XRP experienced a notable rebound, climbing to $2.33 following a period of market volatility. On-chain data reveals a significant surge in XRP Ledger activity, including a record number of DEX transactions and new wallet creations.

What to Know:

- XRP experienced a notable rebound, climbing to $2.33 following a period of market volatility.

- On-chain data reveals a significant surge in XRP Ledger activity, including a record number of DEX transactions and new wallet creations.

- Analysts have identified key price levels and potential breakout targets for XRP, contingent on maintaining support and overcoming resistance.

XRP has shown resilience, rebounding to $2.33 after a recent dip, fueled by increased activity on the XRP Ledger. This recovery follows a period of market-wide stress that had pushed the token lower. The surge in on-chain metrics suggests renewed interest and utility within the XRP ecosystem.

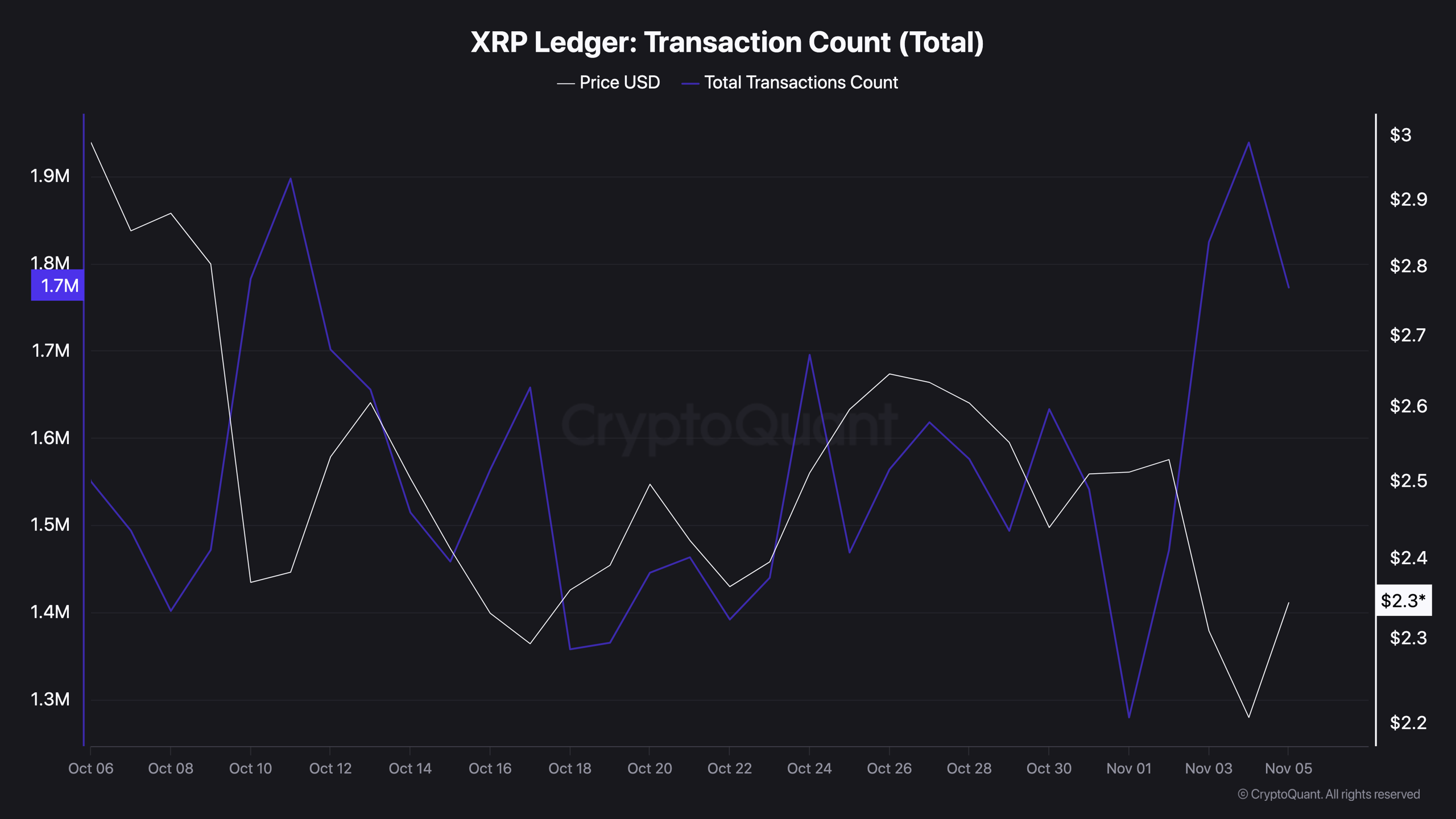

Between October and November, the XRP Ledger saw transaction counts ranging from 1.3 million to 1.9 million, peaking around November 3. This period of heightened activity coincided with a price correction, indicating sustained network usage despite market pressures. The number of new wallets created on the XRP Ledger saw a notable increase, with 21,595 new wallets created over a two-day period.

On November 4, the XRP Ledger’s decentralized exchange (DEX) processed a record 954,000 transactions in a single day. This surge highlights the growing adoption of on-chain trading within the XRP ecosystem. While whale activity initially contributed to downward pressure, the selling has since slowed, potentially stabilizing market sentiment.

Analysts are closely watching key price levels for XRP, with potential targets ranging from $5.76 to $9.73 based on historical breakout patterns. Sustaining levels above $1.94 could establish the current range as an accumulation zone, setting the stage for a more significant breakout. Short-term support is seen at $2.27, with resistance at $2.75, indicating a potential decision point around $2.55.

“A breakout from the lower-high trendline can open the door to further upside,”

Price action in the coming weeks will be crucial in determining XRP’s trajectory, especially as Bitcoin continues to influence the broader crypto market. The surge in new wallets and DEX transactions, combined with positive analyst outlooks, paints a potentially bullish picture for XRP. Monitoring regulatory developments and broader market trends will be essential for investors and traders.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP experienced a notable rebound, climbing to $2.33 following a period of market volatility. On-chain data reveals a significant surge in XRP Ledger activity, including a record number of DEX transactions and new wallet creations.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.