Bitcoin is showing signs of recovery, climbing past $86,000 after a recent dip. XRP is demonstrating strong performance among altcoins, reclaiming the $2.00 level. Privacy coins ZEC and XMR are leading the gains, surging by 14% and 16% respectively.

What to Know:

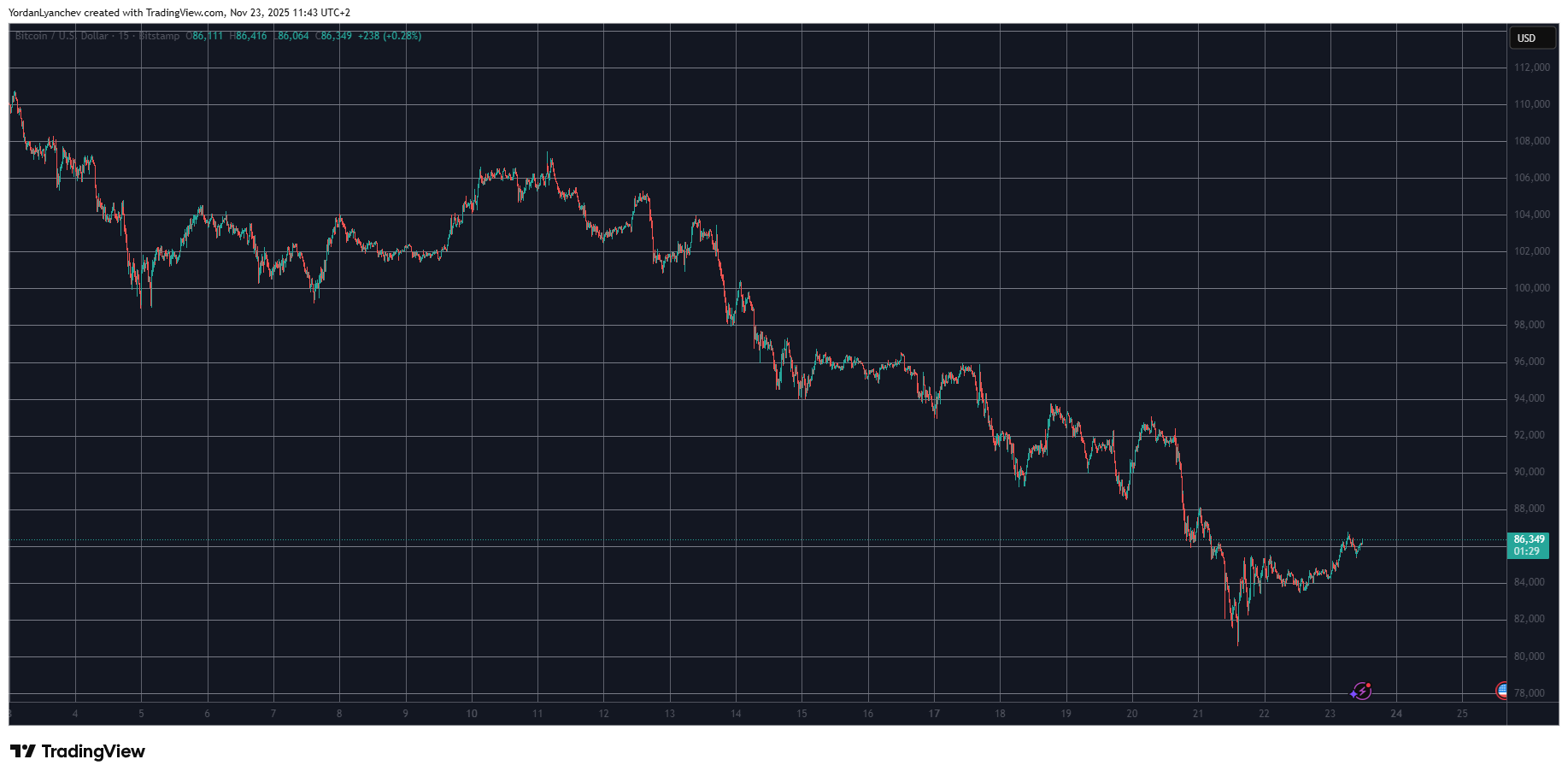

- Bitcoin is showing signs of recovery, climbing past $86,000 after a recent dip.

- XRP is demonstrating strong performance among altcoins, reclaiming the $2.00 level.

- Privacy coins ZEC and XMR are leading the gains, surging by 14% and 16% respectively.

The cryptocurrency market is showing renewed signs of life as Bitcoin attempts to sustain its recovery above $86,000. XRP is outperforming many of its peers, signaling potential shifts in altcoin season. Meanwhile, privacy-focused cryptocurrencies are experiencing significant gains, reflecting interest in digital anonymity.

After a challenging week that saw Bitcoin briefly dip below $81,000 amid selling pressure from large holders and ETF investors, the bulls have stepped in to stabilize prices. This rebound suggests a potential bottom, though sustained recovery will depend on overcoming resistance levels and maintaining investor confidence. Market participants are closely watching for regulatory developments that could further influence market sentiment.

XRP’s recent surge above $2.00 indicates strong buying interest and positive sentiment surrounding Ripple’s ongoing legal battles and potential use cases. The ability of XRP to maintain this level could signal further upside, especially if Ripple secures favorable regulatory outcomes. Investors are also considering the broader implications for cross-border payments and decentralized finance (DeFi).

ZEC and XMR’s impressive gains highlight the increasing demand for privacy-focused solutions within the crypto space. As regulatory scrutiny intensifies, these coins may attract more attention from users seeking enhanced anonymity. The performance of these assets could also influence the development and adoption of privacy-enhancing technologies across the broader cryptocurrency ecosystem.

Overall, the cryptocurrency market is displaying resilience, with Bitcoin showing signs of recovery, XRP demonstrating strength, and privacy coins leading the charge. Investors should remain vigilant, monitoring regulatory developments and market trends to make informed decisions in this dynamic landscape.

Related: Bitcoin Recovers After Drop Below $84K

Source: Original article

Quick Summary

Bitcoin is showing signs of recovery, climbing past $86,000 after a recent dip. XRP is demonstrating strong performance among altcoins, reclaiming the $2.00 level. Privacy coins ZEC and XMR are leading the gains, surging by 14% and 16% respectively.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.