Tokenized US Treasuries have emerged as a fundamental asset in decentralized finance (DeFi). Major financial institutions like BlackRock and Franklin Templeton are actively involved in tokenizing real-world assets (RWAs).

What to Know:

- Tokenized US Treasuries have emerged as a fundamental asset in decentralized finance (DeFi).

- Major financial institutions like BlackRock and Franklin Templeton are actively involved in tokenizing real-world assets (RWAs).

- Regulatory clarity and integration with stablecoins are crucial for the continued growth and stability of tokenized Treasuries.

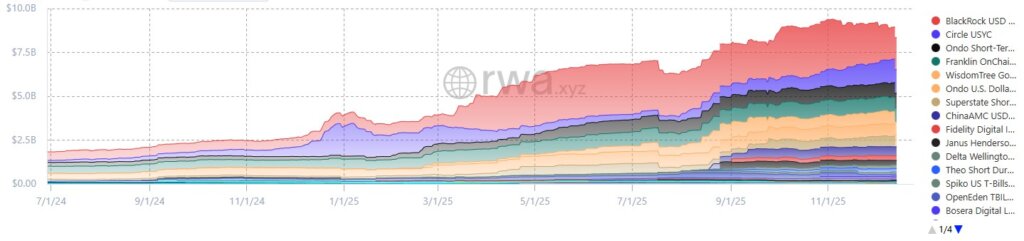

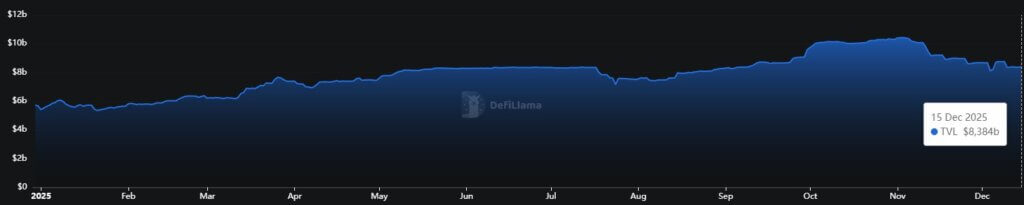

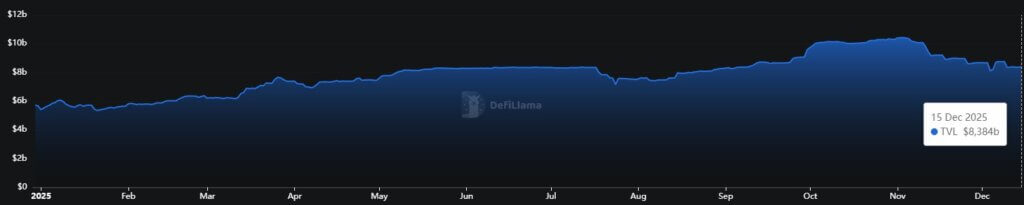

Tokenized US Treasuries have quietly become a cornerstone of the evolving crypto landscape, marking a significant shift from purely crypto-native collateral. These tokenized assets, representing shares in government securities and money-market funds, have grown exponentially, reaching nearly $9 billion across various platforms. This transformation signals a deeper integration between traditional finance (TradFi) and DeFi, with major players like BlackRock and Franklin Templeton leading the charge.

The rise of tokenized US Treasuries reflects a fundamental change in how DeFi operates, moving away from reliance solely on crypto-native assets. These tokenized assets now serve as a crucial form of collateral, mirroring their role in the traditional financial system.

BlackRock’s BUIDL fund, for example, has gained significant traction, reaching nearly $3 billion in size and being accepted as collateral on major exchanges like Binance. Franklin Templeton’s BENJI token represents a substantial investment in a US-registered government money-market fund, showcasing the increasing institutional interest in this asset class.

The issuer landscape reveals different approaches to how crypto collateral evolves. BlackRock’s BUIDL operates as a tokenized institutional liquidity fund managed by Securitize, with Bank of New York Mellon handling custody and fund administration. Franklin Templeton took a different path by tokenizing the shareholder registry itself: one share equals one BENJI token, with transfer and record-keeping maintained on-chain rather than in a legacy transfer-agent database.

Circle’s USYC has also seen substantial growth, driven by partnerships that allow institutional investors to use the token as collateral for derivatives trading. JPMorgan’s launch of a tokenized money-market fund on Ethereum further underscores the growing acceptance and integration of these assets into the broader financial ecosystem.

Despite the advancements, challenges remain in terms of composability and regulatory clarity. Most tokenized Treasury products operate within regulated frameworks, requiring KYC and often restricting full composability to permissioned venues.

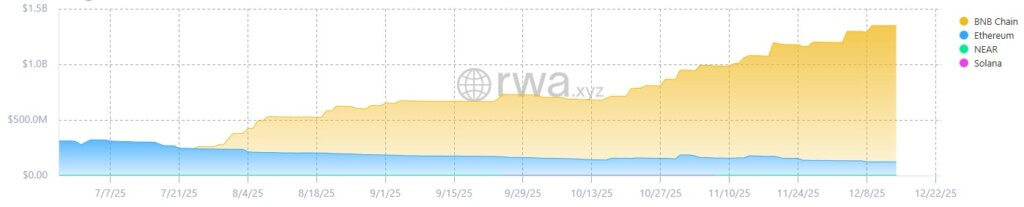

Ethereum functions as the regulatory spine, with BUIDL, BENJI, and Anemoy, while Solana operates as a high-throughput rail where Treasury-backed tokens behave almost like interest-bearing stablecoins in DeFi applications. As tokenized T-bills and Treasury-backed stablecoins proliferate, markets become the price-discovery layer for short-end rates in DeFi.

Tokenized US Treasuries represent a significant evolution in the crypto space, bridging the gap between traditional finance and decentralized finance. As regulatory frameworks become clearer and adoption continues to grow, these assets are poised to play an increasingly important role in the future of finance, offering new opportunities for investors and traders alike.

Related: XRP Price Prediction: XRP and SWIFT Partnership

Source: Original article

Quick Summary

Tokenized US Treasuries have emerged as a fundamental asset in decentralized finance (DeFi). Major financial institutions like BlackRock and Franklin Templeton are actively involved in tokenizing real-world assets (RWAs). Regulatory clarity and integration with stablecoins are crucial for the continued growth and stability of tokenized Treasuries.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.