Liquidity across major crypto exchanges has structurally declined since October’s market wipeout. Bitcoin and Ether have seen the most significant and persistent decrease in market depth. Reduced liquidity could lead to sharper price swings and increased volatility in the crypto market.

What to Know:

- Liquidity across major crypto exchanges has structurally declined since October’s market wipeout.

- Bitcoin and Ether have seen the most significant and persistent decrease in market depth.

- Reduced liquidity could lead to sharper price swings and increased volatility in the crypto market.

The crypto market is navigating a landscape of reduced liquidity, especially after the leverage wipeout in October. This environment, characterized by thinner order books, poses both challenges and opportunities for investors and traders. As market participants reassess risk, understanding the dynamics of liquidity is crucial for navigating potential volatility.

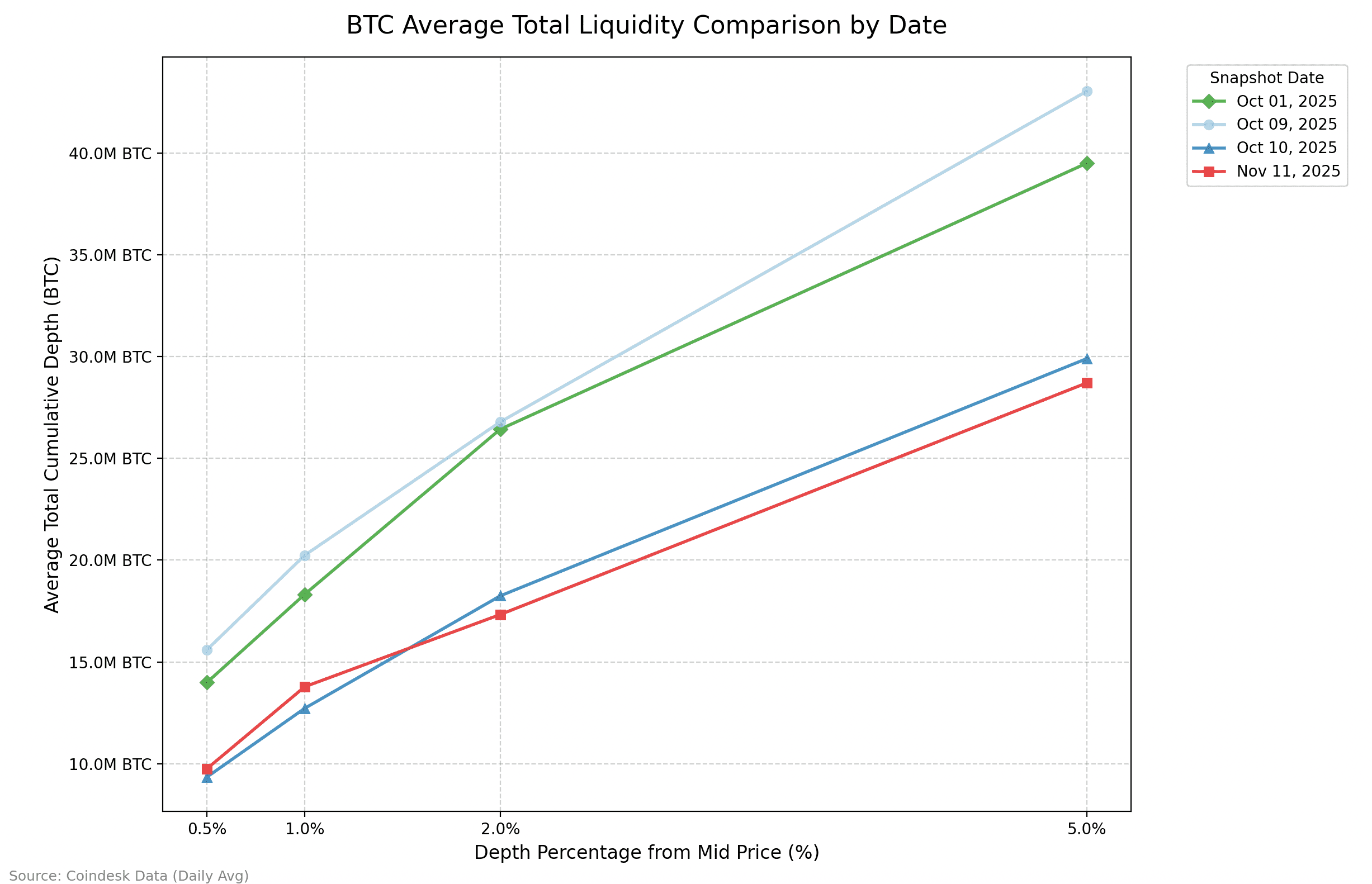

The October liquidation cascade not only erased billions in open interest but also triggered a more subtle shift: a notable exodus of resting liquidity from centralized exchanges. Bitcoin’s average cumulative depth at 1% from the mid-price has slipped from nearly $20 million to $14 million, a decline of almost one-third. Ether shows a similar pattern, with depth at 1% from the mid-price receding from just above $8 million to just under $6 million.

Altcoins, including XRP, SOL, ATOM and ENS, experienced a deeper liquidity collapse but staged a rapid technical recovery, although not to prior strength. This divergence suggests a distinction in liquidity regimes, with altcoins experiencing a knee-jerk collapse and Bitcoin and Ether undergoing a more deliberate withdrawal of liquidity. This impacts not only directional traders but also delta-neutral firms and volatility traders.

Macro factors, including outflows from Bitcoin ETFs and uncertainty around interest rate policies, have contributed to a cautious stance among liquidity providers. The reduced market depth means that less capital is required to move spot markets, potentially leading to sharp price movements. This also leaves the system more vulnerable to liquidation cascades, though it could amplify upside moves if risk appetite returns.

As the year concludes, the crypto market’s structure has been reshaped, with Bitcoin and Ether in a new, thinner liquidity regime. While the future remains uncertain, caution and awareness of these dynamics are essential for traders and investors navigating the evolving crypto landscape, especially as regulatory developments unfold and institutional interest in crypto ETFs continues to grow.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

Liquidity across major crypto exchanges has structurally declined since October’s market wipeout. Bitcoin and Ether have seen the most significant and persistent decrease in market depth. Reduced liquidity could lead to sharper price swings and increased volatility in the crypto market.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.