Bitcoin is showing resilience, holding steady between $100,000 and $126,000 since July, while altcoins face increased volatility. JPMorgan is reportedly set to allow institutional clients to use Bitcoin and Ether as collateral, signaling deeper integration of crypto into traditional finance.

What to Know:

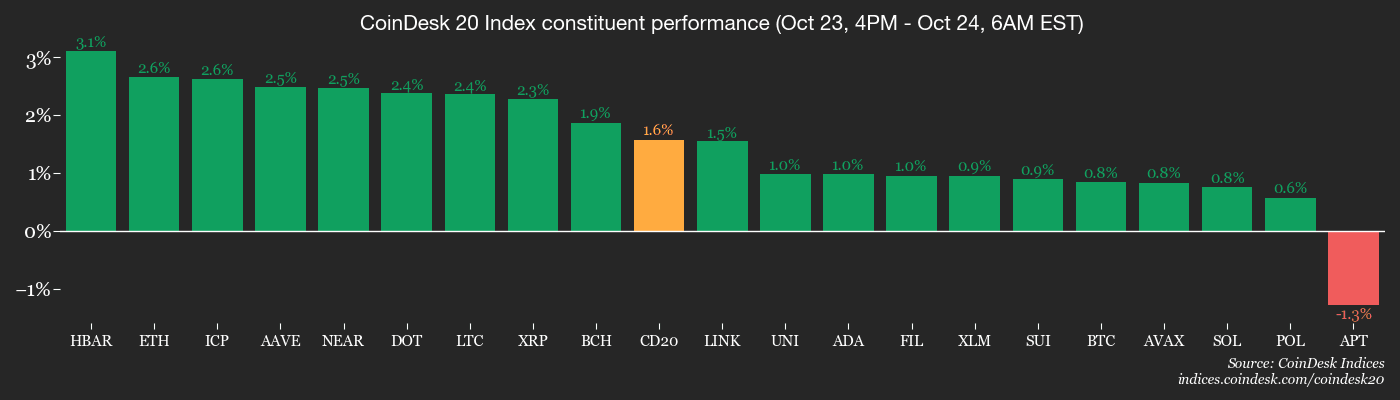

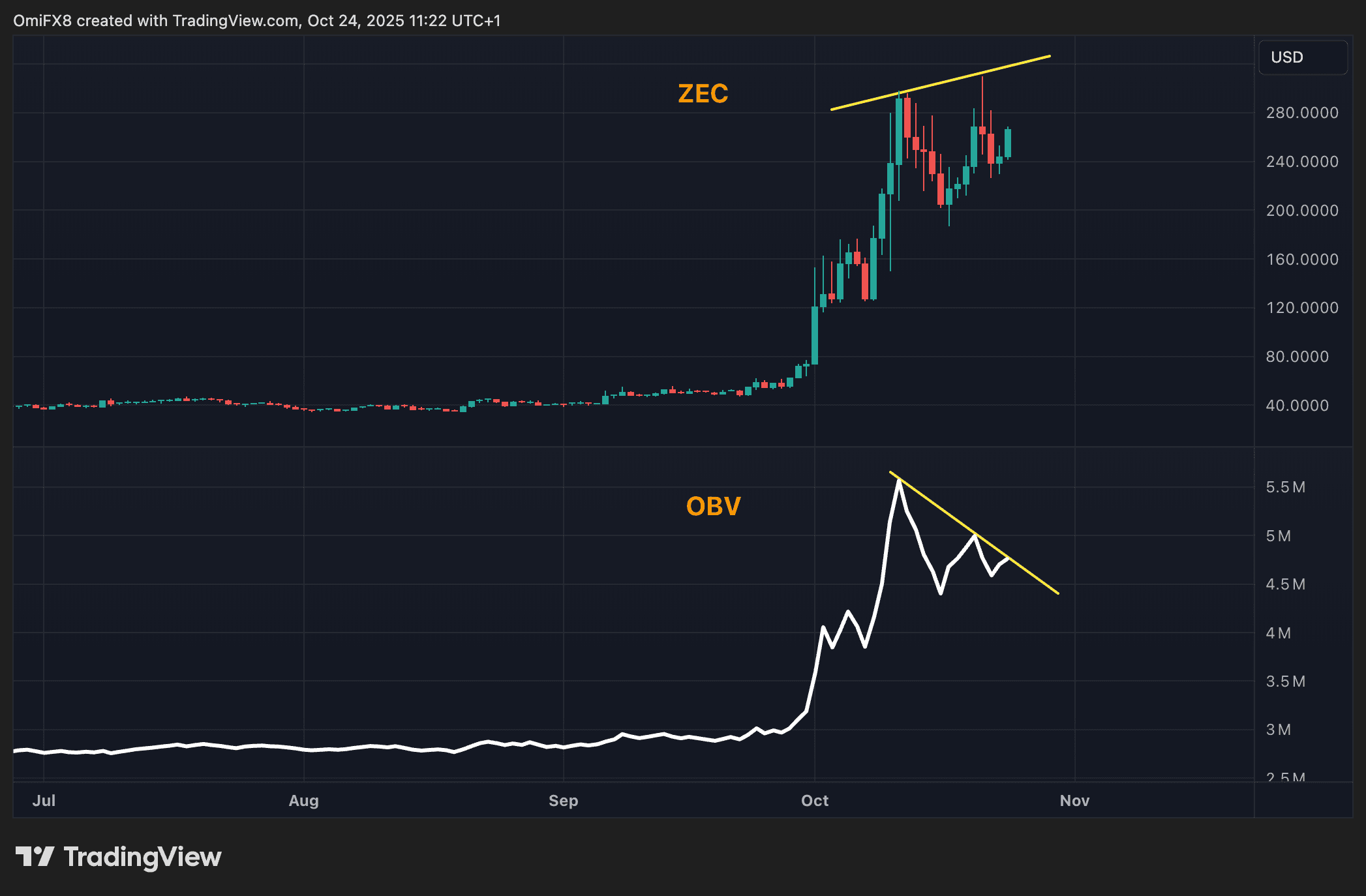

- Bitcoin is showing resilience, holding steady between $100,000 and $126,000 since July, while altcoins face increased volatility.

- JPMorgan is reportedly set to allow institutional clients to use Bitcoin and Ether as collateral, signaling deeper integration of crypto into traditional finance.

- Traders are closely watching U.S. inflation data for potential market impacts, with options pricing suggesting higher expected volatility in Ether compared to Bitcoin.

The crypto market is experiencing a wave of activity, with Bitcoin exhibiting stability amid broader market movements. Recent developments include institutional adoption and anticipation surrounding key economic data releases. This confluence of factors is shaping the current landscape for investors and traders alike.

The market responded positively to news of potential meetings between key global leaders, reflecting the interconnectedness of crypto with broader geopolitical events. Bitcoin ETFs continue to attract inflows, providing a solid base, though long-term holder distribution introduces potential volatility. These dynamics highlight the complex interplay of factors influencing market stability.

JPMorgan’s move to potentially accept Bitcoin and Ether as collateral marks a significant step toward mainstream acceptance. Such integration could provide increased legitimacy and utility for cryptocurrencies within traditional financial systems. This evolution underscores the growing role of digital assets in the broader economy.

Stablecoin-focused layer 1 blockchain Stable saw rapid success with its pre-deposit campaign, hitting its hard cap quickly. Multicoin Capital’s proposal for “Attention Perps” introduces an innovative approach to trading based on cultural and social attention metrics. These developments highlight the continuous innovation within the crypto space.

As the market navigates these developments, traders should remain vigilant and informed. The potential for increased volatility, coupled with ongoing regulatory developments, requires a balanced and strategic approach. Keeping abreast of both technical indicators and macroeconomic trends will be crucial for making informed decisions.

Related: XRP, Bitcoin Could React to Inflation Data

Source: Original article

Quick Summary

Bitcoin is showing resilience, holding steady between $100,000 and $126,000 since July, while altcoins face increased volatility. JPMorgan is reportedly set to allow institutional clients to use Bitcoin and Ether as collateral, signaling deeper integration of crypto into traditional finance. Traders are closely watching U.S.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.