Fidelity has launched its own stablecoin, the Fidelity Digital Dollar (FIDD), on the Ethereum mainnet, making it a significant move in the digital asset space. Regulatory clarity, driven by the GENIUS Act and OCC approvals, is fostering a new era of compliance-focused stablecoins.

What to Know:

- Fidelity has launched its own stablecoin, the Fidelity Digital Dollar (FIDD), on the Ethereum mainnet, marking a significant move in the digital asset space.

- Regulatory clarity, driven by the GENIUS Act and OCC approvals, is fostering a new era of compliance-focused stablecoins.

- The stablecoin market is segmenting based on distribution, compliance, redemption, chain portability, and treasury strategies, creating distinct “digital dollars.”

The financial landscape is evolving with Fidelity’s recent launch of its stablecoin, the Fidelity Digital Dollar (FIDD), on the Ethereum mainnet. This move positions Fidelity at the forefront of integrating traditional finance with blockchain technology, offering a compliance-wrapped settlement dollar. As the stablecoin market experiences rapid growth, Fidelity’s entry signifies a strategic effort to capture a segment of the burgeoning digital asset market.

Fidelity’s FIDD is issued by Fidelity Digital Assets, National Association, and is backed by reserves consisting of cash, cash equivalents, and short-term US Treasuries. The token is transferable to any Ethereum mainnet address, though Fidelity reserves the right to restrict or freeze certain addresses. This controlled approach aims to provide a secure and compliant digital dollar for its users.

The timing of Fidelity’s stablecoin launch is underpinned by recent regulatory developments, notably the GENIUS Act, which establishes a federal framework for payment stablecoins. The Office of the Comptroller of the Currency (OCC) has also conditionally approved national trust bank charters for several firms, including Fidelity Digital Assets. This regulatory clarity provides a solid foundation for institutions to innovate within a well-defined framework, boosting investor confidence.

Fidelity’s token is designed as a settlement dollar with an explicit US compliance perimeter, differentiating it from offshore stablecoins. The firm’s national trust bank status ensures direct regulatory supervision, and its distribution through Fidelity platforms offers immediate access to a wide range of customers. Redemption processes are streamlined within Fidelity’s operational hours and banking relationships, enhancing efficiency and security.

The segmentation of the stablecoin market is driven by five key factors: distribution, compliance perimeter, redemption rails, chain portability, and treasury strategy. These elements create distinct digital dollars that cater to different needs and preferences. Fidelity’s FIDD leverages its existing distribution channels and compliance framework to offer a trusted and reliable stablecoin option.

