Bitcoin experienced a sharp decline, falling below $92,000 amidst geopolitical tensions and broader market uncertainty. The downturn impacted most altcoins, with Ethereum and XRP also experiencing notable price drops.

What to Know:

- Bitcoin experienced a sharp decline, falling below $92,000 amidst geopolitical tensions and broader market uncertainty.

- The downturn impacted most altcoins, with Ethereum and XRP also experiencing notable price drops.

- This volatility highlights the sensitivity of XRP and the broader crypto market to global events, potentially affecting liquidity and investor sentiment.

Cryptocurrency markets faced a turbulent start to the week as Bitcoin dipped below $92,000, triggering a widespread sell-off across the altcoin market. This downturn occurred against a backdrop of escalating geopolitical tensions, adding to investor uncertainty. While Bitcoin has since recovered slightly, the overall market remains cautious.

Bitcoin’s Price Drop

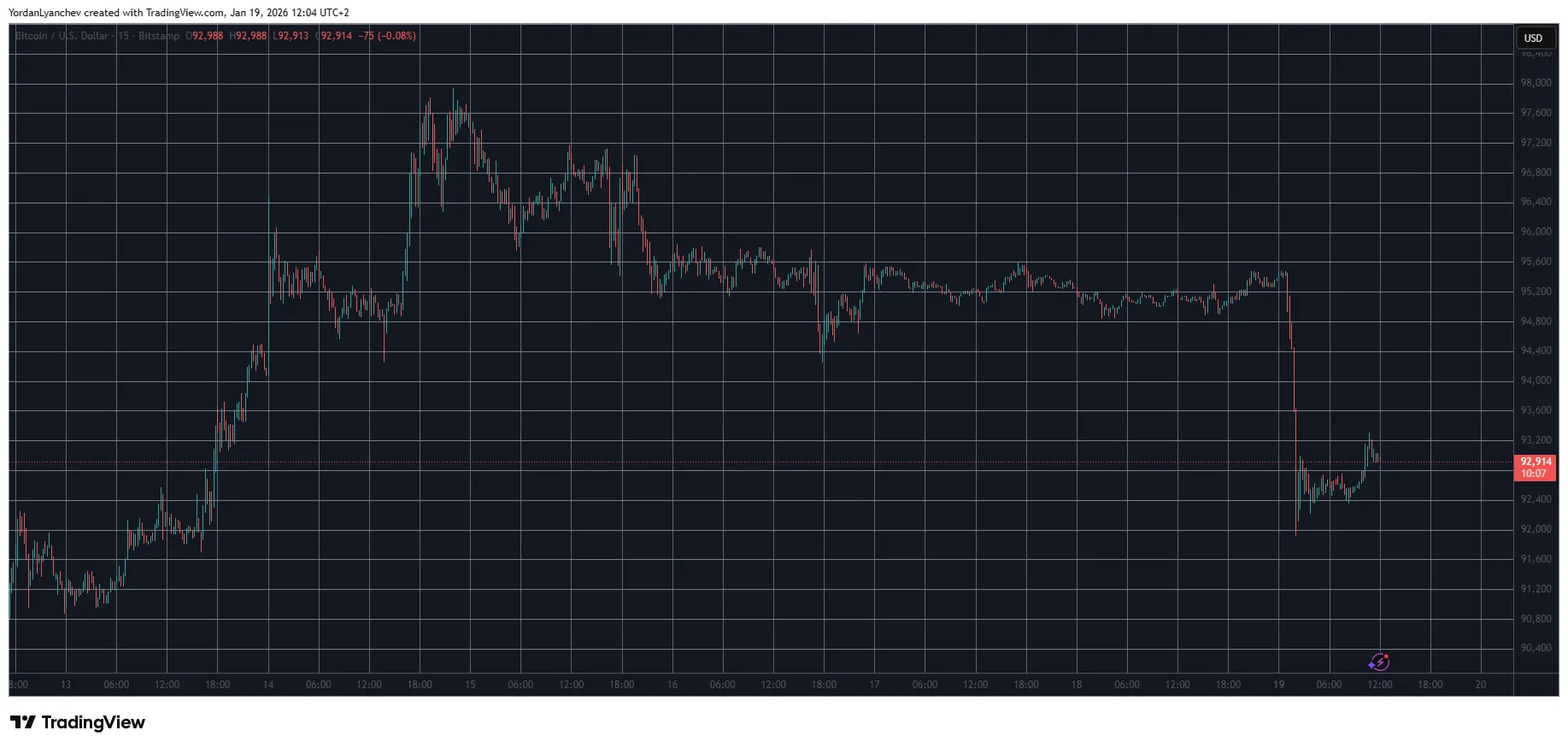

Bitcoin began the previous week with a rally, reaching a multi-month high of $98,000. However, it encountered strong resistance at this level and subsequently remained above $95,000 for several days. Over the weekend, despite escalating geopolitical tensions, Bitcoin remained relatively stable. However, as Asian markets opened on Monday, Bitcoin experienced a sharp decline, falling to a six-day low of just under $92,000. It has since recovered by $1,000 but remains down over 2% on the day. Bitcoin’s market capitalization now stands below $1.860 trillion, with its dominance over altcoins at 57.5%.

