Bitcoin and Ethereum’s yield mechanisms face structural limitations, including reliance on external entities or inflationary token issuance. XRP Tundra offers a different yield standard, backed by real protocol revenue from DeFi activities, with a dual-token system and fixed supply.

What to Know:

- Bitcoin and Ethereum’s yield mechanisms face structural limitations, including reliance on external entities or inflationary token issuance.

- XRP Tundra offers a different yield standard, backed by real protocol revenue from DeFi activities, with a dual-token system and fixed supply.

- XRP Tundra provides staking tiers with predictable returns, audited contracts, and a transparent dashboard, presenting a potentially superior yield option.

XRP Tundra is emerging as a compelling alternative in the DeFi space, offering a unique approach to yield generation that contrasts with the models of Bitcoin and Ethereum. This innovative platform is designed to provide sustainable, revenue-backed returns through its DeFi ecosystem. As investors seek dependable yield opportunities, XRP Tundra’s architecture stands out by linking staking rewards to measurable economic activity.

Bitcoin’s fundamental design lacks a native yield mechanism, making users reliant on external platforms that carry counterparty risks. Ethereum, while offering on-chain staking, ties its rewards to network-wide inflation and validator issuance, leading to fluctuating payouts. XRP Tundra distinguishes itself by generating yield from real protocol revenue, creating a more sustainable and transparent model.

XRP Tundra’s architecture is built around two tokens: TUNDRA-S on Solana for high-speed DeFi activity, and TUNDRA-X on the XRP Ledger for governance and reserves. The platform’s revenue model is transparent, with fees from swaps, borrows, lends, bridges, and derivatives transactions directly funding the staking vault. This approach mirrors successful models like GMX and Gains Network, known for their transparency and sustainability.

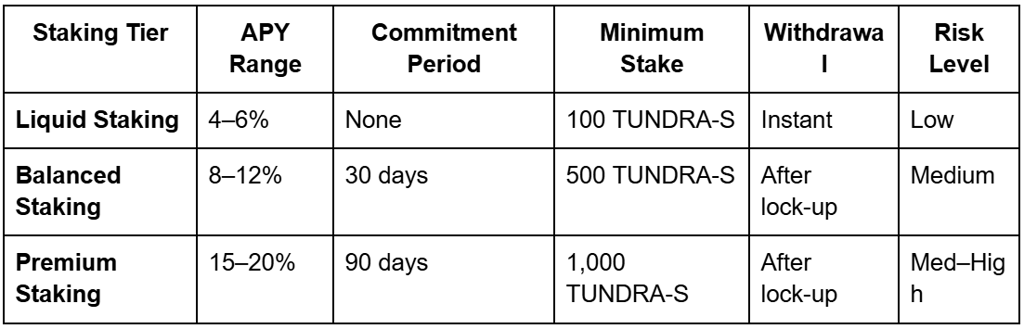

The staking system offers multiple tiers, providing users with flexibility and predictable, revenue-backed returns. Each tier is funded by protocol fees, offering a non-inflationary alternative to Ethereum’s saturated validator landscape. XRP Tundra’s Arctic Spinner also introduces instant bonuses based on purchase size, offering an additional incentive for long-term participants.

Compared to Bitcoin and Ethereum, XRP Tundra’s yield is grounded in verifiable revenue, supported by a dual-token design, audited contracts, and a fixed supply. This approach offers a more sustainable and transparent alternative for investors seeking reliable returns in the DeFi space. As the DeFi landscape evolves toward revenue-based models, XRP Tundra is positioning itself as a compelling platform.

In conclusion, XRP Tundra presents a forward-looking approach to DeFi yield generation, offering a potentially more sustainable and transparent alternative to Bitcoin and Ethereum. Its revenue-backed model, dual-token design, and audited contracts position it as a noteworthy platform for investors seeking reliable returns. As the DeFi landscape shifts, XRP Tundra’s innovative approach may attract increasing attention.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

Bitcoin and Ethereum’s yield mechanisms face structural limitations, including reliance on external entities or inflationary token issuance. XRP Tundra offers a different yield standard, backed by real protocol revenue from DeFi activities, with a dual-token system and fixed supply.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.