BlackRock’s BUIDL fund will utilize UniswapX for trading via Securitize, making it a significant step in institutional adoption of DeFi. Tokenized real-world assets (RWA) are growing rapidly, but most growth is occurring in “walled gardens” that limit DeFi composability.

What to Know:

- BlackRock’s BUIDL fund will utilize UniswapX for trading via Securitize, marking a significant step in institutional adoption of DeFi.

- Tokenized real-world assets (RWA) are growing rapidly, but most growth is occurring in “walled gardens” that limit DeFi composability.

- Uniswap is positioning itself as a key execution layer for TradFi tokenization, offering atomic settlement and 24/7 availability with KYC-gated access.

BlackRock’s $2.2 billion Institutional Digital Liquidity Fund (BUIDL) is set to trade on UniswapX through a partnership with Securitize, signaling a major move in the convergence of traditional finance and decentralized finance. This integration allows BUIDL holders to swap into USDC via an on-chain request-for-quote system with quotes from allowlisted market makers. BlackRock has also disclosed a strategic investment in the Uniswap ecosystem, highlighting its interest in the DeFi space.

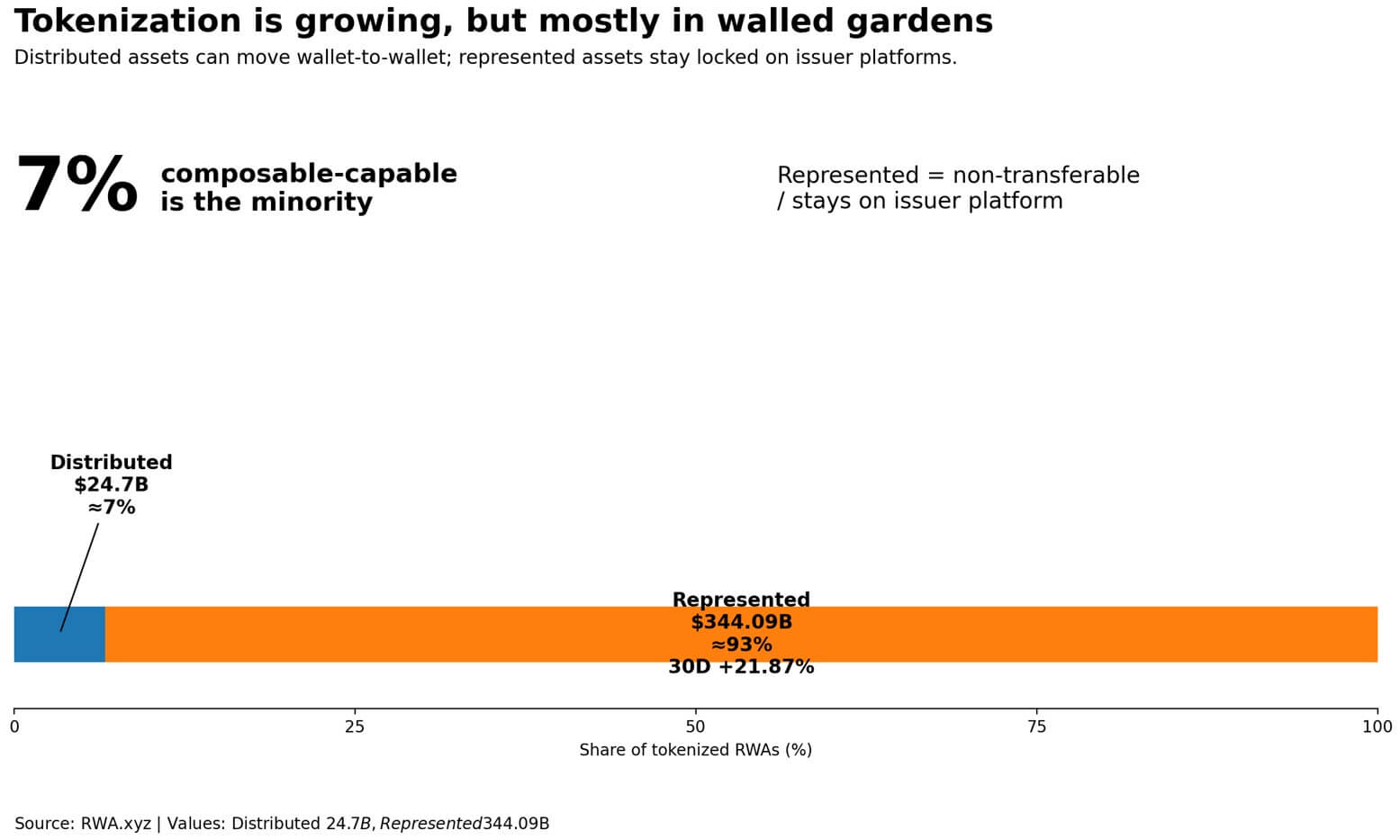

Tokenized real-world assets (RWA) have seen substantial growth, reaching $24.7 billion in distributed assets and $344.09 billion in represented assets. Distributed assets, which are transferable wallet-to-wallet, make up a smaller portion of the market compared to represented assets that remain within issuer platforms. This split highlights the different approaches to tokenization and their implications for DeFi composability.

