Bitcoin experienced a sharp correction, falling below $100,000 amid broader market concerns and significant ETF outflows. Despite the price drop, some analysts suggest positioning remains neutral-to-cautious, with no strong appetite for chasing further downside.

What to Know:

- Bitcoin experienced a sharp correction, falling below $100,000 amid broader market concerns and significant ETF outflows.

- Despite the price drop, some analysts suggest positioning remains neutral-to-cautious, with no strong appetite for chasing further downside.

- Macroeconomic headwinds, including uncertainty around interest rate cuts and economic data releases, continue to exert pressure on crypto prices.

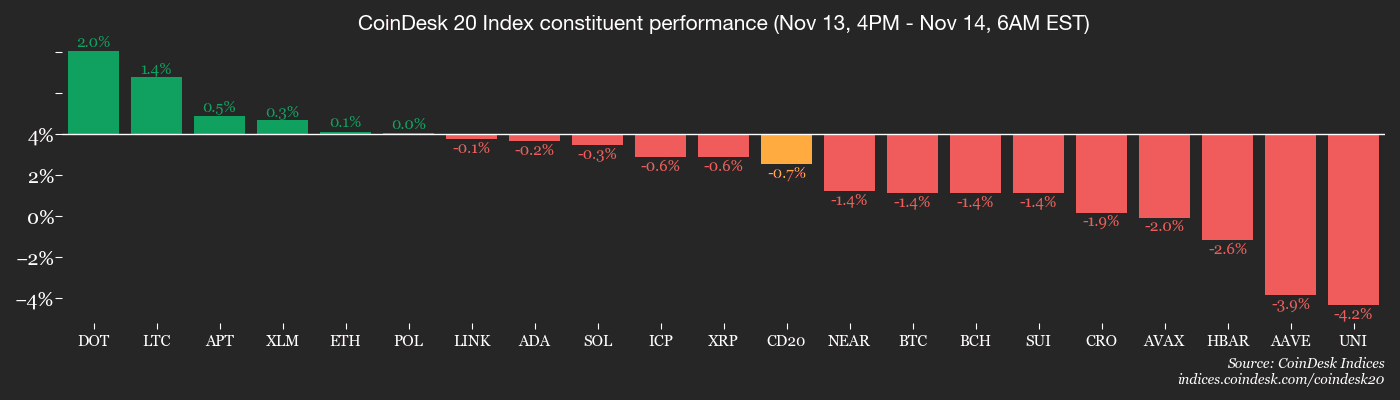

The crypto market experienced a notable downturn, with Bitcoin leading the decline as it slipped below $100,000, impacting overall investor sentiment. Spot Bitcoin ETFs also saw substantial outflows, marking the second-largest daily exit on record, totaling $869 million. This correction arrives amidst a complex interplay of macroeconomic factors and evolving market dynamics.

Despite the recent price drop, some analysts suggest a degree of resilience in the market, noting that positioning leans neutral-to-cautious, with no significant interest in pursuing further downside. This suggests that while concerns exist, there isn’t a widespread expectation of a continued sharp decline. Wintermute observed steady interest in owning long-dated BTC vol around 80-120k, paired with selective short-term call selling.

“We’re seeing steady interest in owning long-dated BTC vol around 80–120k, paired with selective short-term call selling (classic covered call activity),” crypto market maker Wintermute said. “Positioning leans neutral-to-cautious but shows no appetite to chase big downside.”

The broader market context reveals increasing uncertainty regarding future interest rate cuts, with the CME’s FedWatch tool indicating a near toss-up for a rate cut this month. Adding to the uncertainty, the White House has indicated that recent key economic indicators may face delays due to the now-ended government shutdown. Such macroeconomic factors continue to influence investor sentiment across all asset classes, including crypto.

While the crypto sector continues to mature, with milestones like spot ETFs and central bank adoption, it remains susceptible to broader economic trends. Investors should remain vigilant, monitoring both crypto-specific developments and macroeconomic indicators to navigate the evolving landscape. Keeping a close watch on market movements, token events, and upcoming conferences will be crucial for making informed decisions.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

Bitcoin experienced a sharp correction, falling below $100,000 amid broader market concerns and significant ETF outflows. Despite the price drop, some analysts suggest positioning remains neutral-to-cautious, with no strong appetite for chasing further downside.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.