Crypto investment products saw $2.17 billion in inflows last week, the strongest since October 2025. These inflows reflect renewed institutional interest despite macro and geopolitical headwinds. XRP led altcoin inflows, signaling broader risk appetite beyond Bitcoin.

What to Know:

- Crypto investment products saw $2.17 billion in inflows last week, the strongest since October 2025.

- These inflows reflect renewed institutional interest despite macro and geopolitical headwinds.

- XRP led altcoin inflows, signaling broader risk appetite beyond Bitcoin.

Digital asset markets are displaying signs of renewed institutional vigor, with last week’s inflows into crypto investment products reaching levels not seen in years. This influx of capital underscores a growing acceptance of cryptocurrencies as a viable asset class, even as traditional markets grapple with uncertainty. While Bitcoin continues to dominate, the performance of altcoins like XRP suggests a broadening interest in the digital asset space.

Record Inflows and Market Dynamics

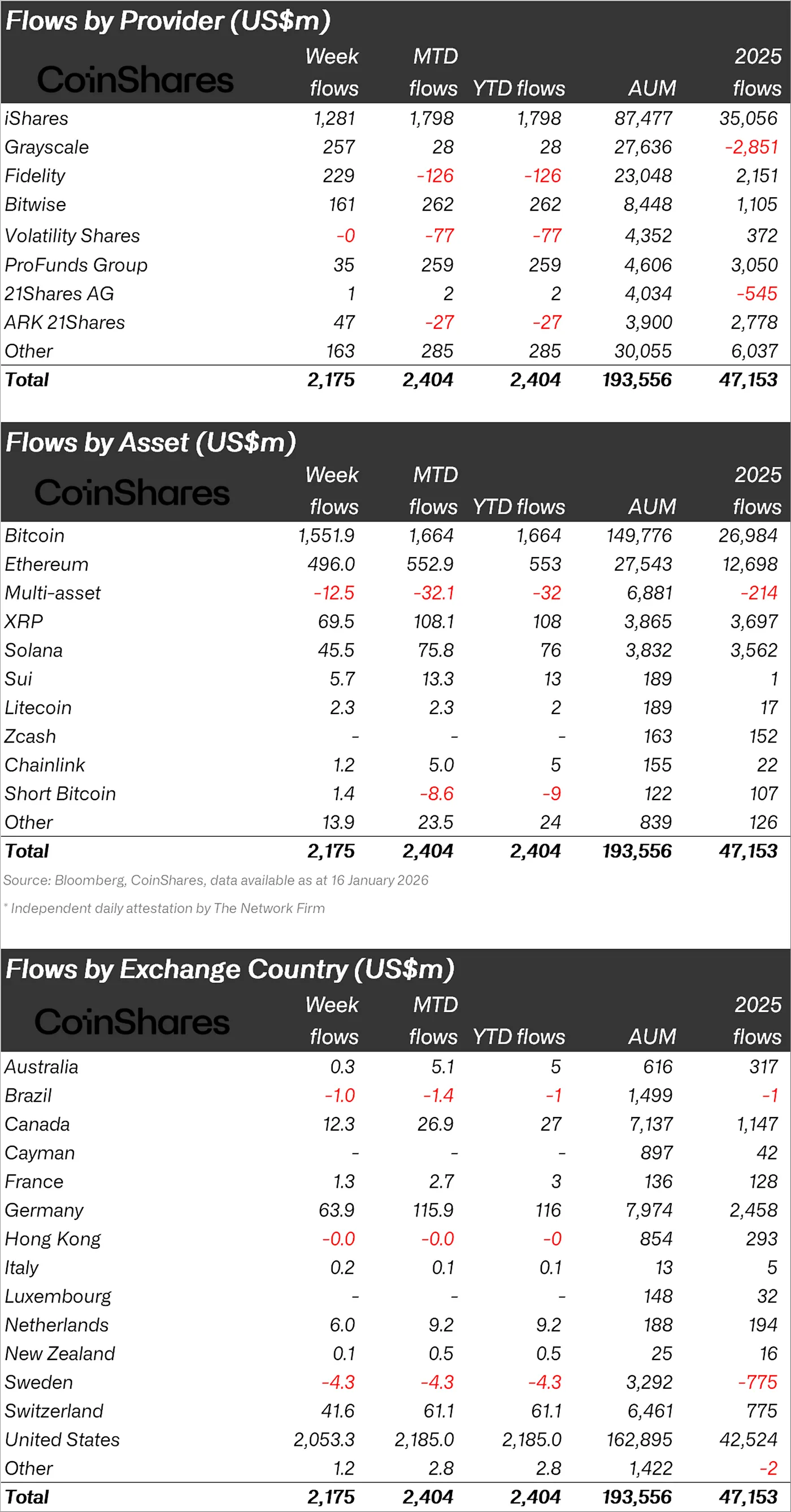

Last week witnessed a remarkable $2.17 billion flowing into crypto investment products, marking the most significant weekly inflow since October 2025. These figures, reported by CoinShares, signal a resurgence of institutional demand for crypto exposure. The inflows were concentrated early in the week, with a late-week outflow of $378 million triggered by geopolitical concerns and renewed tariff threats, underscoring the sensitivity of these markets to global events.

Bitcoin’s Continued Dominance

Bitcoin remains the primary beneficiary of institutional interest, attracting $1.55 billion of the total inflows. This reaffirms Bitcoin’s role as a safe-haven asset within the crypto ecosystem, particularly during times of heightened uncertainty. The ongoing regulatory discussions surrounding the CLARITY Act have done little to slow momentum, with institutions continuing to allocate capital to Bitcoin.

Altcoin Interest on the Rise

Beyond Bitcoin, Ethereum attracted $496 million in inflows, indicating continued confidence in its smart contract capabilities. Solana also saw a healthy $45.5 million added, suggesting investors are diversifying into other layer-1 solutions. XRP led the altcoin pack with $69.5 million in inflows, reflecting potentially renewed optimism around its regulatory outlook and utility. Other altcoins like Sui, Lido, and Hedera also saw inflows, pointing to a broader appetite for risk within the digital asset space.

Regional Flow Distribution

The United States led the regional inflows with a substantial $2.05 billion, highlighting its position as a key market for crypto investment. Germany, Switzerland, Canada, and the Netherlands also contributed with significant inflows, indicating a growing global interest in digital assets. This geographical diversification suggests that institutional adoption is not limited to a single region but is expanding across multiple jurisdictions.

Blockchain Equities as a Sentiment Indicator

In addition to crypto investment products, blockchain equities also experienced inflows of $72.6 million. This combined performance indicates that institutional investors are steadily increasing their exposure to the digital asset ecosystem, even in the face of short-term market volatility. The inflows into both crypto assets and blockchain-related stocks serve as a bullish signal, suggesting a long-term commitment to the space.

The recent surge in inflows into crypto investment products, led by Bitcoin but also including significant interest in XRP and other altcoins, reflects a growing institutional acceptance of digital assets. While macroeconomic and geopolitical factors continue to exert influence, the overall trend suggests a positive outlook for the crypto market. Investors should monitor regulatory developments and global economic conditions to navigate potential risks and capitalize on emerging opportunities.

Related: Bitcoin Signals Safe Haven Amidst Uncertainty

Source: Original article

Quick Summary

Crypto investment products saw $2.17 billion in inflows last week, the strongest since October 2025. These inflows reflect renewed institutional interest despite macro and geopolitical headwinds. XRP led altcoin inflows, signaling broader risk appetite beyond Bitcoin.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.