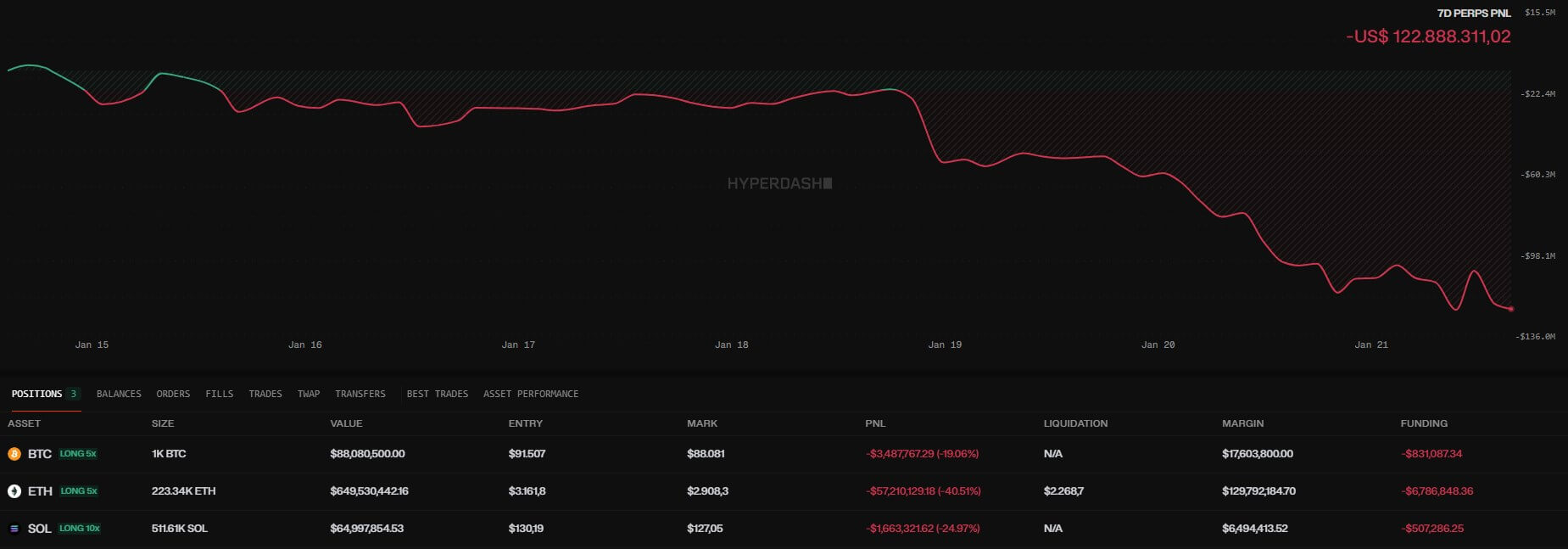

A single wallet holds a massive $649.6 million long position in Ethereum (ETH) on Hyperliquid, raising concerns about potential market volatility.

What to Know:

- A single wallet holds a massive $649.6 million long position in Ethereum (ETH) on Hyperliquid, raising concerns about potential market volatility.

- Hyperliquid’s cross-margin system means the liquidation price of this position is dynamic, influenced by collateral changes, funding rates, and other positions in the account.

- Liquidation heatmaps indicate significant leverage clusters for ETH between $2,800 and $2,600, with another concentration near $2,400, suggesting potential cascade zones if prices decline.

The crypto market is currently watching a single wallet on Hyperliquid that holds a substantial Ethereum (ETH) long position, valued at approximately $649.6 million. Entered at around $3,161.85 per ETH, with a liquidation estimate near $2,268.37, the position’s size and the platform’s cross-margin mechanics introduce potential market pressures. As traders navigate the ever-evolving landscape of digital assets, such large positions warrant close attention.

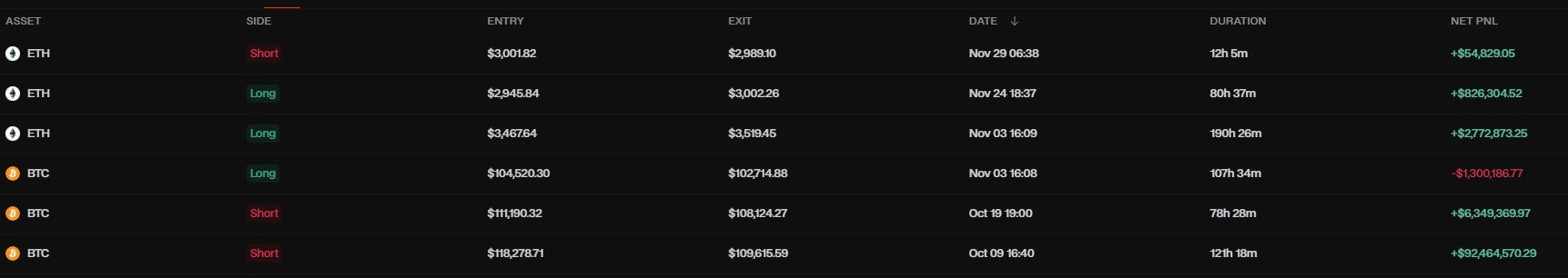

The wallet’s history reveals a track record of successful trades, including significant profits during October’s crypto selloff by shorting Bitcoin (BTC) and holding an ETH long. However, the current drawdown is notable due to the position’s sheer size and the potential for cascading effects on Hyperliquid. The trader’s past success does not guarantee future outcomes, especially considering the complexities of cross-margin liquidation.

