A trader opened a $196 million leveraged short position across BTC, XRP, and ZEC, indicating high-risk appetite. The XRP/BTC pair is showing a technical setup similar to July’s rally, potentially signaling a significant move.

What to Know:

- A trader opened a $196 million leveraged short position across BTC, XRP, and ZEC, indicating high-risk appetite.

- The XRP/BTC pair is showing a technical setup similar to July’s rally, potentially signaling a significant move.

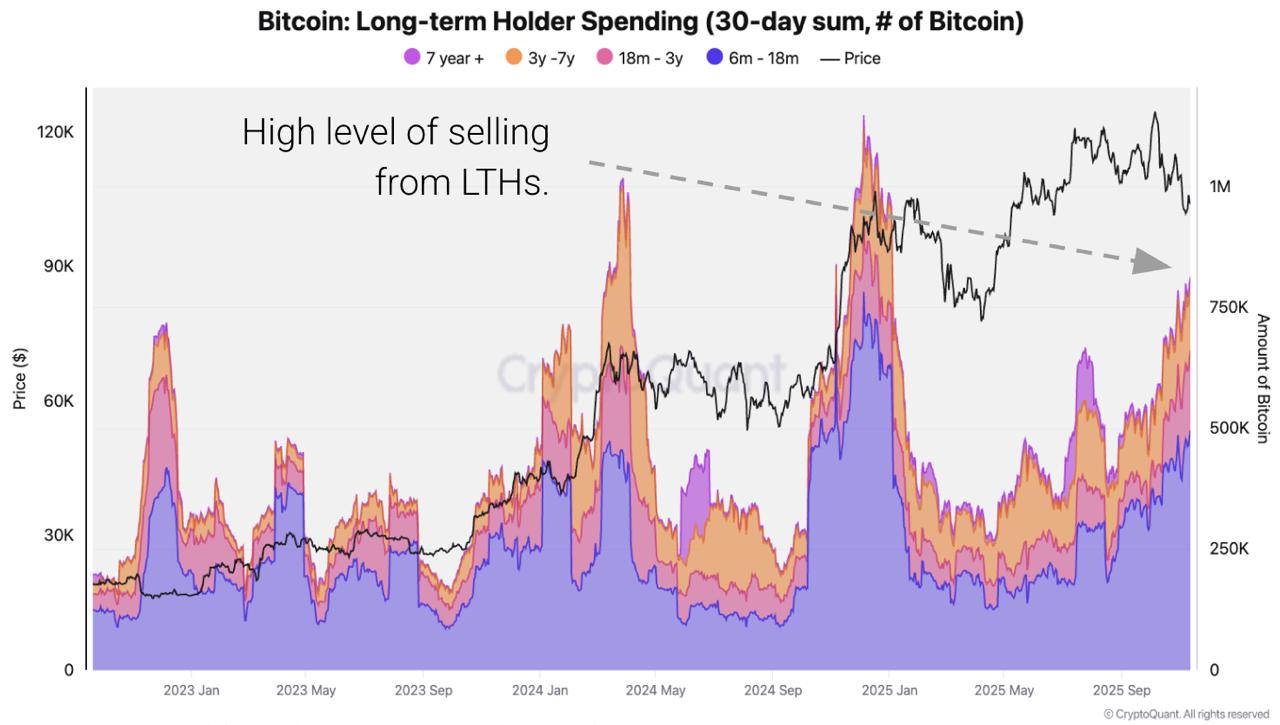

- Long-term Bitcoin holders have sold off a substantial amount of BTC, influencing market dynamics.

The crypto market is exhibiting conflicting signals, from aggressive leveraged trades to promising technical setups. XRP is presenting a structured opportunity amidst general market uncertainty. Meanwhile, significant Bitcoin sales by long-term holders are reshaping the macro landscape.

XRP is displaying a notable setup against Bitcoin, potentially mirroring a previous rally. The XRP/BTC pair is replicating the moving average interaction seen in July, which preceded a 40% surge. This alignment suggests XRP could experience a substantial move if Bitcoin’s dominance wanes.

Large-scale Bitcoin sales from long-term holders are impacting market behavior. Over the past 30 days, these holders have sold 815,000 BTC, marking the most significant distribution since early 2024. This selling pressure introduces a dynamic where technical signals become less reliable, and sustained upward trends are harder to establish.

Regulatory developments and the performance of Bitcoin ETFs continue to be pivotal. Some analysts suggest the market has been in a corrective phase for months, with ETF-driven liquidity potentially reshaping the market cycle. This perspective views the recent BTC sales as a final transition stage rather than the start of a prolonged downturn.

As the market navigates these crosscurrents, keeping an eye on key assets and fundamental shifts is crucial. XRP’s technical setup and Bitcoin’s supply dynamics are factors that could define near-term opportunities and risks. Staying informed and adaptable will be key for investors and traders in this evolving landscape.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

A trader opened a $196 million leveraged short position across BTC, XRP, and ZEC, indicating high-risk appetite. The XRP/BTC pair is showing a technical setup similar to July’s rally, potentially signaling a significant move. Long-term Bitcoin holders have sold off a substantial amount of BTC, influencing market dynamics.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.