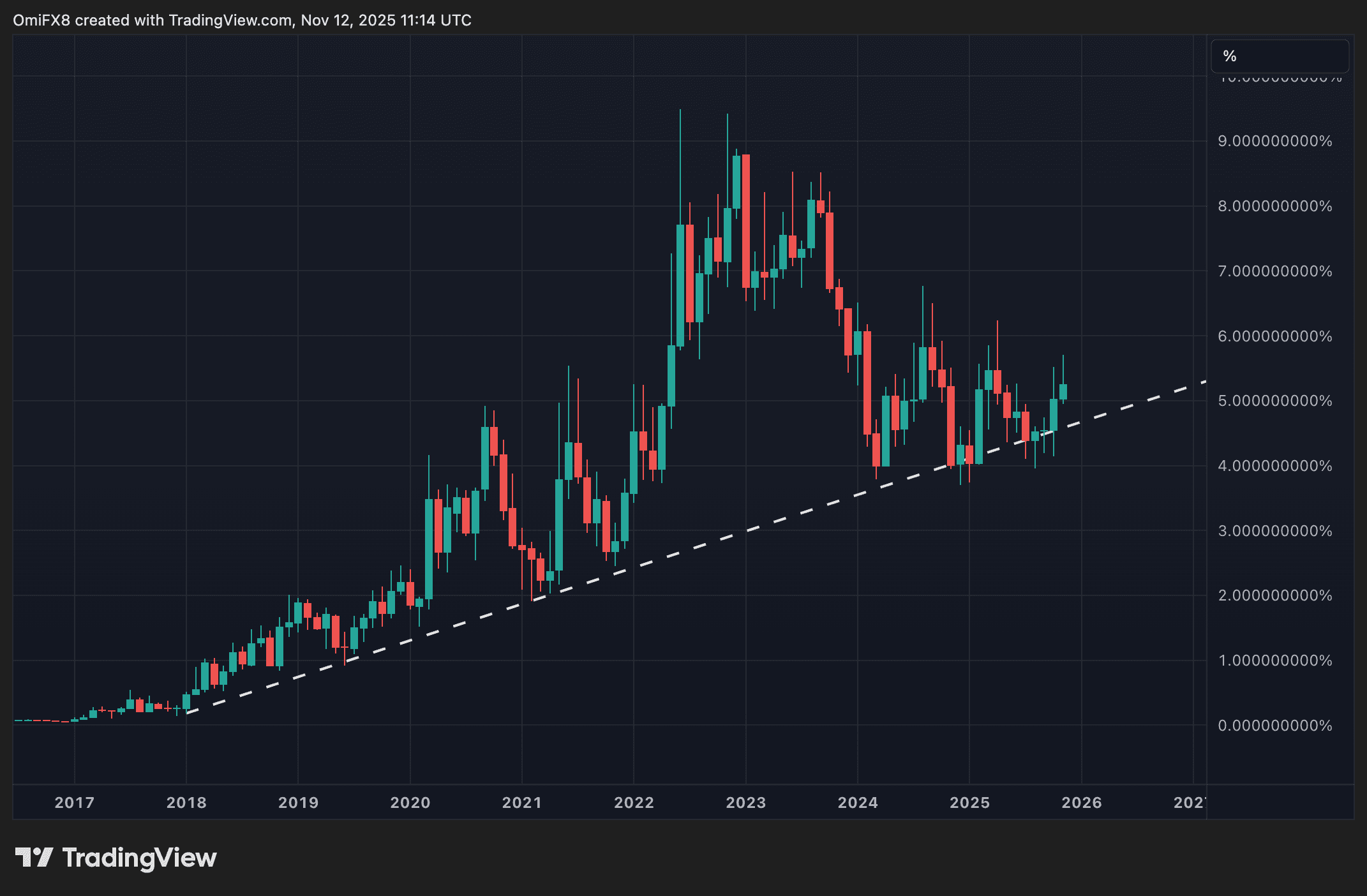

The “apparent demand” metric, which gauges Bitcoin’s issuance against long-term holder behavior, has recently turned positive, soaring to a three-month high. This surge is supported by substantial net inflows into U.S.-listed Bitcoin spot ETFs, marking the highest inflow in over a month. These indicators suggest a growing appetite for Bitcoin among both retail and institutional investors.

Market participants may be growing weary of the drawn-out U.S. government shutdown. As Singapore-based QCP Capital put it: “The Senate’s stopgap bill extending funding through January 30 removes near-term tail risk but does nothing to resolve the underlying fiscal gridlock — a classic ‘kick-the-can’ fix.”

Despite positive demand signals, caution prevails in the derivatives market, with annualized funding rates remaining below average. This cautious approach suggests that traders are carefully managing risk, potentially awaiting further clarity on regulatory and macroeconomic factors. Monitoring these derivatives metrics will be crucial for assessing the market’s true risk appetite.

Kraken Boss Hits Out at UK Crypto Rules (Financial Times): Kraken Co-CEO Arjun Sethi said Financial Conduct Authority warning labels and extra steps create hurdles for investors and leaves most of their U.S. crypto products unavailable to U.K. customers.

The resurgence in Bitcoin demand, coupled with cautious optimism in derivatives markets, paints a nuanced picture of the current crypto landscape. Investors should closely monitor key metrics and regulatory developments to navigate potential opportunities and risks. As the market evolves, staying informed and adaptable will be crucial for success.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

Bitcoin’s “apparent demand” metric has turned positive, reaching a three-month high, signaling increased buying interest from long-term holders. U.S.-listed Bitcoin spot ETFs experienced a significant net inflow, indicating renewed institutional interest in Bitcoin exposure.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.