Bitcoin experienced significant selling pressure, potentially leading to a fall to $73,777. Several altcoins have broken below support levels, indicating strong bearish control. Analysts suggest the current dip in Bitcoin is a positive development for long-term growth.

What to Know:

- Bitcoin experienced significant selling pressure, potentially leading to a fall to $73,777.

- Several altcoins have broken below support levels, indicating strong bearish control.

- Analysts suggest the current dip in Bitcoin is a positive development for long-term growth.

Bitcoin’s recent price action has traders and investors on high alert, with the cryptocurrency experiencing intense selling pressure. This downturn has opened the door for a potential fall to the crucial support level of $73,777. Meanwhile, several altcoins are also showing signs of weakness, slipping below their respective support levels.

Veteran trader Peter Brandt noted on X that the correction was the “best thing” that could have happened to BTC, reinforcing a bullish long-term outlook. He anticipates Bitcoin rallying to $200,000 around the third quarter of 2029. This perspective suggests that seasoned market participants view the current volatility as a necessary phase for future growth.

Bitcoin has yet to find a bottom, but the data suggests buyers were very interested in the abrupt dip to $80,000. Several altcoins are also approaching deep discount levels. https://t.co/eJt2JmBAnl

— Cointelegraph (@Cointelegraph) November 2, 2025

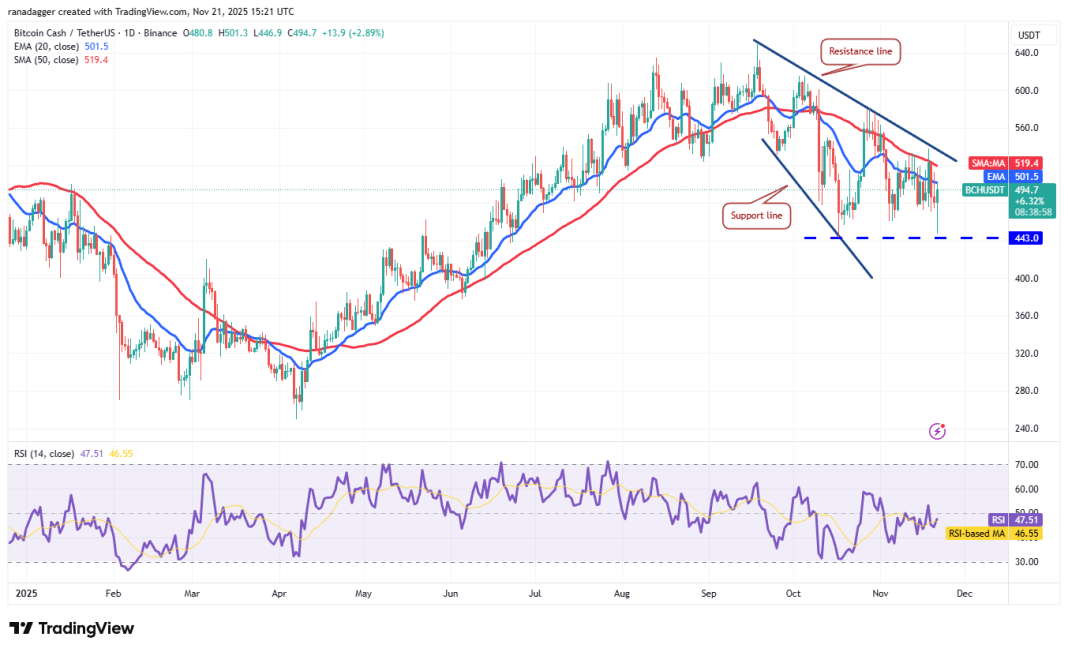

XRP has slipped below the support line of its descending channel pattern, indicating bearish control. A close below this support could lead the XRP/USDT pair to descend to $1.61, a level buyers are expected to defend vigorously to prevent a further downtrend. Conversely, breaking above the downtrend line could signal a potential trend change.

Ether’s fall below $3,000 has cleared the path for a potential drop to $2,500, pushing the RSI into oversold territory and signaling a possible relief rally. If Ether rebounds off $2,500, the ETH/USDT pair could aim for the $3,350 level; however, a shallow bounce could indicate weak demand and increase the risk of further decline. Monitoring these levels will be crucial for gauging Ether’s next move.

As Bitcoin and various altcoins navigate these turbulent waters, traders and investors should remain vigilant, keeping a close watch on key support and resistance levels. The market’s reaction to these levels will provide valuable insights into potential trend reversals and future price movements. While short-term volatility persists, the long-term outlook for Bitcoin remains optimistic among certain analysts.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

Bitcoin experienced significant selling pressure, potentially leading to a fall to $73,777. Several altcoins have broken below support levels, indicating strong bearish control. Analysts suggest the current dip in Bitcoin is a positive development for long-term growth.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.