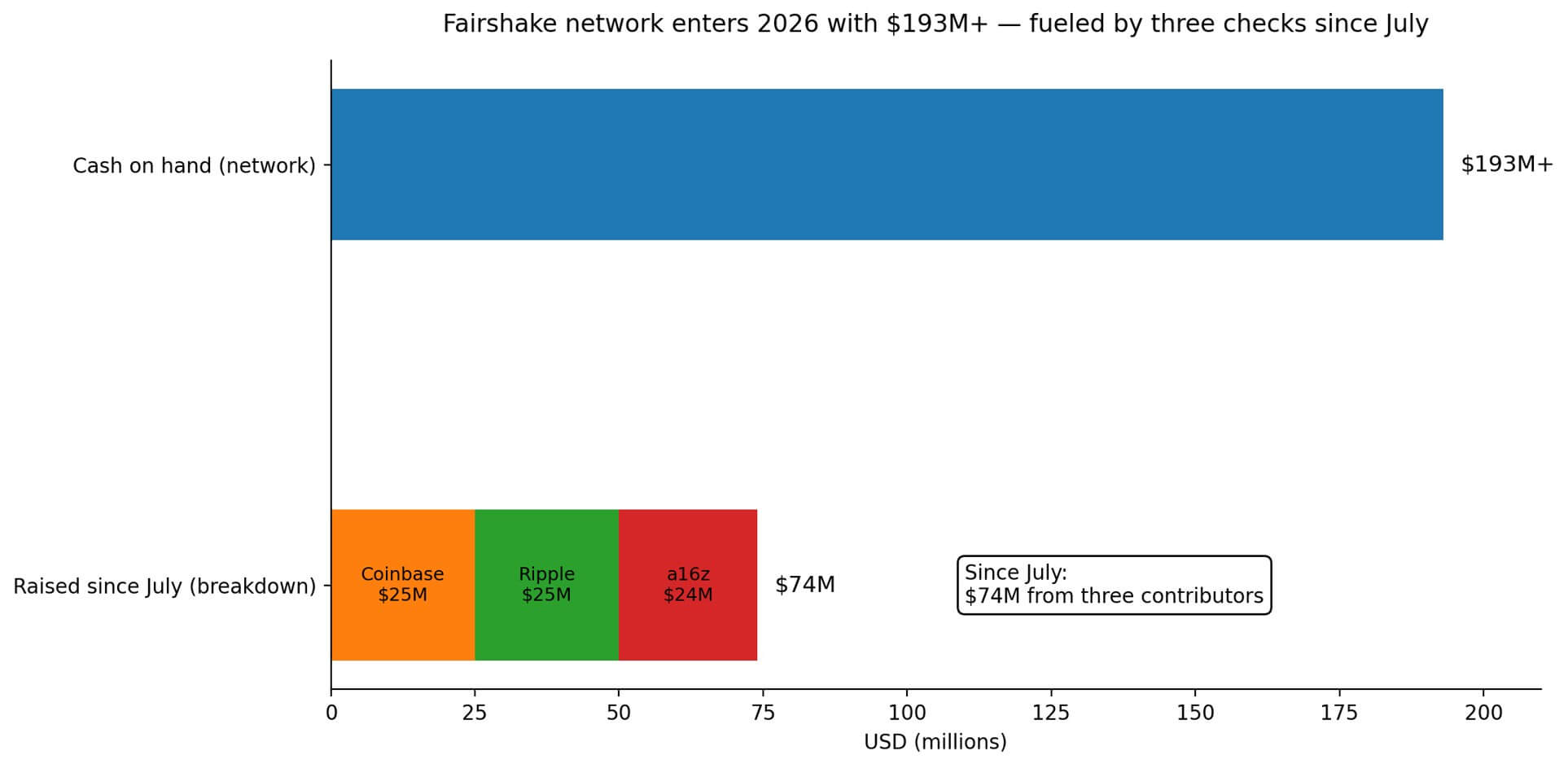

Fairshake and its affiliated super PACs have amassed over $193 million, positioning them as key players in the 2026 midterm elections. The focus is on influencing committee composition in the House and Senate to shape crypto regulations, particularly regarding market structure.

What to Know:

- Fairshake and its affiliated super PACs have amassed over $193 million, positioning them as key players in the 2026 midterm elections.

- The focus is on influencing committee composition in the House and Senate to shape crypto regulations, particularly regarding market structure.

- Potential fragmentation in crypto’s political strategy could impact the effectiveness of bipartisan efforts to achieve regulatory clarity.

Fairshake and its affiliated super PACs are heading into the 2026 midterms with over $193 million in cash, signaling a major push to influence crypto regulations. This substantial financial power aims to shape the composition of key congressional committees that oversee digital assets. The focus is on achieving regulatory clarity and establishing a durable statutory framework for the crypto industry.

