Bitcoin fell to a 19-day low, triggering a broader market decline. The drop reflects increased market volatility amid global economic tensions. XRP experienced a corresponding dip, highlighting its sensitivity to overall market trends.

What to Know:

- Bitcoin fell to a 19-day low, triggering a broader market decline.

- The drop reflects increased market volatility amid global economic tensions.

- XRP experienced a corresponding dip, highlighting its sensitivity to overall market trends.

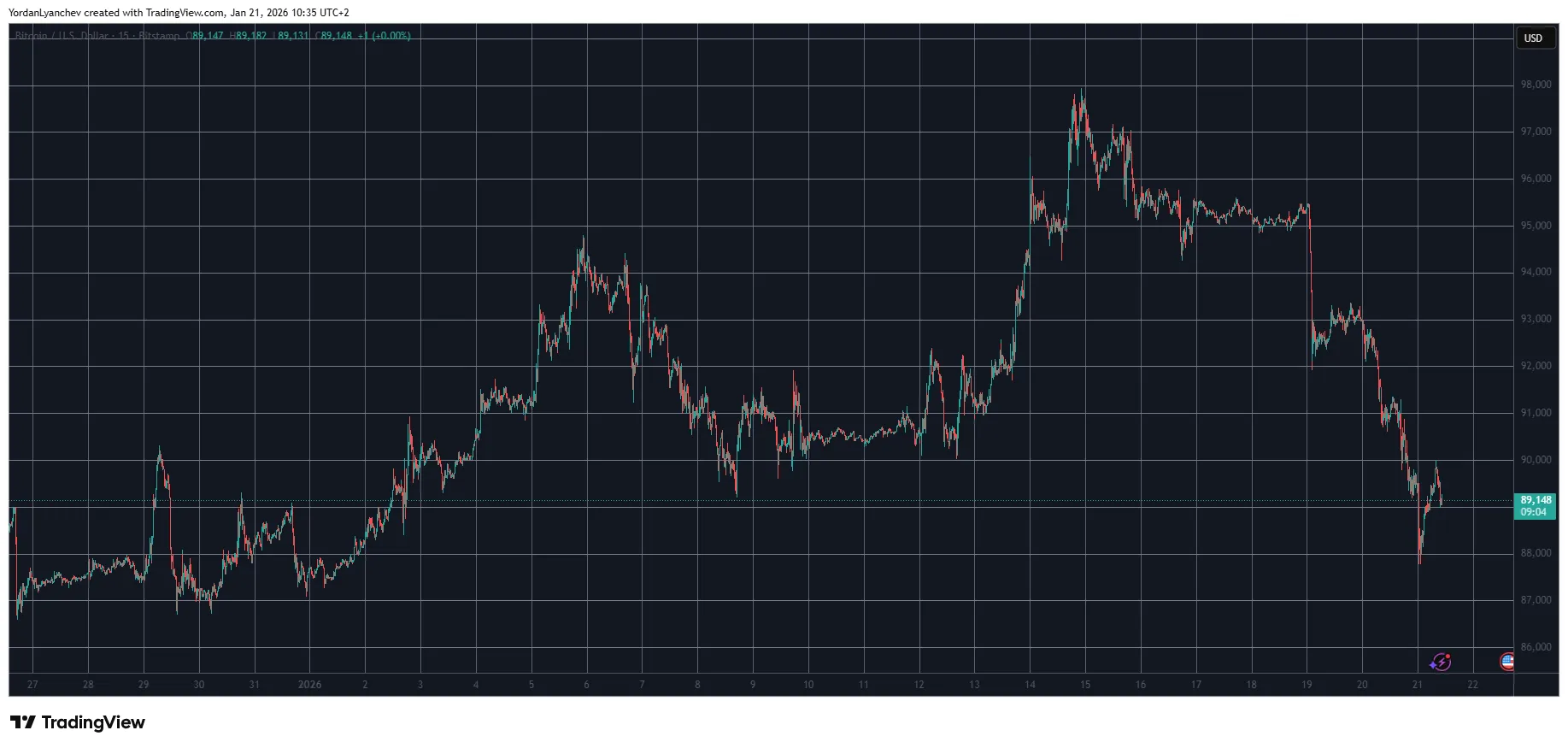

After a promising start to the year, cryptocurrency markets experienced a sharp correction this week. Bitcoin’s tumble below $90,000 rattled investor confidence, leading to a widespread sell-off across altcoins. This downturn underscores the inherent volatility of the crypto market and its susceptibility to macroeconomic factors.

Bitcoin’s Retreat from Recent Highs

Bitcoin (BTC) faced a significant pullback after briefly touching $98,000, a multi-month high. The inability to breach the $100,000 mark led to a wave of profit-taking, exacerbated by growing unease in traditional markets. BTC’s decline to under $88,000 represents a 6% weekly decrease, reducing its market capitalization to $1.780 trillion.

Altcoins Feel the Impact

The altcoin market mirrored Bitcoin’s struggles, with Ethereum (ETH) dropping below $3,000 after holding above $3,300 over the weekend. XRP also experienced a notable decline, falling from $2.10 to $1.90. Other major altcoins like BNB and TRX also saw declines, reflecting the broad market downturn.

XRP’s Price Action

XRP’s price movement closely followed the overall market trend, highlighting its correlation with Bitcoin and Ethereum. While XRP has shown resilience in the face of regulatory challenges, it remains vulnerable to broader market corrections. The dip underscores the importance of monitoring overall market sentiment when assessing XRP’s potential.

Monero and HYPE Lead Declines

Among the altcoins, Monero (XMR) and HYPE experienced the most significant losses, with XMR falling 15% and HYPE dropping over 8%. This demonstrates the higher volatility associated with smaller market capitalization cryptocurrencies. Conversely, CC and WLFI were among the few gainers, highlighting the selective nature of market rallies.

Market Cap Correction

The cumulative market capitalization of all crypto assets has fallen below $3.1 trillion, a decrease of over $250 billion since Monday. This significant contraction underscores the scale of the recent market correction and the impact of Bitcoin’s downturn on the broader crypto ecosystem. Investors should exercise caution and conduct thorough research before making investment decisions during this period of heightened volatility.

Conclusion

The recent cryptocurrency market downturn serves as a reminder of the inherent risks and volatility associated with digital assets. While the long-term outlook for crypto remains positive, investors should remain vigilant and adapt their strategies to navigate these market fluctuations. Monitoring Bitcoin’s price action and overall market sentiment will be crucial for assessing potential opportunities and mitigating risks in the weeks ahead.

Related: Bitcoin Liquidation: $1.5B Signals Market Turn

Source: Original article

Quick Summary

Bitcoin fell to a 19-day low, triggering a broader market decline. The drop reflects increased market volatility amid global economic tensions. XRP experienced a corresponding dip, highlighting its sensitivity to overall market trends. After a promising start to the year, cryptocurrency markets experienced a sharp correction this week.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.