Bitcoin bulls are defending key levels, but ETF outflows pose a challenge. Several altcoins are testing crucial support levels, indicating potential shifts in momentum. Technical analysis suggests key price levels to watch for Bitcoin, Ether, XRP, and other major cryptocurrencies.

What to Know:

- Bitcoin bulls are defending key levels, but ETF outflows pose a challenge.

- Several altcoins are testing crucial support levels, indicating potential shifts in momentum.

- Technical analysis suggests key price levels to watch for Bitcoin, Ether, XRP, and other major cryptocurrencies.

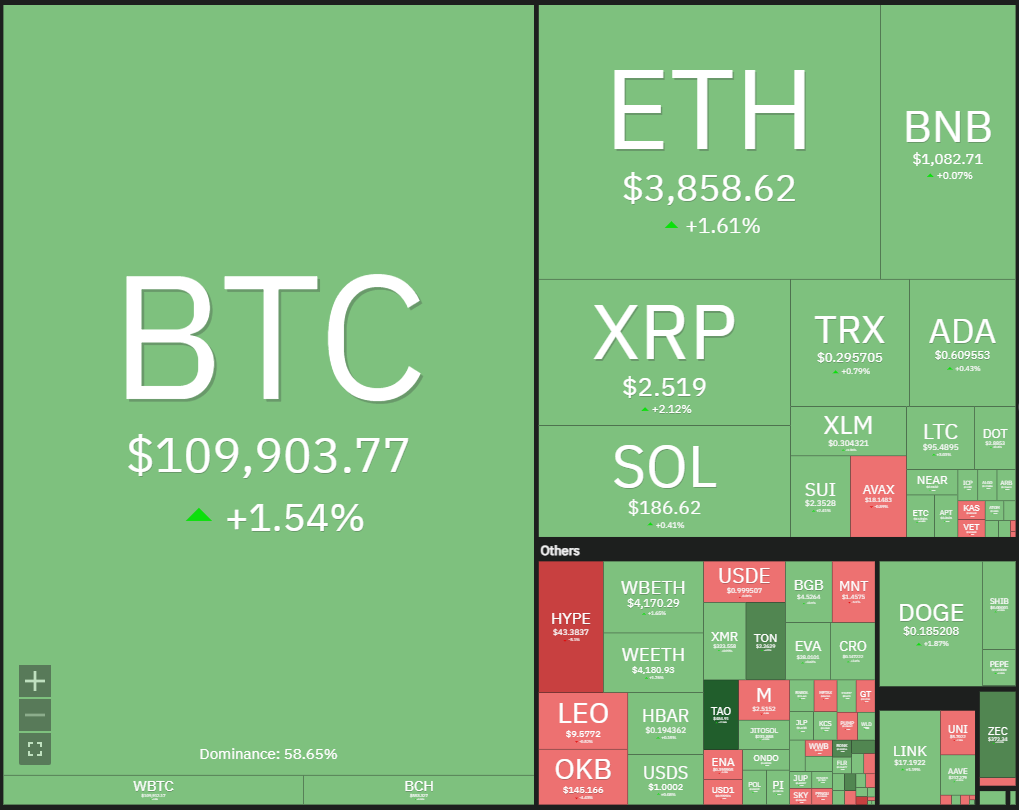

Bitcoin’s price is currently being defended by bulls around the $107,000 mark, but recent net outflows from spot Bitcoin ETFs are creating concerns. This increased selling pressure raises the possibility of a breakdown in the near term. Investors are closely watching these dynamics to gauge the next potential move in the market.

Bitcoin’s struggle to maintain its price above $110,000, coupled with bearish sentiment from some analysts, highlights the uncertainty surrounding its current cycle. While some believe Bitcoin may have already reached its cycle peak based on the four-year halving cycle, others argue that this pattern no longer holds true. The debate continues as market participants analyze various factors to determine future price trajectories.

XRP has seen its price dip below the 20-day EMA, signaling that bears are attempting to seize control. Key support levels to watch include the $2.32 to $2.19 zone, where buyers are expected to defend vigorously. A break below this zone could intensify selling pressure, potentially driving the price down to $1.90.

Ether is showing signs of buying interest at lower levels, bouncing off the support line of a descending channel pattern. However, the recovery faces potential selling pressure at the moving averages. For BNB, a battle is ensuing between bulls and bears around the 50-day simple moving average, with potential for a deeper correction if the price closes below this level.

Technical analysis of Solana shows that it’s trading within a symmetrical triangle, indicating indecision. A break below the uptrend line could lead to a tumble toward the $155 support, while a move above the 20-day EMA could signal further consolidation within the triangle. For Dogecoin, buyers are trying to hold above the $0.17 support, but a break below could lead to a descent to $0.14.

As the cryptocurrency market navigates these uncertain times, monitoring key support and resistance levels is crucial. The interplay between technical indicators, ETF flows, and broader market sentiment will likely dictate the direction of Bitcoin, XRP, and other major cryptocurrencies in the coming weeks.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

Bitcoin bulls are defending key levels, but ETF outflows pose a challenge. Several altcoins are testing crucial support levels, indicating potential shifts in momentum. Technical analysis suggests key price levels to watch for Bitcoin, Ether, XRP, and other major cryptocurrencies.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.