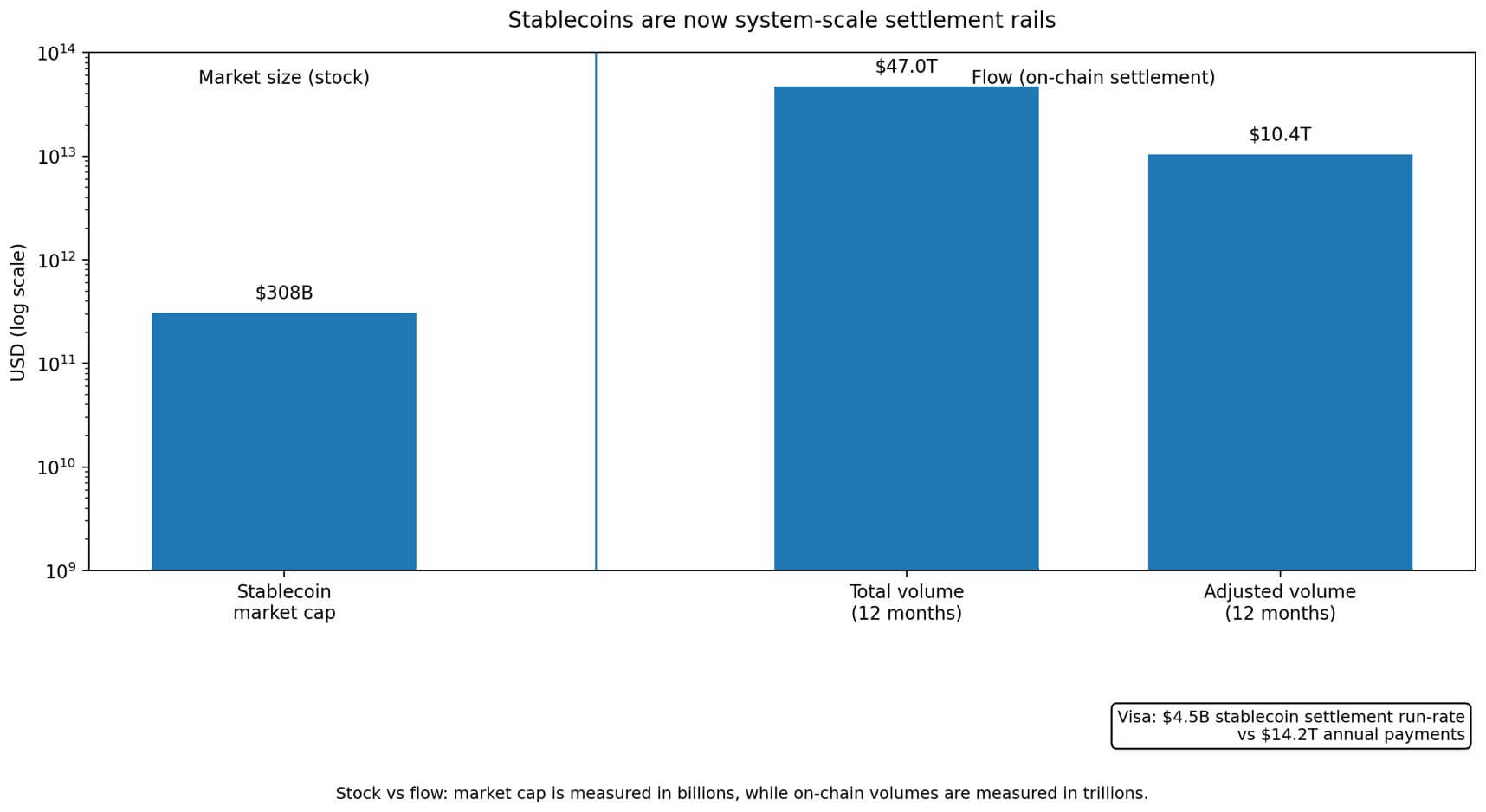

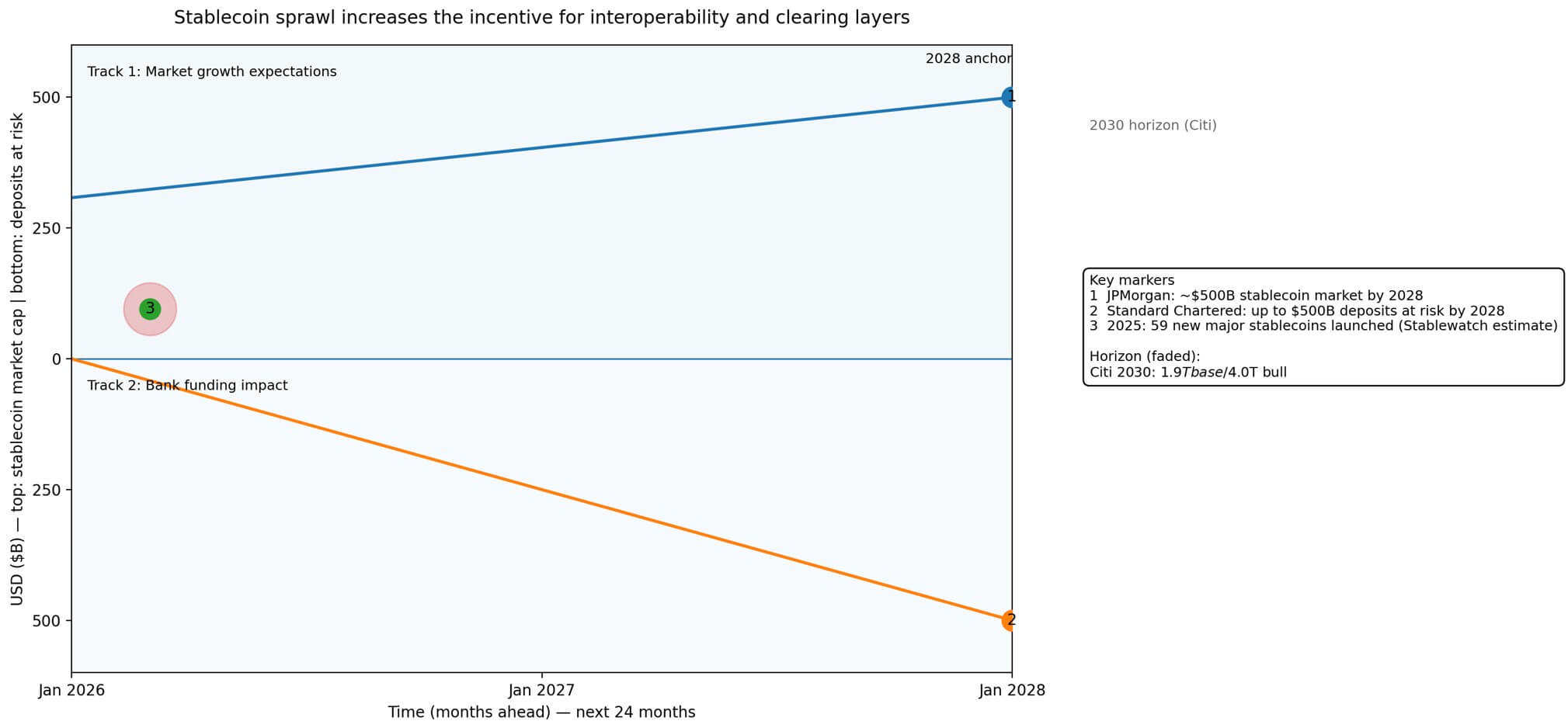

Looking ahead, the key question is not whether there are too many stablecoins, but rather who will build the interoperability layers to reconcile them. As the stablecoin market continues to evolve, the focus will shift towards creating seamless integration and exchange between different digital dollars. Infrastructure players who can facilitate clearing, attestation, and interoperability will be crucial in shaping the future of the stablecoin ecosystem.

In conclusion, Fidelity’s entry into the stablecoin market underscores the growing importance of compliance and trust in the digital asset space. By leveraging its established infrastructure and regulatory standing, Fidelity is well-positioned to capture a significant share of the market. The future success of stablecoins will depend on the industry’s ability to foster interoperability and create a cohesive ecosystem that benefits both institutions and users.

Related: Bitcoin Liquidations Explode: Price Plunges

Source: Original article

Quick Summary

Fidelity has launched its own stablecoin, the Fidelity Digital Dollar (FIDD), on the Ethereum mainnet, marking a significant move in the digital asset space. Regulatory clarity, driven by the GENIUS Act and OCC approvals, is fostering a new era of compliance-focused stablecoins.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.