Spot crypto ETFs have attracted significant inflows, validating the demand for regulated crypto investment vehicles. The increasing number of crypto ETFs will likely drive investors towards diversified crypto index ETPs.

What to Know:

- Spot crypto ETFs have attracted significant inflows, validating the demand for regulated crypto investment vehicles.

- The increasing number of crypto ETFs will likely drive investors towards diversified crypto index ETPs.

- While convenient, crypto index funds come with higher fees and unique risk profiles compared to single-asset ETFs.

The rise of US spot crypto ETFs has transformed the investment landscape, attracting over $70 billion in net inflows since January 2024. This surge highlights the growing acceptance of cryptocurrencies like Bitcoin and Ethereum within traditional financial structures. As the market matures, investors are increasingly seeking exposure through regulated and familiar investment vehicles.

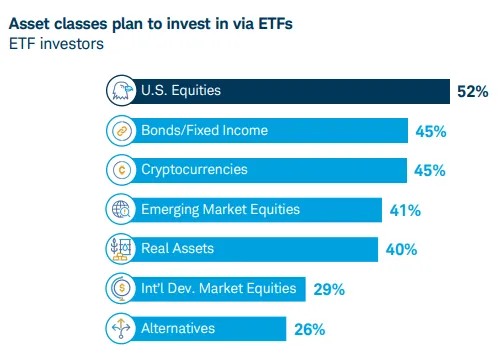

The expected approval of over 100 additional crypto ETFs next year presents wealth managers with a challenge. The decision will shift from simply investing in Bitcoin to selecting from a multitude of single-asset products, requiring extensive due diligence. This complexity is pushing investors towards simpler, diversified solutions.

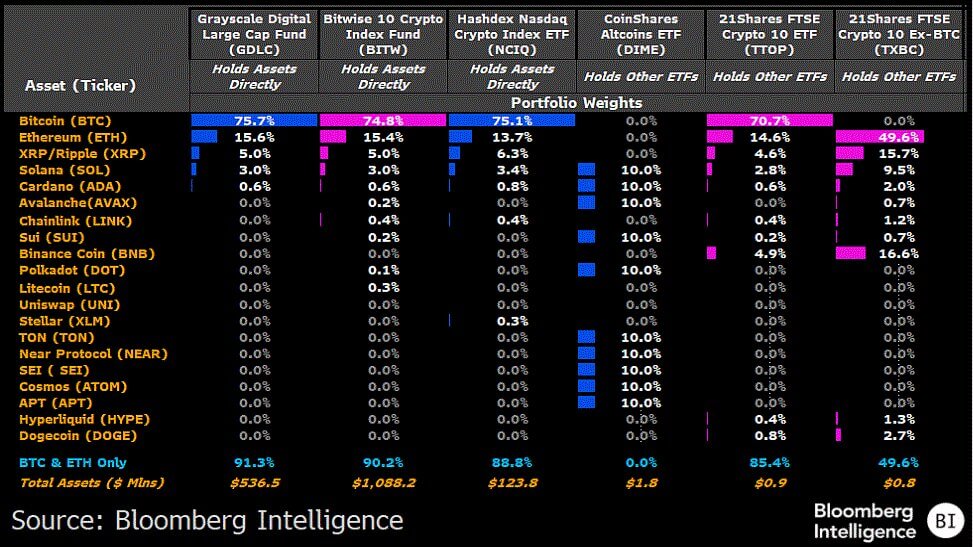

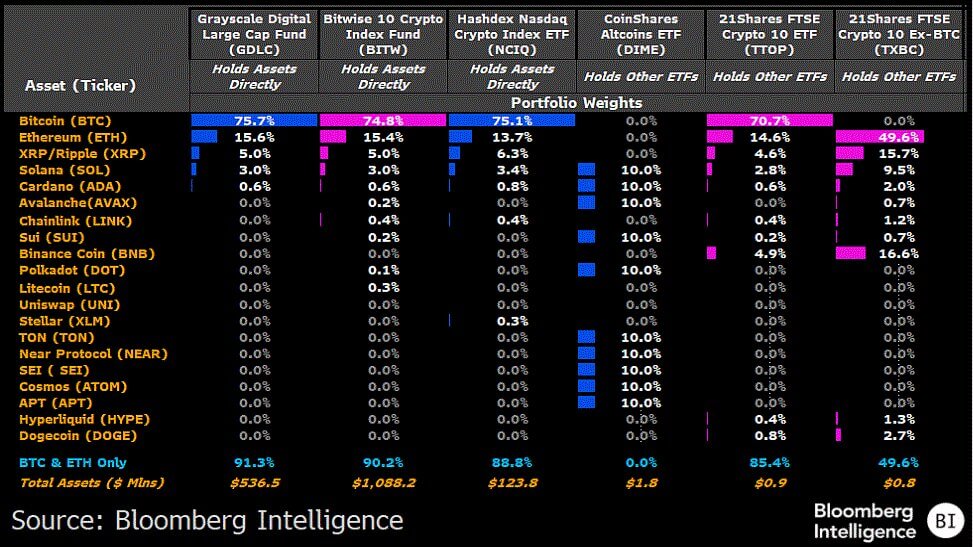

Crypto index ETPs offer a solution by packaging baskets of tokens into a single security, providing broad market exposure. Grayscale’s launch of the CoinDesk Crypto 5 ETF marked a significant step, followed by similar products from Bitwise, 21Shares, Hashdex, and Franklin Templeton. This trend mirrors the evolution in equity markets, where investors often transition from individual stocks to broad index funds as the asset class matures.

Most multi-asset crypto index products share similar holdings, primarily Bitcoin and Ethereum, due to market capitalization and liquidity filters. Grayscale’s Digital Large Cap Fund (GDLC) exemplifies this, with a significant portion allocated to Bitcoin and Ethereum, and smaller allocations to XRP, Solana, and Cardano. The consistent presence of Cardano across various funds highlights the influence of market capitalization on passive fund flows.

However, the convenience of crypto index funds comes at a cost, with higher fees compared to spot Bitcoin ETFs. Rebalancing can be challenging due to lower liquidity in less prominent tokens, potentially leading to adverse trading outcomes. Additionally, the risk profile may not align with expectations, as the diversification can increase beta rather than provide a defensive offset during market downturns.

Looking ahead to 2026, issuers anticipate a shift towards diversified crypto index ETPs. Bloomberg Intelligence ETF analyst James Seyffart expects crypto index ETPs to be a primary category for asset gathering next year. If US crypto ETF flows maintain their current pace, a portion could be directed into index products, potentially ranging from $0.94 billion to $4.70 billion.

Related: XRP Signals Rotation From Bitcoin

Source: Original article

Quick Summary

Spot crypto ETFs have attracted significant inflows, validating the demand for regulated crypto investment vehicles. The increasing number of crypto ETFs will likely drive investors towards diversified crypto index ETPs. While convenient, crypto index funds come with higher fees and unique risk profiles compared to single-asset ETFs.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.