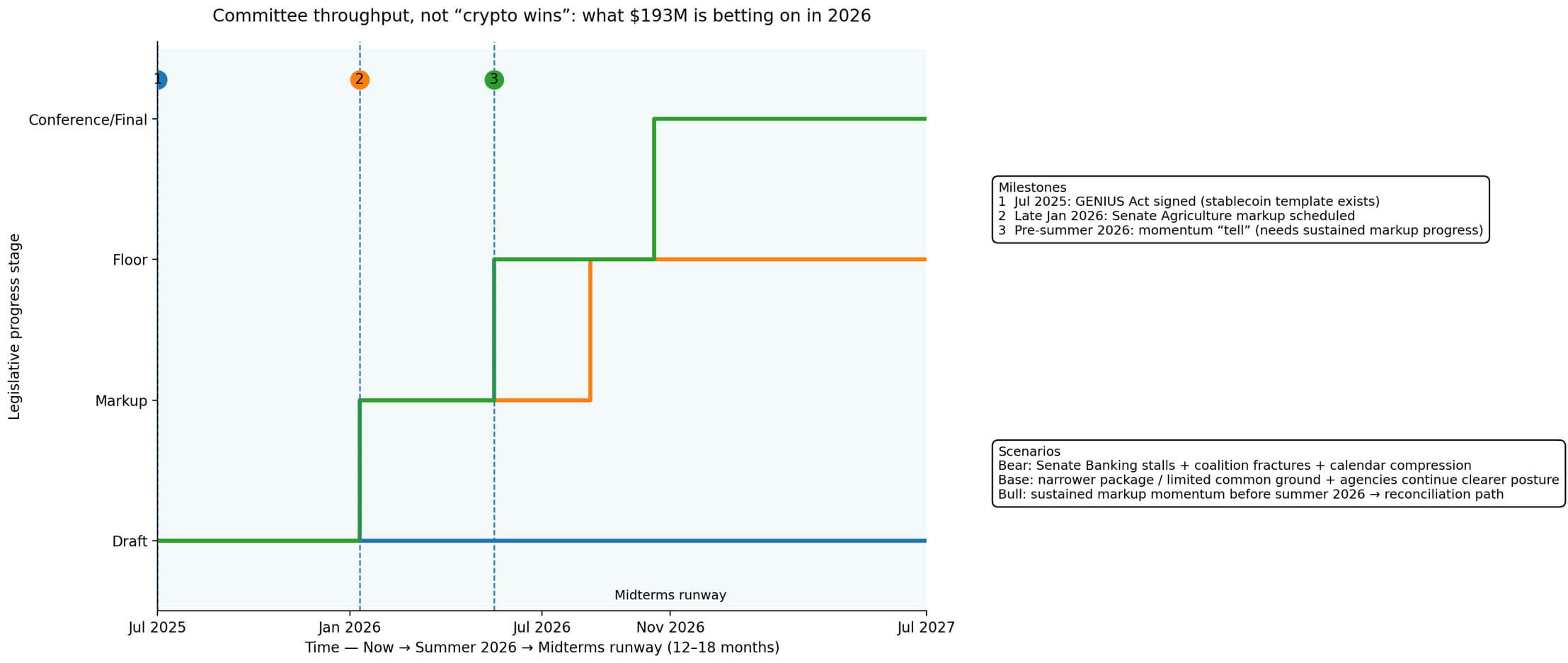

The super PAC’s strategy revolves around influencing committee jurisdiction and agenda control in the House Financial Services and Agriculture committees, as well as the Senate Banking and Agriculture committees. These committees are pivotal in shaping the regulatory landscape for crypto assets, including market structure, oversight of commodities, and the stablecoin perimeter. By strategically targeting key races, Fairshake aims to ensure that favorable legislation is advanced and unfavorable measures are blocked.

The ability to influence committee composition translates directly into shaping the future of crypto regulations. For example, shifts in committee membership can determine who becomes chair or ranking member, influencing the fate of proposed legislation. This strategic approach extends to primary elections, where lower turnout makes it easier to set the narrative and influence voter choices, potentially impacting the selection of candidates who are more favorable to the crypto industry.

Despite the substantial financial backing, challenges remain in achieving a unified crypto policy framework. Divergences in approach between the House and Senate, as well as differing priorities among crypto sectors, can create obstacles to bipartisan consensus. The emergence of new super PACs, such as the one launched by the Winklevoss twins, suggests a potential fragmentation in crypto’s political strategy, with some players hedging their bets by building partisan infrastructure in parallel.

Ultimately, the success of Fairshake’s efforts hinges on converting committee influence into concrete statutory outcomes. A comprehensive market-structure deal would provide lasting regulatory clarity, reducing uncertainty and lowering the cost of capital for crypto businesses. However, failure to achieve consensus could leave the industry vulnerable to shifting agency postures and leadership transitions, underscoring the importance of the 2026 elections in shaping the future of crypto regulation.

Related: XRP Signals Upside Against Bitcoin

Source: Original article

Quick Summary

Fairshake and its affiliated super PACs have amassed over $193 million, positioning them as key players in the 2026 midterm elections. The focus is on influencing committee composition in the House and Senate to shape crypto regulations, particularly regarding market structure.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.