Uniswap’s role in providing the execution and settlement layer for permissioned assets is a key development. The UniswapX RFQ framework mirrors traditional OTC mechanics while automating quote aggregation and settling instantly on-chain. This setup allows institutions to benefit from atomic settlement and self-custody without the need to rebuild clearinghouses.

The integration of BUIDL with UniswapX leverages stablecoins like USDC as a base layer for institutional cash flows. This enables seamless conversions between yield-bearing institutional cash and the largest on-chain dollar pools. Such integrations are crucial for bridging the gap between traditional finance and the crypto space.

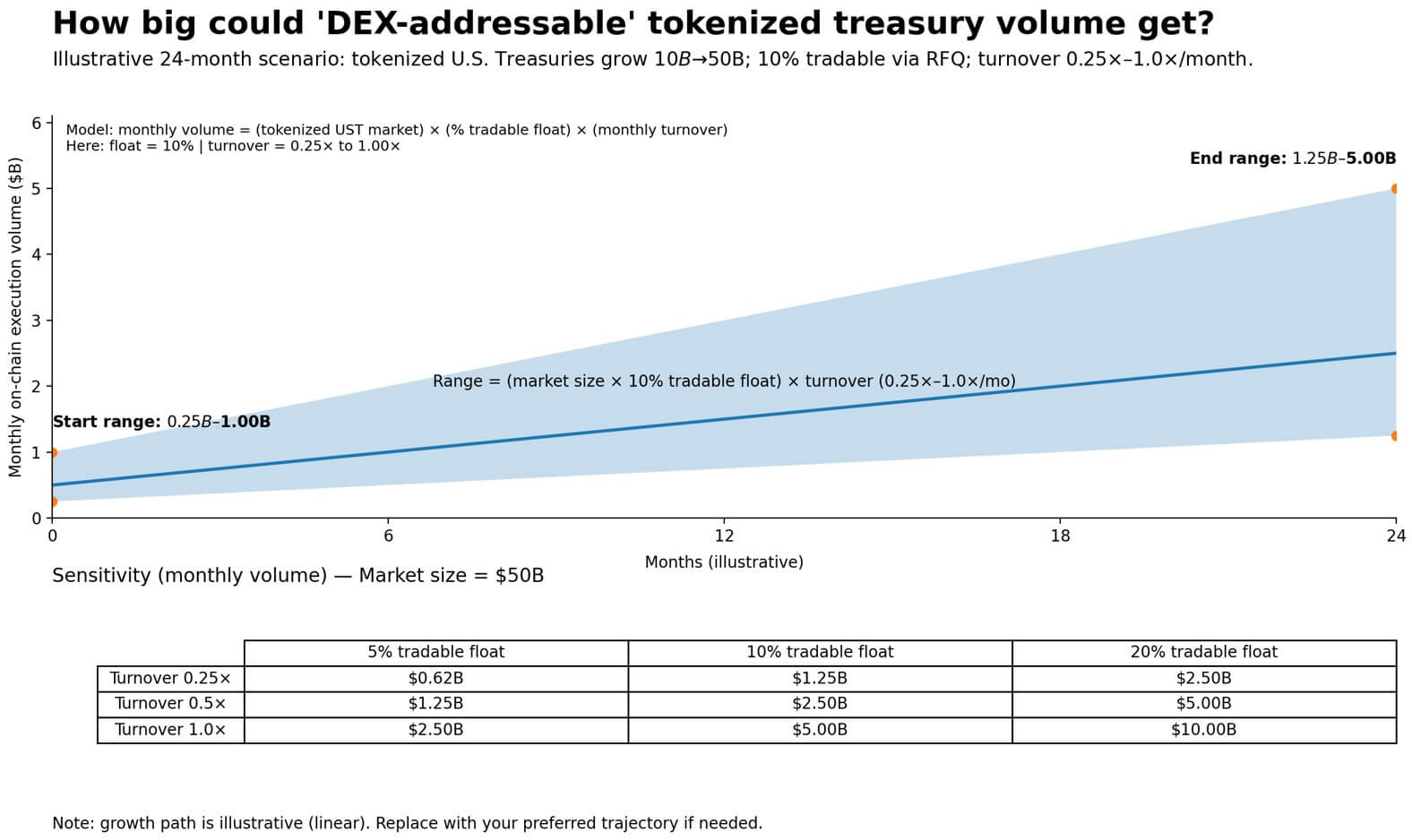

The future of DeFi as regulated market infrastructure hinges on the acceptance of composability within KYC-compliant environments. While open liquidity pools may be surpassed by closed RFQ systems, this shift ensures regulatory compliance for gatekeepers. The challenge lies in scaling distributed assets within compliant frameworks to make DeFi infrastructure indispensable.

Related: Crypto ETF Flows Reveal Bitcoin Dominance

Source: Original article

Quick Summary

BlackRock’s BUIDL fund will utilize UniswapX for trading via Securitize, marking a significant step in institutional adoption of DeFi. Tokenized real-world assets (RWA) are growing rapidly, but most growth is occurring in “walled gardens” that limit DeFi composability.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.