Tokenized public stocks are experiencing significant growth, driven by increasing investor interest. Ondo Finance leads the tokenized asset space, followed by Securitize and Backed Finance.

What to Know:

- Tokenized public stocks are experiencing significant growth, driven by increasing investor interest.

- Ondo Finance leads the tokenized asset space, followed by Securitize and Backed Finance.

- Despite impressive growth, the tokenized stock market is still in its early stages, with substantial potential for future expansion.

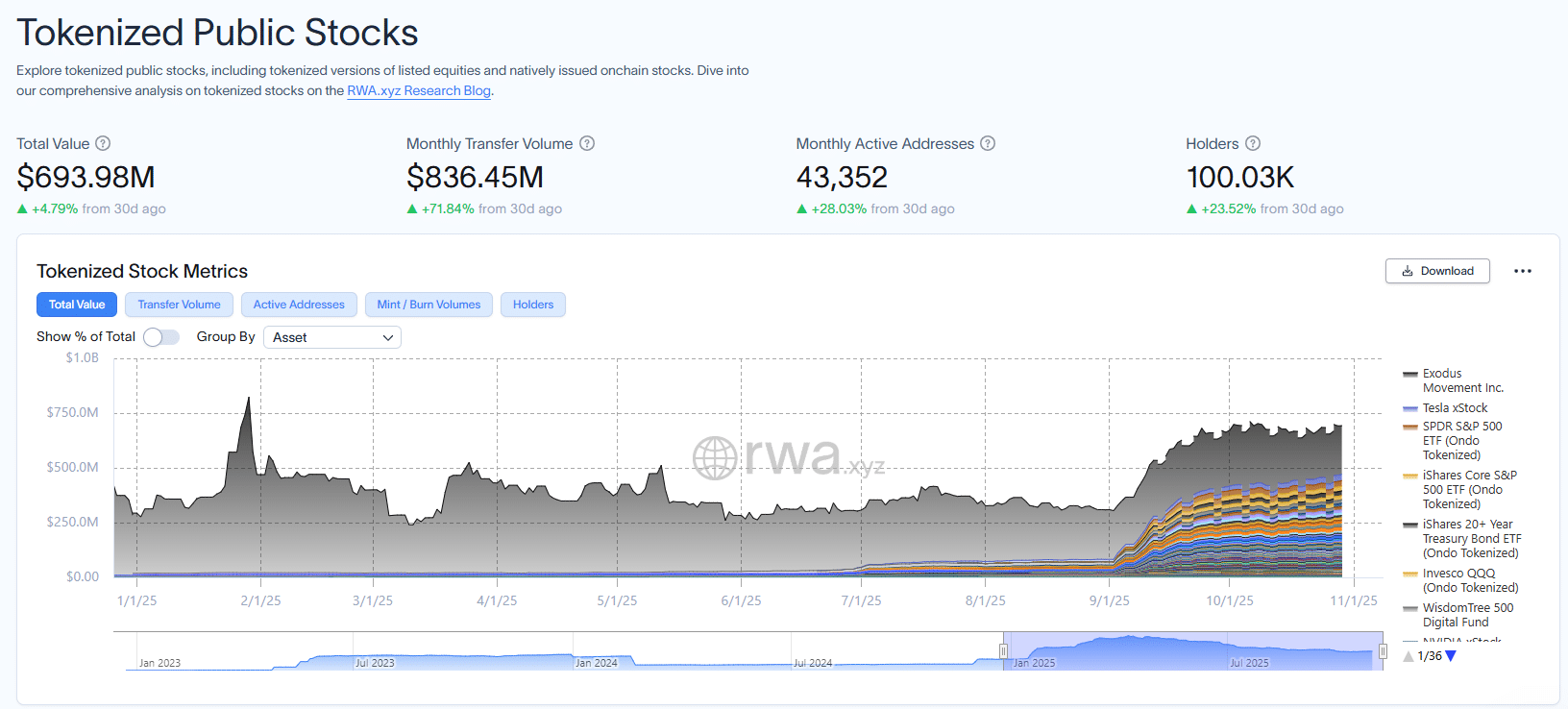

The securities tokenization market, particularly for equities, is experiencing a boom, with more stocks becoming available on-chain for both retail and institutional investors, primarily led by Ethereum. Data indicates substantial growth in the tokenized public stock sector, reflecting increased investor interest. The total market value has surged to approximately $694 million, marking a 4.8% increase over the past 30 days.

Interest in tokenized stocks becomes even more apparent when observed over a longer period. Since the close of the second quarter of 2025, the sector has seen a remarkable 129% growth, as capital continues to flow into the market. This upward trend suggests a strong and sustained interest in bringing traditional assets onto the blockchain.

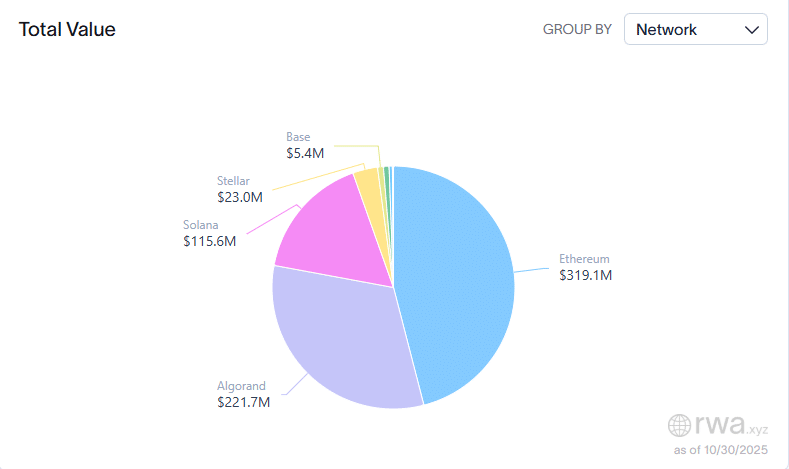

Ondo Finance currently leads the tokenized public stocks market, holding approximately $317.6 million in tokenized assets on its platform. Key offerings include tokenized versions of BlackRock’s iShares Core S&P 500 ETF and the SPDR S&P 500 ETF. Securitize, which recently partnered with BNY Mellon to launch tokenized funds backed by AAA-rated collateralized loans on-chain, holds the second position.

Securitize commands about 31.94% of the tokenized stock market shares, valued at $221 million. Backed Finance (xStocks) follows with a total value of $121.2 million, capturing a 17.46% market share. Other platforms like WisdomTree and Centrifuge hold smaller portions of the market.

The monthly transfer volume of tokenized public stocks stands at $836.45 million, a 71.84% increase over the last 30 days. There has also been a 28% surge in monthly active addresses, reaching 43,352, and a 23.5% growth in holders, now totaling 100,030.

The tokenization of real-world assets is still considered to be in its early stages. Bringing real-world equities onto the blockchain allows for 24/7 trading and broadens accessibility to on-chain users. As awareness grows and more stocks are tokenized, the sector is expected to continue its expansion, with major players like BlackRock and Ripple actively exploring real-world asset tokenization to tap into trillions of dollars in potential.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

Tokenized public stocks are experiencing significant growth, driven by increasing investor interest. Ondo Finance leads the tokenized asset space, followed by Securitize and Backed Finance. Despite impressive growth, the tokenized stock market is still in its early stages, with substantial potential for future expansion.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.