RLUSD’s growth is primarily on Ethereum due to its established DeFi ecosystem. High transfer volumes and increasing holder counts indicate genuine utility for RLUSD on Ethereum. XRPL’s compliance-focused design creates friction that hinders organic adoption compared to Ethereum.

What to Know:

- RLUSD’s growth is primarily on Ethereum due to its established DeFi ecosystem.

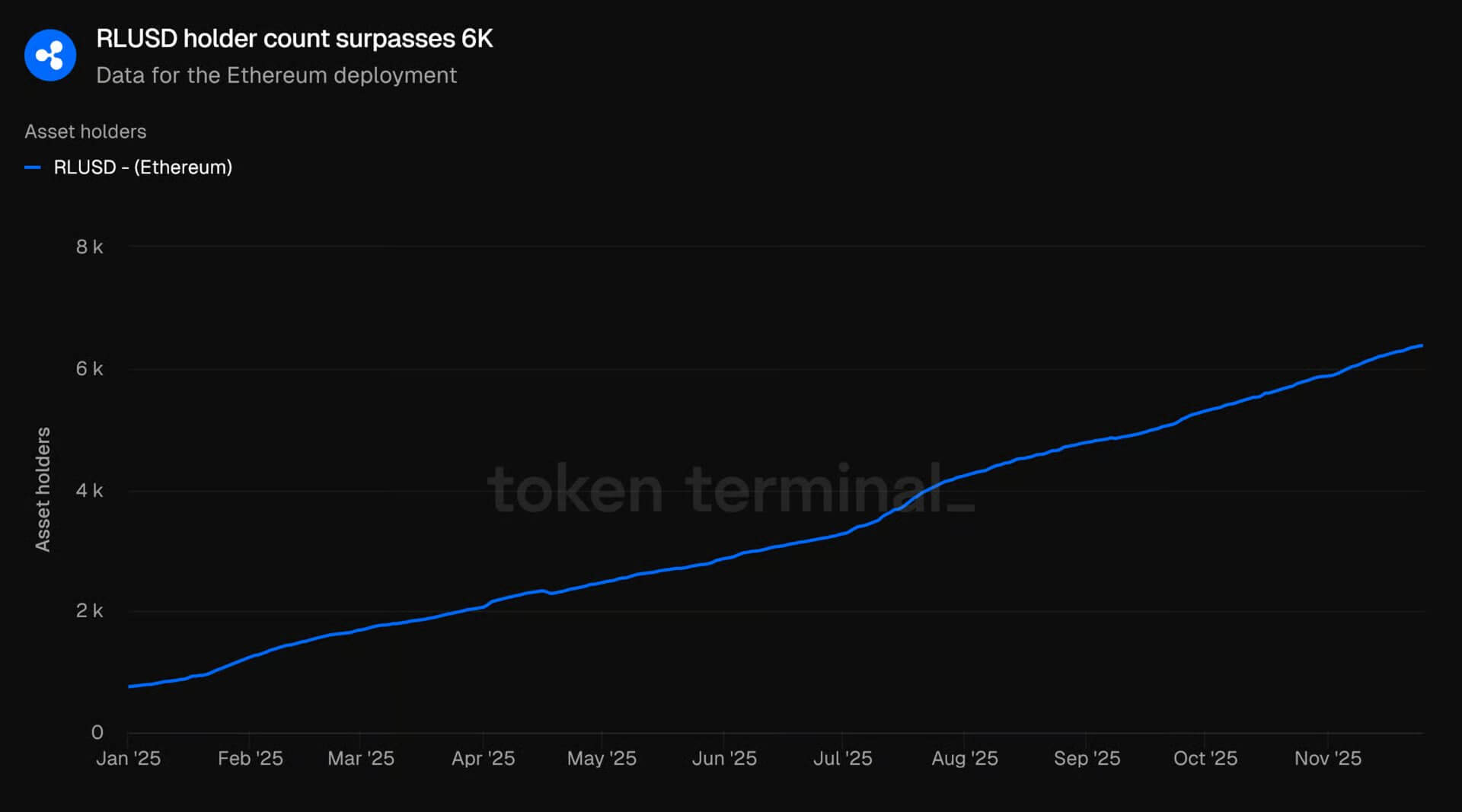

- High transfer volumes and increasing holder counts indicate genuine utility for RLUSD on Ethereum.

