Ripple has decided against pursuing an IPO despite resolving its legal issues with the SEC and experiencing significant growth. The company cites its strong capitalization and ability to fund growth organically as reasons for not needing to go public.

What to Know:

- Ripple has decided against pursuing an IPO despite resolving its legal issues with the SEC and experiencing significant growth.

- The company cites its strong capitalization and ability to fund growth organically as reasons for not needing to go public.

- Ripple’s decision contrasts with other crypto firms that have recently gone public, highlighting different strategic approaches within the industry.

Ripple, the blockchain company known for XRP, has announced it will not pursue an initial public offering (IPO) after settling its long-standing dispute with the Securities and Exchange Commission. This decision comes despite a period of substantial growth and increased regulatory clarity for the crypto sector. The company is prioritizing its current financial stability and organic growth strategies over entering the public markets.

Ripple’s president, Monica Long, stated that the company is well-capitalized and capable of funding its expansion through organic means, strategic partnerships, and other initiatives. This financial strength allows Ripple to maintain its independence and strategic direction without the need for public funding. The company’s decision marks a shift from previous hints at a potential IPO, especially before the SEC lawsuit in late 2020.

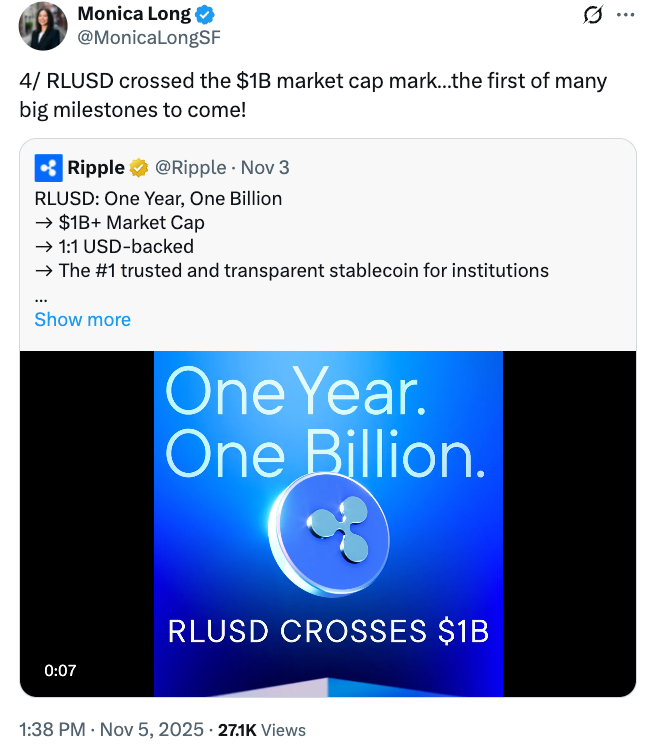

Ripple’s revenue figures remain undisclosed, but estimates suggest a substantial income, and the company reported doubling its customer base, driven by the adoption of its RLUSD stablecoin. This growth is further supported by a recent $500 million strategic investment from notable institutional investors. These developments underscore Ripple’s increasing influence and stability in the digital asset space.

The company’s repurchase of over 25% of its outstanding shares further demonstrates its commitment to providing liquidity for shareholders and employees. While Ripple is opting out of an IPO, other crypto firms like Circle, Bullish, and Gemini have recently gone public, signaling diverse strategies within the industry. These moves reflect the evolving landscape of crypto regulations and market opportunities.

In conclusion, Ripple’s decision to remain private reflects its strong financial position and strategic focus on organic growth and internal investment. This approach sets it apart from some of its peers in the crypto industry, as the digital asset space continues to mature and adapt to evolving market conditions and regulatory frameworks. Ripple’s focus remains on expanding its ecosystem and leveraging its technological advancements.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

Ripple has decided against pursuing an IPO despite resolving its legal issues with the SEC and experiencing significant growth. The company cites its strong capitalization and ability to fund growth organically as reasons for not needing to go public.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.