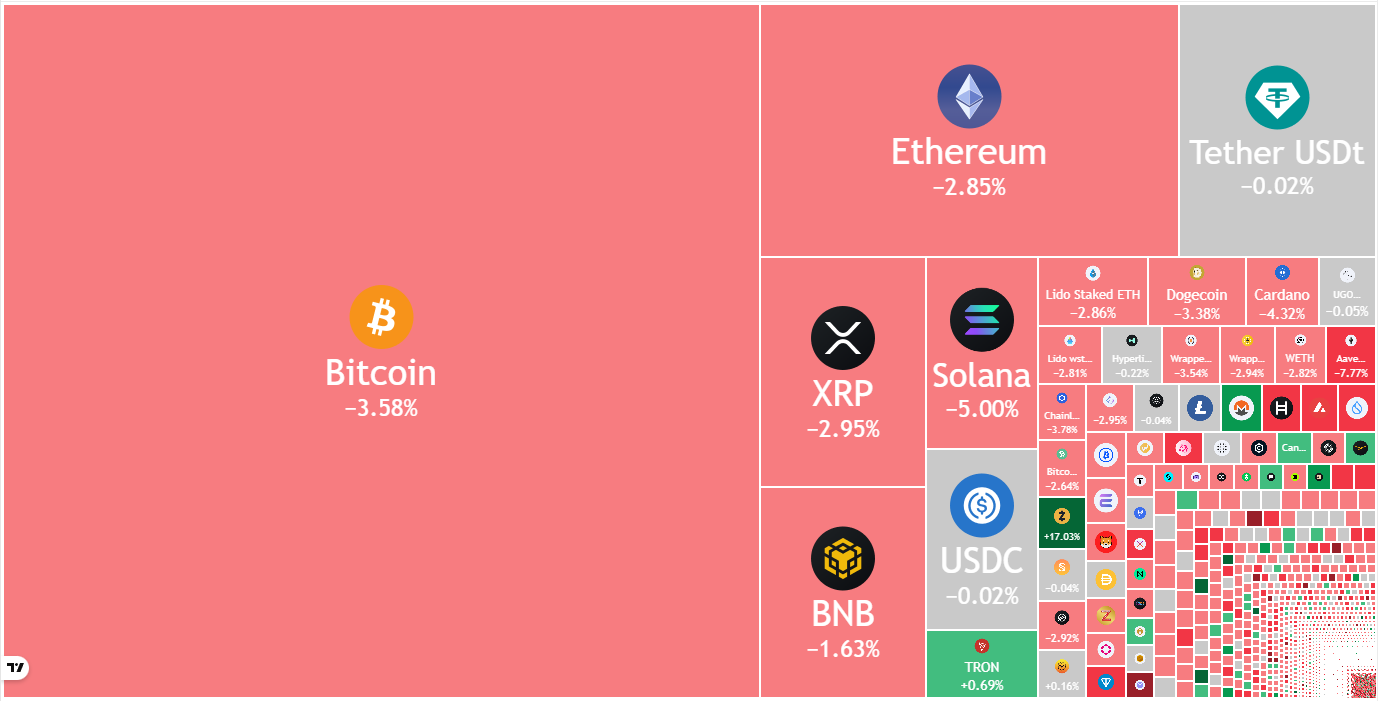

Bitcoin’s recent drop below $100,000 has intensified market concerns, potentially leading to further declines toward $87,800. Altcoins like Ether, XRP, and BNB are testing critical support levels, with potential for significant downward movement if these levels fail.

What to Know:

- Bitcoin’s recent drop below $100,000 has intensified market concerns, potentially leading to further declines toward $87,800.

- Altcoins like Ether, XRP, and BNB are testing critical support levels, with potential for significant downward movement if these levels fail.

- Despite current bearish trends, some analysts predict a possible “unexpected November rally” driven by stronger investors capitalizing on market dips.

Recent market activity has seen Bitcoin struggle, falling below the key $100,000 mark, which has put downward pressure on the broader crypto market. This level was seen as a critical psychological support, and its breach suggests further bearish momentum. Investors are now closely watching to see if Bitcoin can stabilize or if deeper corrections are ahead.

The overall sentiment in the crypto market has shifted, with the Crypto Fear & Greed Index dropping to levels not seen since early March. This heightened fear could lead to increased selling pressure as investors become more risk-averse. However, some analysts suggest this could also signal an upcoming buying opportunity.

XRP is currently testing its 50-day SMA, with analysts warning of a potential drop to $2.06 if support breaks down, followed by a possible fall to $1.61. BNB is also under pressure, approaching a critical $860 support level, with potential declines to $730 if breached.

Despite the current bearish outlook, some analysts remain optimistic about Bitcoin’s long-term prospects. Bitwise CIO Matt Hougan suggests that while a rally in 2025 didn’t materialize as expected, positive underlying fundamentals could set up Bitcoin for a strong performance in 2026.

Santiment noted on X that negative sentiment could indicate an approaching point of capitulation, potentially leading to an unexpected rally. This rally could occur as stronger investors buy up cryptocurrencies from those with weaker hands, suggesting a possible shift in market dynamics.

that the crowd turning negative on BTC suggests the point of capitulation is nearing. An “unexpected November rally” could happen as stronger hands scoop up the cryptocurrencies sold by weaker hands. It added that it was “not a matter of if, but when this will next happen.”

While Bitcoin’s recent performance has raised concerns, the cryptocurrency market remains dynamic, with potential for both further declines and unexpected rallies. Investors should closely monitor key support levels and broader market sentiment to navigate the evolving landscape.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

Bitcoin’s recent drop below $100,000 has intensified market concerns, potentially leading to further declines toward $87,800. Altcoins like Ether, XRP, and BNB are testing critical support levels, with potential for significant downward movement if these levels fail.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.