Hyperliquid’s cross-margin system means the liquidation price isn’t fixed; it shifts based on collateral changes, funding payments, and unrealized profits or losses across the account’s positions. This dynamic liquidation threshold makes monitoring the position even more critical. The platform’s design ensures that liquidation events are managed within the perpetual market first, potentially minimizing direct impact on spot prices.

The $129.9 million margin provides some buffer, but fluctuating funding rates on ETH perpetuals and correlated losses in other positions could quickly erode this cushion. Should the liquidation process be triggered, Hyperliquid’s liquidator vault and HLP backstop are designed to absorb initial losses. However, extreme conditions could activate the auto-deleveraging mechanism, closing out opposing positions to prevent bad debt.

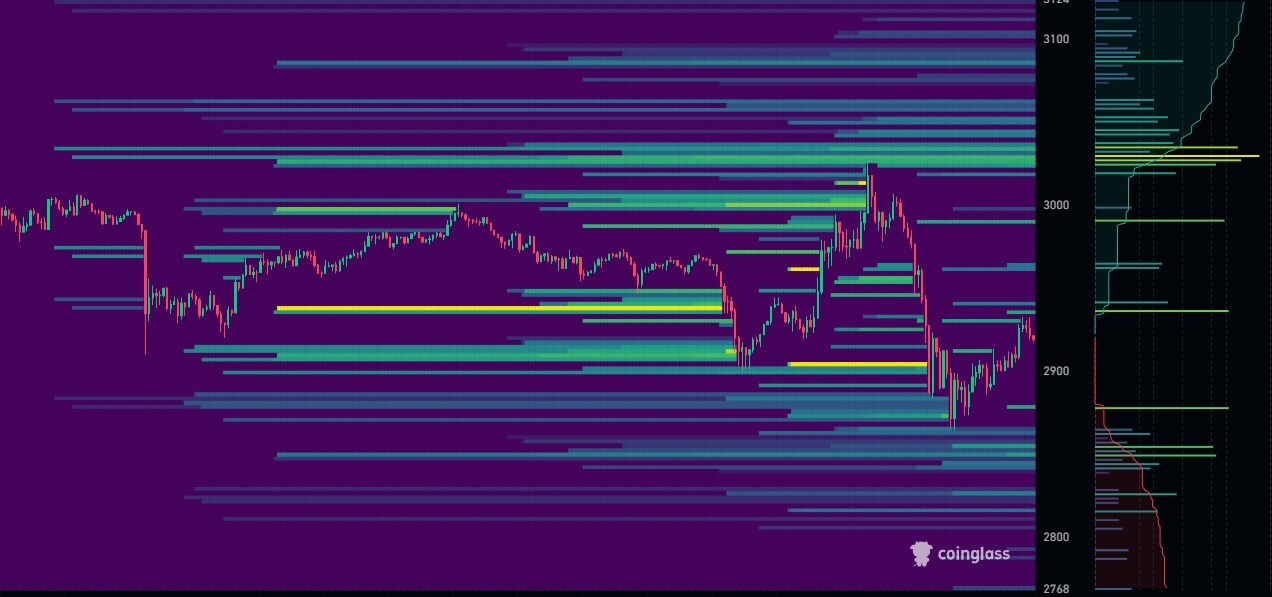

Liquidation heatmaps from CoinGlass offer a glimpse into potential cascade risks, indicating areas where liquidations might cluster. These heatmaps, while not deterministic forecasts, highlight leverage concentrations that could amplify price movements. For ETH, significant leverage clusters exist between $2,800 and $2,600, with another concentration near $2,400.

While the $2,268 liquidation threshold for the $650 million long sits below these clusters, a broader deleveraging wave could still trigger a cascade. The potential for ETH to experience significant drawdowns, combined with the position’s accumulated losses, underscores the need for careful monitoring. The situation highlights the inherent risks associated with leveraged trading in the crypto market.

In conclusion, the large ETH long position on Hyperliquid serves as a reminder of the leverage risks inherent in cryptocurrency trading. While the trader has a history of successful trades, the current situation requires vigilance due to the position’s size and the potential for cascading liquidations. Monitoring market dynamics, funding rates, and overall risk sentiment will be crucial for assessing the potential impact of this position on the broader crypto market.

Related: XRP Burn Signals Potential Liquidity Shift

Source: Original article

Quick Summary

A single wallet holds a massive $649.6 million long position in Ethereum (ETH) on Hyperliquid, raising concerns about potential market volatility. Hyperliquid’s cross-margin system means the liquidation price of this position is dynamic, influenced by collateral changes, funding rates, and other positions in the account.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.