- XRPL’s compliance-focused design creates friction that hinders organic adoption compared to Ethereum.

Ripple’s RLUSD stablecoin is seeing significant growth, but surprisingly, it’s primarily occurring on the Ethereum network rather than Ripple’s own XRP Ledger (XRPL). The total circulating supply of RLUSD has reached $1.26 billion within a year of its launch, with the majority residing on Ethereum. This trend highlights the importance of existing infrastructure and liquidity in the crypto space.

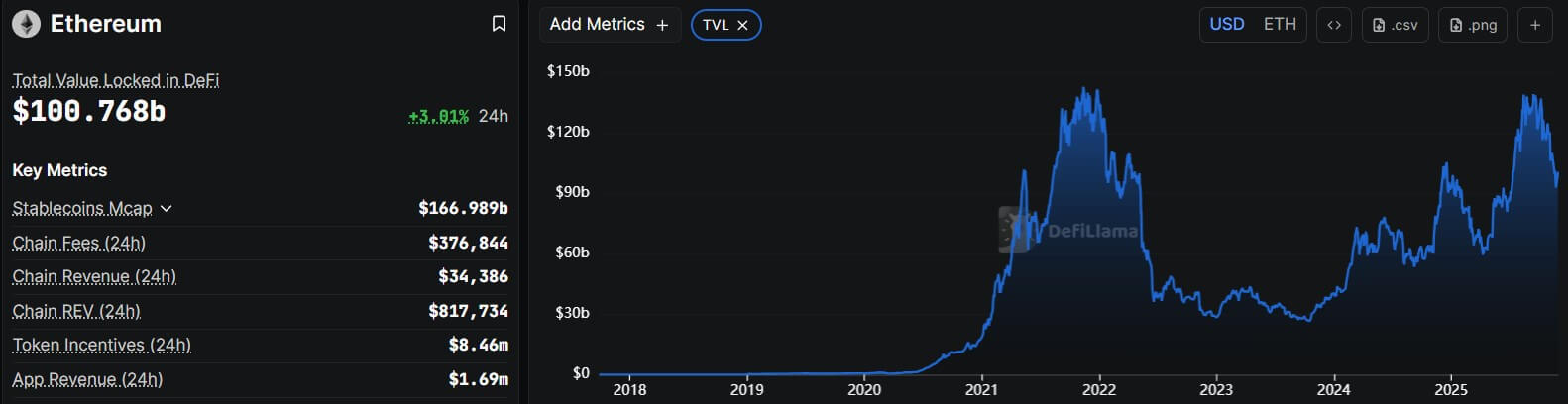

The concentration of RLUSD on Ethereum is largely due to the maturity of Ethereum’s decentralized finance (DeFi) ecosystem. Ethereum’s robust DeFi protocols, such as Aave, Curve, and Uniswap, offer immediate integration and utility for new stablecoins like RLUSD. This allows for seamless participation in established routing engines, collateral frameworks, and risk models, attracting institutional treasuries and market makers.

RLUSD’s presence in major DeFi protocols like Aave and Curve underscores its acceptance and utility within the Ethereum ecosystem. The USDC/RLUSD pool on Curve, for example, boasts substantial liquidity, making it attractive for large-volume trades and yield-farming strategies. This depth is crucial for institutional players who require low-slippage execution for their trading activities.

