Ripple is evolving into a full-stack institutional financial platform, resembling a 21st-century investment bank. The company’s strategy includes a closed liquidity loop that reduces friction and improves transaction velocity.

What to Know:

- Ripple is evolving into a full-stack institutional financial platform, resembling a 21st-century investment bank.

- The company’s strategy includes a closed liquidity loop that reduces friction and improves transaction velocity.

- Ripple’s pursuit of regulatory credibility, including a bank charter application, is deepening trust among institutional investors.

Ripple, initially recognized for its legal challenges and XRP token, has been quietly constructing an ambitious institutional financial platform. This evolution positions Ripple as a comprehensive solution for digital asset management, trading, and settlements. With the integration of Ripple Prime, Ripple Payments, and Ripple Custody, the company is creating a robust ecosystem for the future of finance.

After gaining legal clarity with the SEC, Ripple strategically invested in becoming a regulated financial infrastructure provider. Key acquisitions like Hidden Road, Palisade, GTreasury, and Rail now underpin a vertically integrated enterprise. This covers trading, custody, payments, and liquidity management, all essential for a modern financial institution.

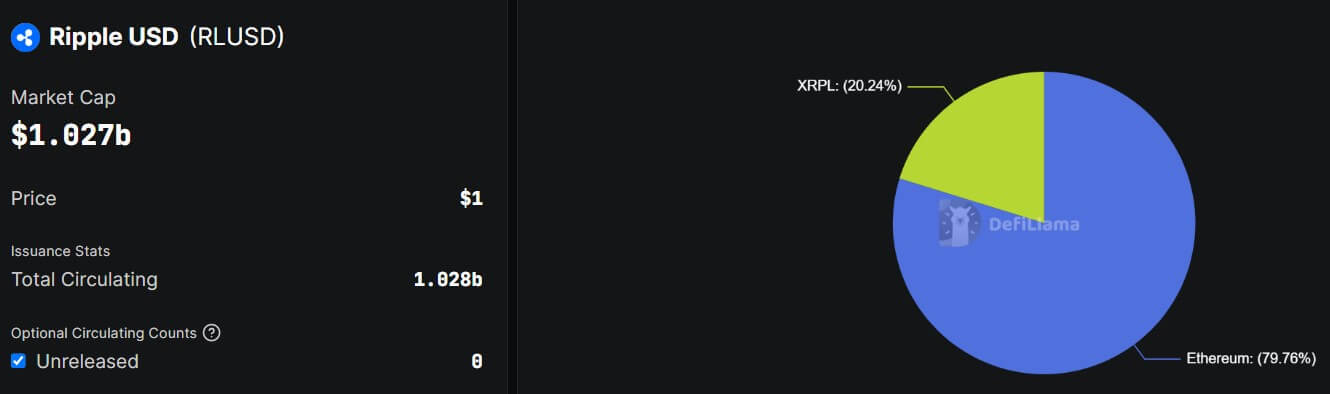

Ripple Prime functions as the trading interface, while Ripple Custody secures assets through advanced MPC and zero-trust architecture. Ripple Payments facilitates real-time settlements across various blockchains and fiat corridors. The RLUSD stablecoin acts as a universal medium of exchange, streamlining operations across Ripple’s services.

Ripple’s liquidity design promotes a circular flow: clients trade via Ripple Prime, store assets in Ripple Custody, and settle payments through Ripple Payments. This is all interconnected using XRP and RLUSD. The closed-loop system reduces friction and enhances the velocity of transactions, centralizing value within the Ripple ecosystem.

Ripple’s pursuit of regulatory approval includes applying for a national bank charter and seeking a Federal Reserve Master Account. These steps would ensure compliance and transparency, potentially setting a new standard for stablecoin operations. Such measures aim to build confidence among institutional investors wary of opaque reserve practices.

“[Ripple is] pursuing opportunities to massively transform the space, leveraging our unique position and strengths of XRP to accelerate our business and enhance our current solutions and technology.”

Ripple is bridging the gap between traditional finance and decentralized settlement, supporting tokenized real-world assets (RWAs) for seamless on-chain transactions. While XRP remains a key component, Ripple’s focus has shifted towards infrastructure and institutional adoption. The company’s broader vision involves replicating core banking functions using crypto infrastructure.

Ripple’s evolution suggests a future where financial services are more integrated with blockchain technology. As it continues to build its financial empire, Ripple is poised to modernize how value moves across borders. The company is building a “bank without a bank,” operating within US financial law and potentially reshaping the landscape of regulated crypto finance.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

Ripple is evolving into a full-stack institutional financial platform, resembling a 21st-century investment bank. The company’s strategy includes a closed liquidity loop that reduces friction and improves transaction velocity. Ripple’s pursuit of regulatory credibility, including a bank charter application, is deepening trust among institutional investors.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.