OpenEden secured funding from Ripple and other institutional players to scale its tokenized U.S. Treasury offerings. The funding reflects growing institutional interest in tokenized real-world assets (RWAs) as a bridge between traditional finance and decentralized finance (DeFi).

What to Know:

- OpenEden secured funding from Ripple and other institutional players to scale its tokenized U.S. Treasury offerings.

- The funding underscores growing institutional interest in tokenized real-world assets (RWAs) as a bridge between traditional finance and decentralized finance (DeFi).

- OpenEden plans to expand its tokenized treasury products and yield-bearing stablecoin, potentially increasing liquidity and utility in the crypto space.

The tokenization of real-world assets (RWAs) continues to gain traction, with OpenEden securing an investment round backed by Ripple and other notable institutions. This development highlights the increasing appetite for regulated and market-ready products that bridge the gap between traditional finance and decentralized finance. For institutional investors, this represents an opportunity to tap into new yield sources and diversify their portfolios within the digital asset ecosystem.

OpenEden’s latest funding round includes participation from Lightspeed Faction, Gate Ventures, FalconX, and Anchorage Digital Ventures, among others. The capital injection will be used to expand OpenEden’s tokenization-as-a-service platform and roll out new products tied to traditional markets. The primary focus remains on its tokenized U.S. Treasury fund, TBILL, and USDO, a yield-bearing stablecoin backed by those Treasurys. This move could enhance liquidity within the crypto markets, providing institutions with more efficient ways to manage and deploy capital.

The strategic importance of this funding round is amplified by the current macroeconomic environment. With interest rates remaining relatively high, tokenized U.S. Treasuries offer an attractive yield alternative compared to traditional stablecoins or holding cash. This trend mirrors the rise of money market funds in traditional finance, which tend to see increased inflows during periods of higher interest rates. The ability to tokenize these assets and make them accessible on blockchain networks further enhances their appeal, particularly for institutions looking to optimize their treasury management strategies.

USDO and its wrapped version, cUSDO, have already seen integration across decentralized exchanges and lending markets. Earlier this year, cUSDO was approved as off-exchange collateral at Binance, allowing clients to post the asset while trading on the venue. This is a significant step toward mainstream adoption, as it demonstrates the growing acceptance of tokenized RWAs within established crypto trading platforms. Such integrations can improve market efficiency and reduce counterparty risk, making these assets more attractive to institutional investors.

OpenEden’s decision to appoint the Bank of New York Mellon Corporation (BNY) as custodian and investment manager for the Treasurys underlying TBILL underscores the importance of regulatory compliance and institutional-grade security. Furthermore, securing investment-grade ratings from S&P Global and Moody’s adds another layer of credibility, making TBILL more palatable for risk-averse institutions. This move is reminiscent of how early ETF issuers partnered with established custodians to build trust and confidence in their products.

News

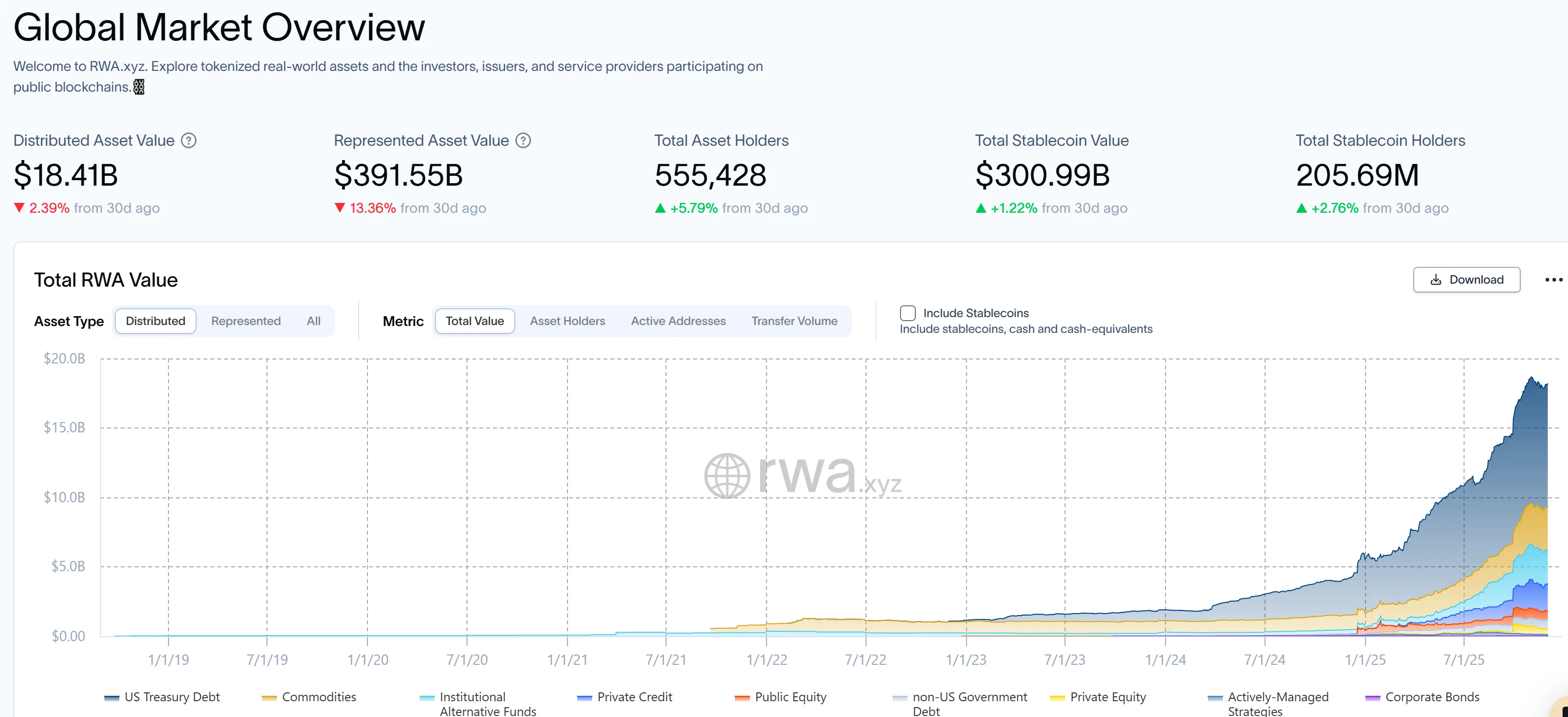

The Bank for International Settlements (BIS) recently highlighted the growing importance of tokenized money market funds, noting that assets in this sector have climbed to nearly $9 billion, up from about $770 million at the end of 2023. This exponential growth underscores the potential for tokenized RWAs to become a significant part of the broader financial landscape. As more institutions enter the space and regulatory frameworks become clearer, we can expect to see further innovation and adoption in this area.

In conclusion, OpenEden’s successful funding round, backed by Ripple and other major institutions, is a positive sign for the continued growth and maturation of the tokenized RWA market. By focusing on regulatory compliance, institutional-grade security, and strategic partnerships, OpenEden is well-positioned to capitalize on the increasing demand for yield-generating digital assets. This development not only enhances liquidity and utility within the crypto space but also paves the way for greater institutional participation in the broader digital asset ecosystem.

Related: XRP Ledger Chosen for Dubai’s Real Estate Tokenization

Source: Original article

Quick Summary

OpenEden secured funding from Ripple and other institutional players to scale its tokenized U.S. Treasury offerings. The funding underscores growing institutional interest in tokenized real-world assets (RWAs) as a bridge between traditional finance and decentralized finance (DeFi).

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.