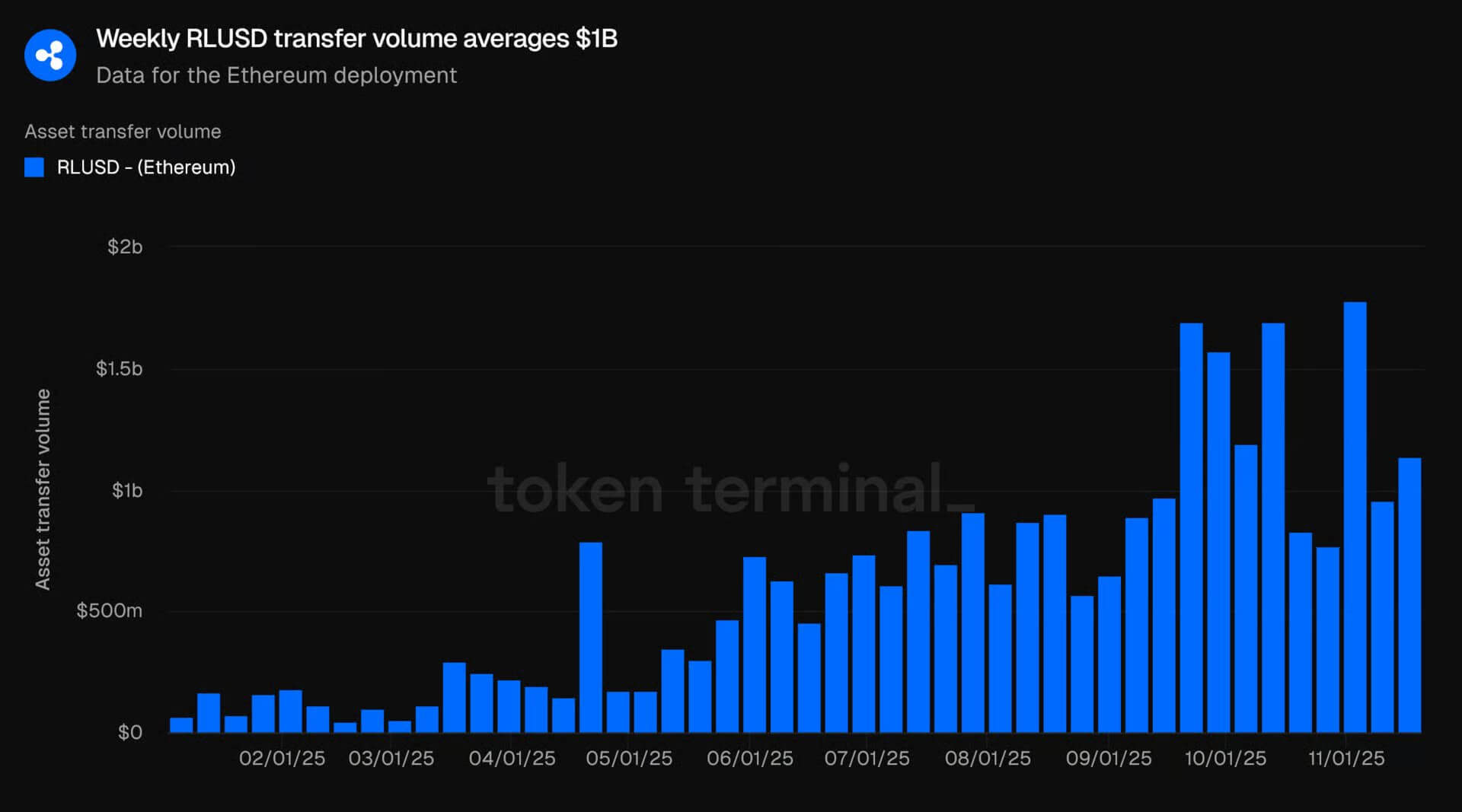

On-chain data reveals that RLUSD on Ethereum is not just sitting idle; it’s actively being used with high velocity and recurring usage. Weekly transfer volumes on Ethereum average around $1.0 billion, a significant increase from the beginning of the year. This indicates a shift from a distribution phase to a utility phase, suggesting the token is being used in ongoing flows like institutional settlement and commercial payments.

In contrast, XRPL’s design, while technically sound, imposes friction on users, hindering organic adoption. The need for XRP balances, trustline configurations, and potential allow-listing requirements creates operational burdens that make XRPL less competitive for high-frequency, automated DeFi flows. This highlights the importance of user experience in driving adoption in the crypto space.

Despite the current imbalance, RLUSD’s overall trajectory positions Ripple as a potential major player in the stablecoin market. To fully capitalize on this potential, Ripple may need to explore strategies to jumpstart its native chain, such as targeted AMM reward programs and simplified wallet interfaces. The future success of RLUSD will depend on Ripple’s ability to leverage its Ethereum success to bolster XRPL’s ecosystem.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

RLUSD’s growth is primarily on Ethereum due to its established DeFi ecosystem. High transfer volumes and increasing holder counts indicate genuine utility for RLUSD on Ethereum. XRPL’s compliance-focused design creates friction that hinders organic adoption compared to Ethereum.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.