Custody standards are evolving, with cryptographic accountability becoming a key expectation for investors. The crypto market is currently seeking a new leader to spark the next broad rally, with various assets vying for dominance.

What to Know:

- Custody standards are evolving, with cryptographic accountability becoming a key expectation for investors.

- The crypto market is currently seeking a new leader to spark the next broad rally, with various assets vying for dominance.

- ETH’s recent price surge appears to be driven by Digital Asset Treasury flows rather than organic demand, signaling potential headwinds.

The evolving landscape of crypto custody is prioritizing cryptographic accountability, ensuring transparency and control for investors. As traditional and decentralized finance converge, regulated institutions are increasingly adopting blockchain-native features. This shift emphasizes proving the correct holding of assets, rather than simply holding them.

Multi-signature technology is revolutionizing custody by distributing control and requiring multiple approvals for transactions, enhancing security and accountability. Clients can actively monitor their assets on-chain in real-time, participating in their protection rather than relying solely on institutions. This cryptographic accountability is setting a new standard, making traditional custody models seem outdated.

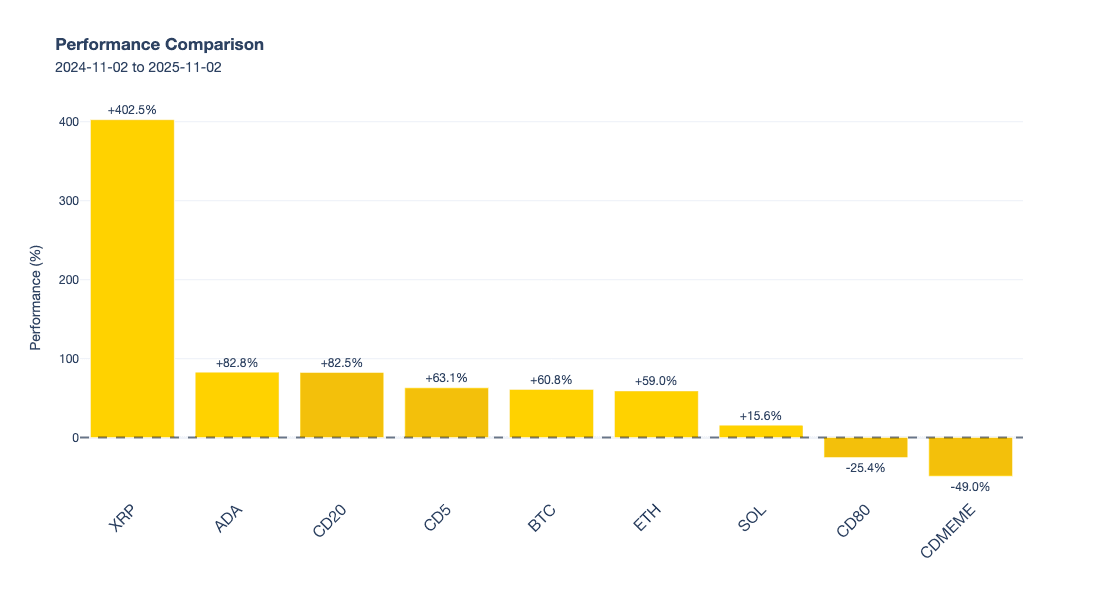

The crypto market is currently in search of a leader to ignite the next significant rally. While Bitcoin led the charge in 2024 through ETF adoption, and Ether saw growth in 2025, other assets like XRP and Solana are vying for prominence. The market is awaiting a catalyst to drive the next wave of institutional and retail investment.

Analyzing ETH’s recent price action reveals that its surge is likely driven by Digital Asset Treasury flows rather than fundamental demand. The divergence between rising ETH prices and declining DeFi pool yields suggests a potential headwind as institutional flows slow down. This highlights the importance of underlying utility and demand in sustaining long-term growth.

In conclusion, the crypto market is undergoing significant shifts in custody practices and asset leadership. Cryptographic accountability is becoming the new standard for secure asset management, while the search for the next market catalyst continues amid evolving dynamics.

Related: XRP Acquisition Finalized by Ripple

Source: Original article

Quick Summary

Custody standards are evolving, with cryptographic accountability becoming a key expectation for investors. The crypto market is currently seeking a new leader to spark the next broad rally, with various assets vying for dominance.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.