Bitcoin experienced a sharp decline, reaching a two-week low and triggering substantial liquidations in the crypto market. Altcoins, including ETH, SOL, and XRP, faced significant downturns, amplifying the overall market correction.

What to Know:

- Bitcoin experienced a sharp decline, reaching a two-week low and triggering substantial liquidations in the crypto market.

- Altcoins, including ETH, SOL, and XRP, faced significant downturns, amplifying the overall market correction.

- Over-leveraged traders and even seasoned whales suffered considerable losses, highlighting the risks associated with high-leverage trading.

The cryptocurrency market experienced a significant downturn, with Bitcoin leading the decline as it plunged to around $105,000. This sudden drop triggered a cascade of liquidations, impacting both retail traders and institutional players. The broader altcoin market also suffered, reflecting the volatility inherent in crypto assets.

Bitcoin’s sharp rejection at $111,000 initiated the sell-off, leading to over $300 million in BTC long positions being liquidated. Even prominent crypto whales, known for their successful trading records, faced substantial losses. This underscores the potential pitfalls of leveraged positions, regardless of experience.

The 100% win streak is over — trader 0xc2a3 has surrendered.

He closed all his $BTC longs and part of his $ETH and $SOL longs at a loss.

His total P&L has flipped from +$33M to –$17.6M.https://t.co/2I4Jrb3MUA pic.twitter.com/3bSIXFG9JV

Altcoins experienced even steeper declines, with many recording double-digit percentage losses. Major cryptocurrencies such as Ethereum, BNB, XRP, and Solana all saw significant price drops. This widespread correction highlights the interconnectedness of the crypto market and the potential for rapid, synchronized movements.

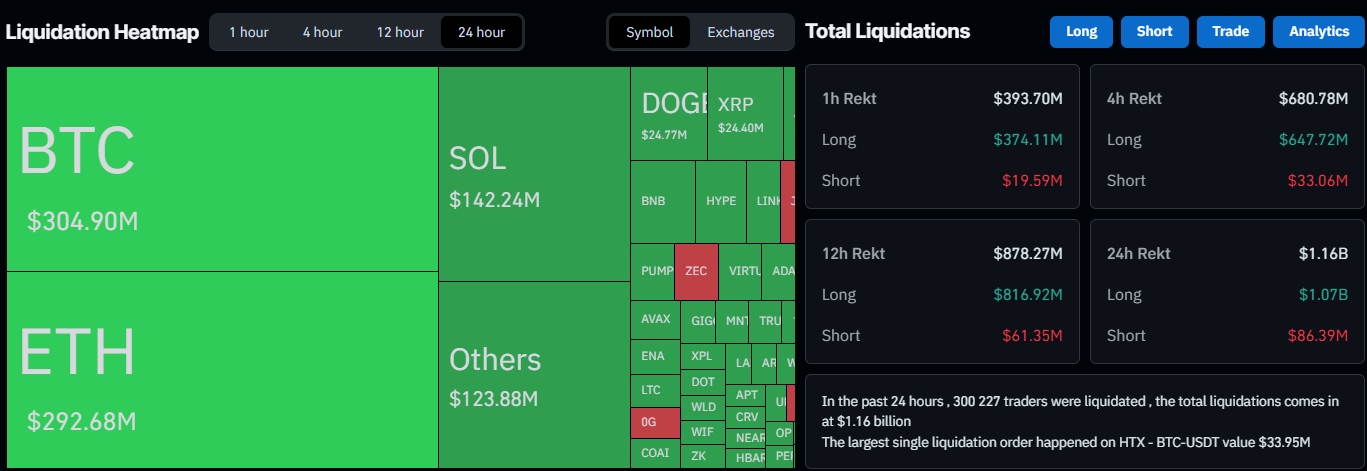

The total liquidations across the crypto market surpassed $1.1 billion, affecting over 300,000 traders. Such large-scale liquidations demonstrate the impact of market volatility and the importance of risk management. As the market evolves, understanding these dynamics will be critical for investors navigating the crypto space, especially as regulatory landscapes and the potential for Bitcoin ETFs continue to develop.

In conclusion, the recent market correction serves as a reminder of the risks inherent in cryptocurrency trading. While volatility can create opportunities, it also underscores the importance of prudent risk management and a well-informed investment strategy.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

Bitcoin experienced a sharp decline, reaching a two-week low and triggering substantial liquidations in the crypto market. Altcoins, including ETH, SOL, and XRP, faced significant downturns, amplifying the overall market correction. Over-leveraged traders and even seasoned whales suffered considerable losses, highlighting the risks associated with high-leverage trading.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.