Altcoins Experience Significant Losses

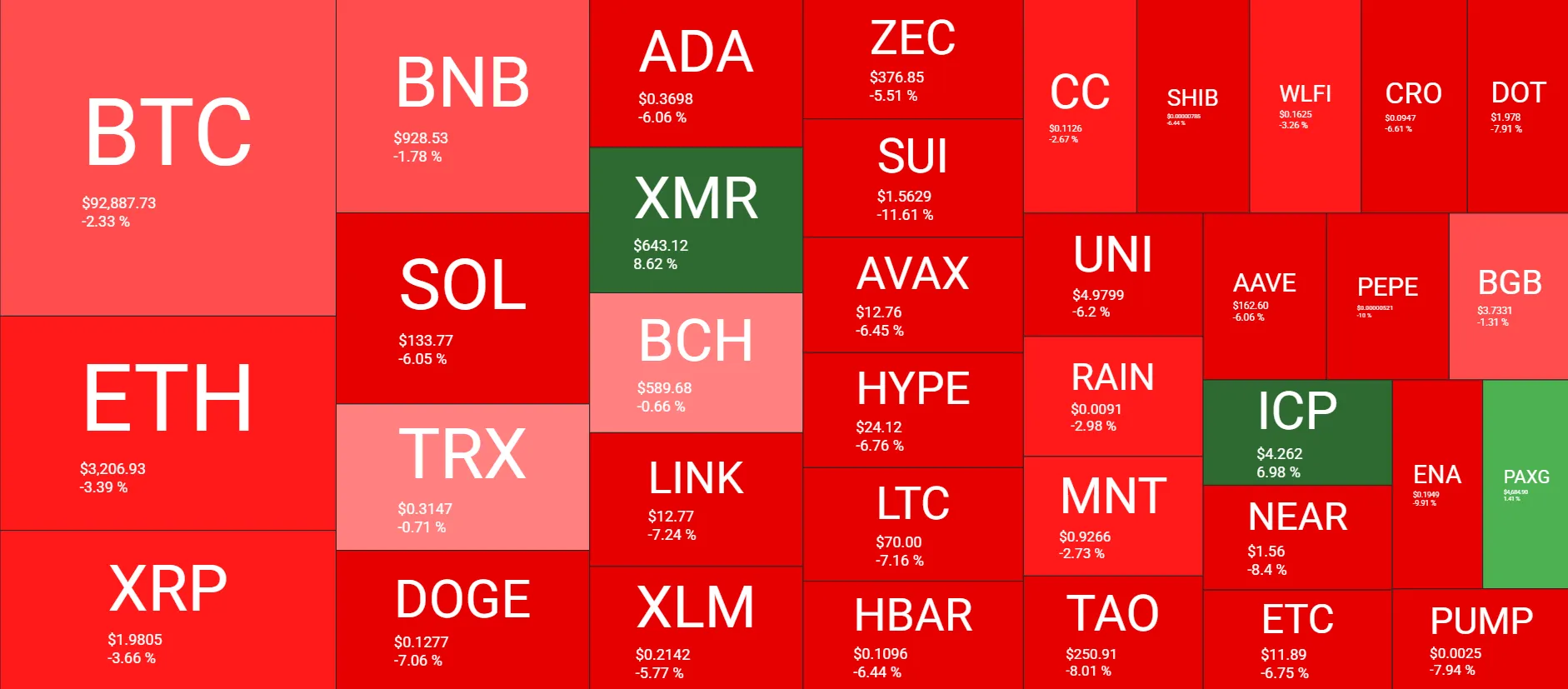

Ethereum faced resistance at $3,350 and is now struggling to stay above $3,200. XRP also experienced a decline, dipping below $2.00 and briefly touching $1.84. Other altcoins, including DOGE, SOL, ADA, LINK, XLM, ZEC, and AVAX, have also suffered significant losses. The most substantial declines were observed in ASTER, SUI, APT, ONDO, ARB, PEPE, and ENA, all of which experienced double-digit percentage drops. XMR and ICP were notable exceptions, trading in positive territory.

Market Capitalization Declines

The total cryptocurrency market capitalization has decreased by $100 billion since yesterday, now standing at $3.220 trillion. This contraction reflects the widespread selling pressure and highlights the interconnectedness of the crypto market, where Bitcoin’s movements often influence the performance of altcoins.

Impact on XRP and Liquidity

The recent market volatility underscores the sensitivity of XRP and other cryptocurrencies to broader market conditions and geopolitical events. For XRP, maintaining liquidity is crucial for its utility in cross-border payments and other applications. Market downturns can reduce liquidity, potentially impacting the efficiency of these processes. Investors should monitor market developments closely to assess potential risks and opportunities related to XRP and its role in the evolving crypto landscape.

Broader Market Context

This market dip serves as a reminder of the inherent volatility in the cryptocurrency space. Factors such as regulatory developments, macroeconomic trends, and technological advancements can all influence market sentiment and price movements. The increasing institutional interest in crypto assets, including the introduction of Bitcoin ETFs, has added a new layer of complexity to market dynamics. Investors should remain vigilant and conduct thorough research before making investment decisions.

In conclusion, the cryptocurrency market is currently navigating a period of uncertainty, with Bitcoin’s recent decline impacting altcoins and overall market capitalization. Investors should exercise caution and stay informed about the factors driving market volatility.

Related: Cardano Founder Attacks Ripple CEO

Source: Original article

Quick Summary

Bitcoin experienced a sharp decline, falling below $92,000 amidst geopolitical tensions and broader market uncertainty. The downturn impacted most altcoins, with Ethereum and XRP also experiencing notable price drops. This volatility highlights the sensitivity of XRP and the broader crypto market to global events, potentially affecting liquidity and investor sentiment.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.