Tether minted another $1 billion USDT as XRP and SHIB attempted recoveries. XRP is trying to recover from a breakdown of multi-month support at $1.30. SHIB is struggling to escape downside zones last seen during previous market stress cycles.

What to Know:

- Tether minted another $1 billion USDT as XRP and SHIB attempted recoveries.

- XRP is trying to recover from a breakdown of multi-month support at $1.30.

- SHIB is struggling to escape downside zones last seen during previous market stress cycles.

The cryptocurrency market is seeing notable activity as XRP and Shiba Inu (SHIB) attempt to rebound amid a fresh $1 billion USDT mint by Tether. This injection of liquidity occurs against a backdrop of recent liquidations and market volatility, prompting questions about its potential impact on altcoin prices and overall market stability. For institutional investors, understanding the dynamics between stablecoin issuance and altcoin behavior is crucial for navigating risk and identifying opportunities.

Tether’s $1 Billion Mint: A Sign of Stability or Speculation?

The minting of $1 billion USDT by Tether introduces new capital into the crypto ecosystem. While some view this as a sign of renewed confidence and potential fuel for speculative rallies, others see it as a move to shore up exchange reserves amid market turbulence. The ultimate impact will depend on how this liquidity is deployed, whether it will stabilize struggling assets like XRP and SHIB or contribute to further volatility. Historically, large USDT mints have preceded periods of both significant rallies and corrections, highlighting the need for careful analysis.

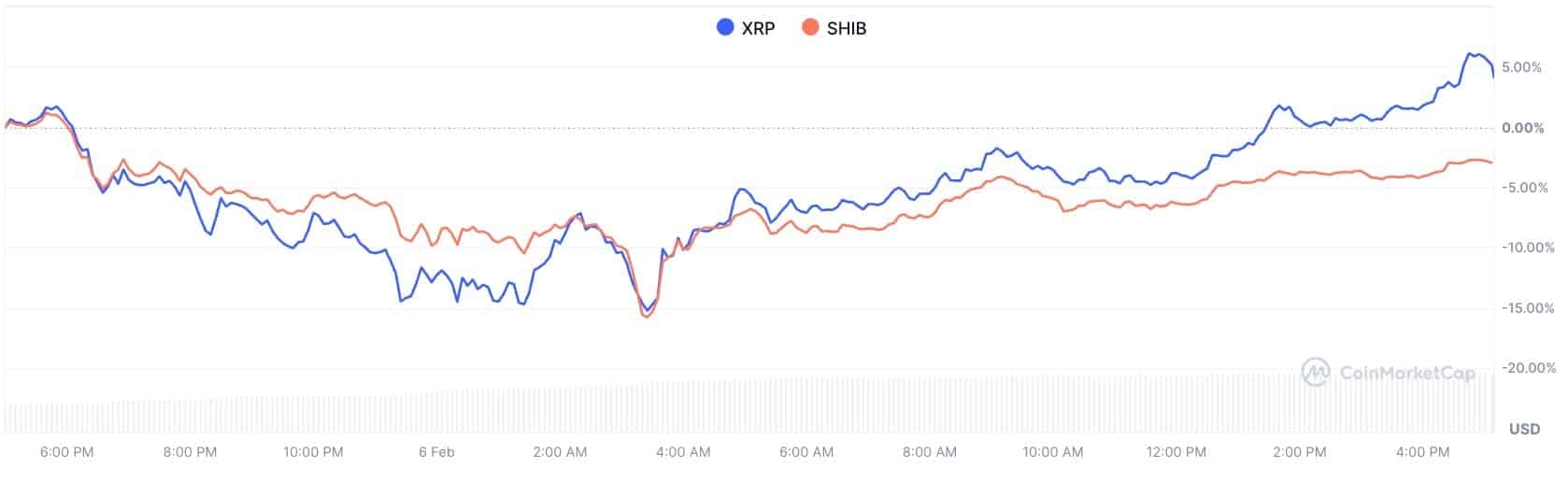

XRP’s Rocky Recovery

XRP experienced a sharp decline, breaking through a key support level of $1.30, before bouncing nearly 18% off capitulation lows near $1.22. This price action suggests a potential “dead cat bounce” rather than a sustained recovery. The digital asset remains significantly below its December peak and faces strong resistance around $1.60. Institutional investors will be watching closely to see if XRP can overcome these hurdles, as its ability to reclaim lost ground could signal broader market sentiment.

Shiba Inu’s Struggle for Momentum

Shiba Inu (SHIB) is also attempting a recovery, grinding back toward the $0.0000068 resistance level after briefly dipping below $0.00000507, a level reminiscent of the Terra collapse in 2023. Despite a 7.8% bounce, SHIB remains in a significant downtrend, trading far below its previous highs. The meme coin faces substantial supply walls at $0.000009 and $0.00001102, indicating strong selling pressure. For institutional portfolios, SHIB’s high volatility and speculative nature require careful risk management.

Liquidity Dynamics and Market Impact

The injection of $1 billion USDT raises critical questions about market liquidity and its potential effects. Will this new capital be used to stabilize altcoins that have experienced sharp declines, or will it simply bolster exchange reserves amid ongoing liquidations? The answer to this question will likely determine the short-term trajectory of assets like XRP and SHIB. If the liquidity is strategically deployed to support these assets, it could provide a much-needed boost. However, if it remains on the sidelines, the market may continue to experience volatility.

Regulatory Considerations and Market Outlook

The regulatory landscape surrounding stablecoins and altcoins remains a key factor influencing market behavior. Increased scrutiny and potential regulatory actions could impact the flow of capital and the overall risk appetite of investors. Institutional investors must stay informed about regulatory developments and their potential implications for portfolio strategy. As the market navigates these challenges, a balanced approach that combines technical analysis with fundamental research will be essential for success.

In conclusion, the $1 billion USDT mint by Tether and the attempted recoveries of XRP and SHIB highlight the ongoing complexities and opportunities in the cryptocurrency market. Institutional investors must carefully assess the liquidity dynamics, regulatory landscape, and asset-specific challenges to make informed decisions and manage risk effectively. This situation underscores the importance of a research-driven approach to digital asset investing.

Related: XRP Surges: Crypto Assets Show Positive Signals

Source: Original article

Quick Summary

Tether minted another $1 billion USDT as XRP and SHIB attempted recoveries. XRP is trying to recover from a breakdown of multi-month support at $1.30. SHIB is struggling to escape downside zones last seen during previous market stress cycles.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.