Bitcoin experienced a sharp correction, briefly touching $75,000, impacting the broader crypto market. The downturn followed a week of declines amid macro uncertainties and geopolitical tensions. XRP and other altcoins saw significant drops, affecting liquidity and market sentiment.

What to Know:

- Bitcoin experienced a sharp correction, briefly touching $75,000, impacting the broader crypto market.

- The downturn followed a week of declines amid macro uncertainties and geopolitical tensions.

- XRP and other altcoins saw significant drops, affecting liquidity and market sentiment.

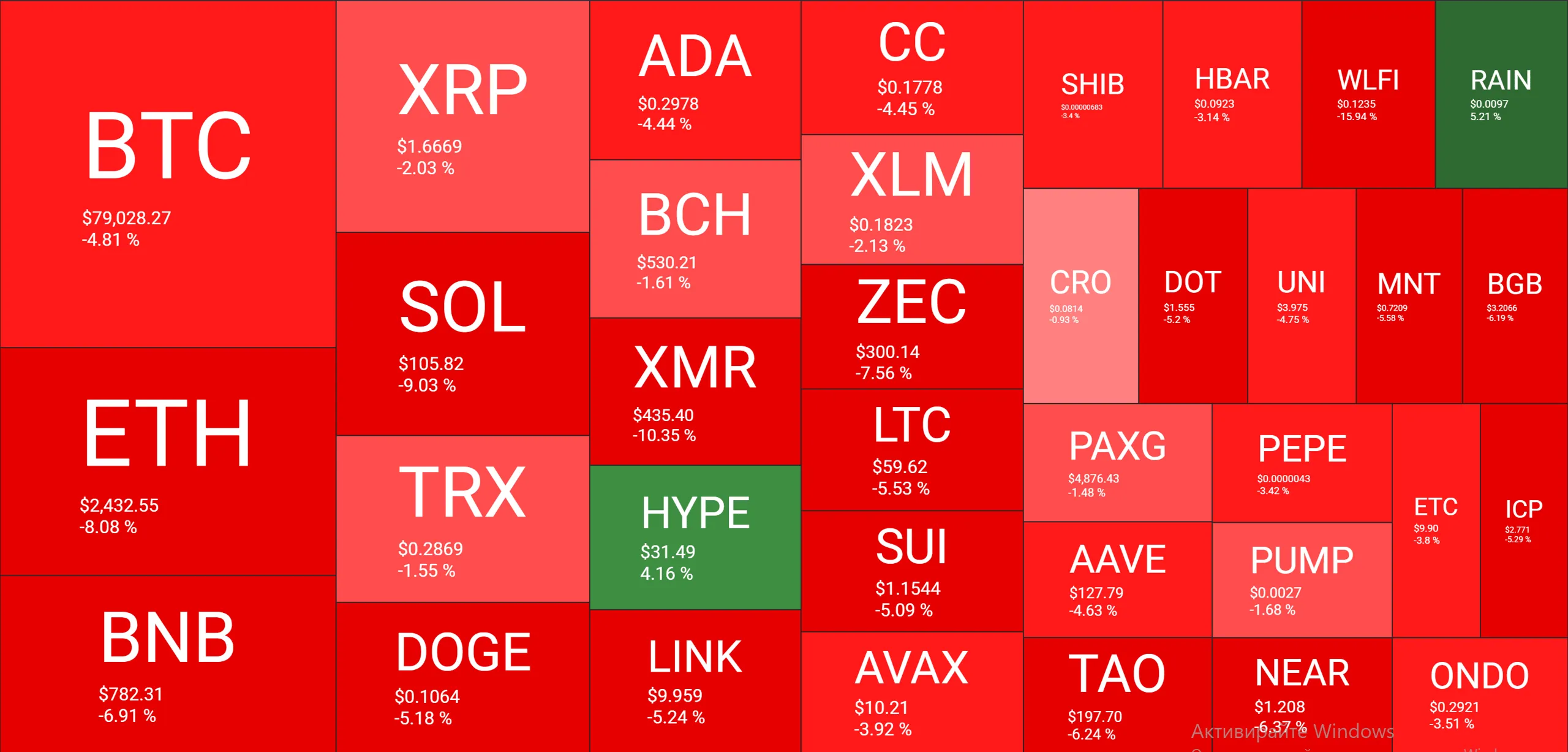

The crypto market experienced a significant downturn this past week, with Bitcoin leading the charge. A sharp sell-off on Saturday saw BTC briefly touch $75,000, a level not seen since April of the previous year. This volatility rippled through the altcoin market, causing substantial losses across the board.

Bitcoin’s Tumultuous Week

Bitcoin’s struggles began the previous week, with an initial drop from $89,000 to $86,000. Subsequent recovery attempts were hampered by the Federal Open Market Committee (FOMC) meeting, where the Fed decided to hold steady on interest rate cuts. Geopolitical tensions further fueled the downturn, with Bitcoin losing $9,000 in a single day, briefly reaching $81,000. The situation culminated on Saturday with a crash to $75,000 before a partial recovery.

Altcoins Feel the Pain

Ethereum mirrored Bitcoin’s decline, falling from $2,800 to $2,250. XRP also experienced a sharp drop, hitting a 14-month low at $1.50. The broader altcoin market followed suit, with most posting double-digit losses at one point. While some altcoins have shown signs of recovery, the overall market sentiment remains cautious.

Market Capitalization Plummets

The total crypto market capitalization experienced a significant contraction, shedding approximately $200 billion. This decline underscores the interconnectedness of the crypto market, where Bitcoin’s movements often dictate the direction of altcoins. The market cap briefly dipped to $2.7 trillion, reflecting the severity of the sell-off.

Factors Influencing the Downturn

Several factors contributed to the market’s downturn, including macroeconomic uncertainty, geopolitical tensions, and profit-taking after a period of sustained gains. The Federal Reserve’s decision to maintain current interest rates added to the uncertainty, while escalating tensions in the Middle East further dampened investor sentiment. These external factors combined with internal market dynamics to trigger the correction.

Looking Ahead

The crypto market’s recent volatility underscores the importance of risk management and diversification. While the long-term outlook for cryptocurrencies remains positive, investors should be prepared for continued price swings in the short term. Monitoring macroeconomic developments and geopolitical events will be crucial for navigating the market in the coming weeks.

Related: XRP: Epstein Email Reveals Enemy Target

Source: Original article

Quick Summary

Bitcoin experienced a sharp correction, briefly touching $75,000, impacting the broader crypto market. The downturn followed a week of declines amid macro uncertainties and geopolitical tensions. XRP and other altcoins saw significant drops, affecting liquidity and market sentiment.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.