Bitcoin’s price consolidation above $90,000 validates oversold conditions, hinting at a potential trend reversal. Ripple executives are considering native staking on the XRP Ledger to boost XRP’s DeFi presence.

What to Know:

- Bitcoin’s price consolidation above $90,000 validates oversold conditions, hinting at a potential trend reversal.

- Ripple executives are considering native staking on the XRP Ledger to boost XRP’s DeFi presence.

- Keep an eye on traditional markets as yen weakness and surging bond yields signal possible Bank of Japan intervention.

The crypto market is currently experiencing a period of choppy trading, with Bitcoin consolidating above the $90,000 mark. This price action, however, may be signaling an underlying shift in market sentiment. Technical indicators and key developments in the XRP ecosystem suggest potential for bullish momentum.

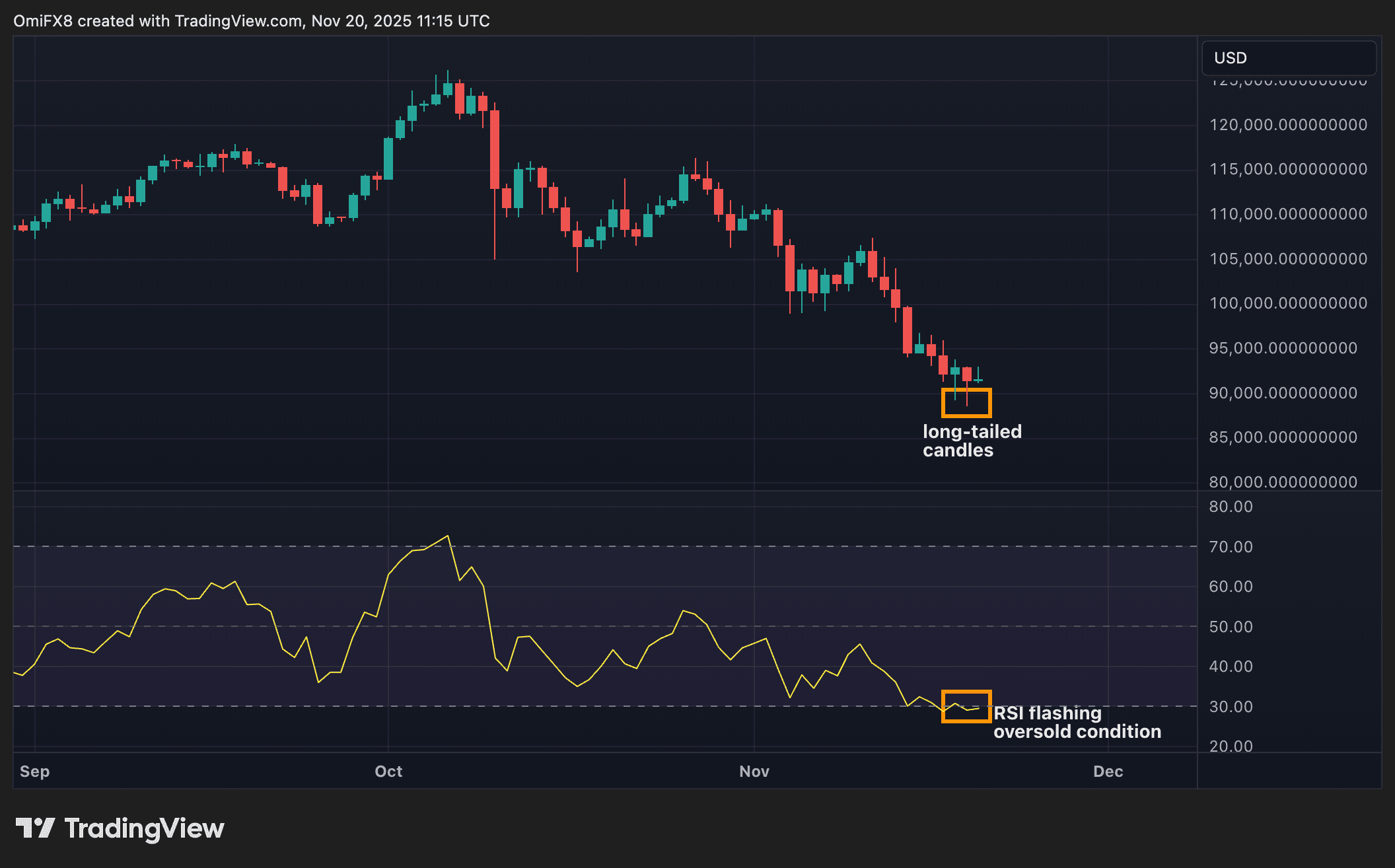

The recent price behavior validates oversold conditions previously indicated by the relative strength index (RSI). The appearance of doji candles with lower wicks signals that sellers may be losing control, suggesting a possible end to the current downtrend. This setup could lead to a short squeeze and a rally if positive news emerges.

Ripple executives are exploring the introduction of native staking on the XRP Ledger. This move could significantly expand XRP’s role in decentralized finance (DeFi) and attract more users to the XRP ecosystem. Such developments are crucial for the long-term growth and utility of XRP.

Base co-founder Jesse Pollak announced on X that his personal token, JESSE, will launch on the Base App, expanding the layer-2’s ecosystem.

In traditional markets, the weakening yen against the dollar, coupled with rising domestic government bond yields, points to fiscal stress. Traders are closely monitoring whether the Bank of Japan will intervene to stabilize the currency. Such interventions can have ripple effects across global markets, including crypto.

- The chart shows BTC’s daily price action in the candlestick format with the 14-day relative strength index (RSI) in the lower panel.

- Back-to-back daily candles with long tails (wicks) indicate failure by bears to keep prices below $90,000.

- This, coupled with the oversold reading on the RSI, suggests scope for a price bounce.

Overall, the crypto market is at an interesting juncture, with technical indicators suggesting a potential shift in momentum for Bitcoin. Developments in the XRP ecosystem and external factors in traditional markets add layers of complexity and opportunity. Staying informed and vigilant is key for navigating these dynamic conditions.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

Bitcoin’s price consolidation above $90,000 validates oversold conditions, hinting at a potential trend reversal. Ripple executives are considering native staking on the XRP Ledger to boost XRP’s DeFi presence. Keep an eye on traditional markets as yen weakness and surging bond yields signal possible Bank of Japan intervention.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.