XRP’s supply in profit hits a 12-month low, signaling potential downside risk. Upcoming XRP ETFs could be a catalyst for renewed bullish momentum. Analyst suggests a decisive rebound above $2.70 is needed for recovery.

What to Know:

- XRP’s supply in profit hits a 12-month low, signaling potential downside risk.

- Upcoming XRP ETFs could be a catalyst for renewed bullish momentum.

- Analyst suggests a decisive rebound above $2.70 is needed for recovery.

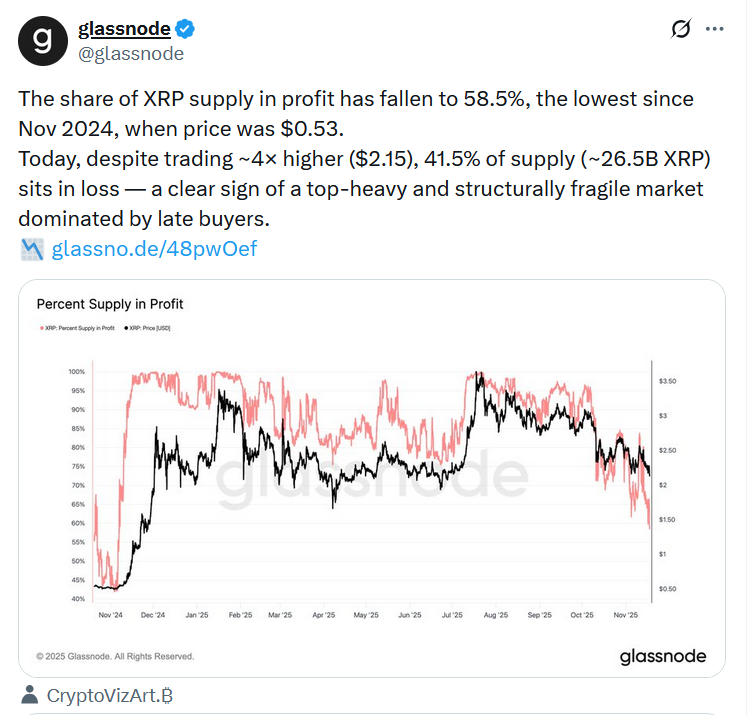

XRP is facing potential downside as a significant portion of its supply sits in loss, but the anticipated launch of XRP ETFs could shift market sentiment. Currently, 41.5% of XRP holders are underwater, reminiscent of levels last seen in November 2024 when the price hovered around $0.53. The market’s fragility is underscored by its domination by late buyers, making a recovery crucial.

“XRP supply in profit” has reached its lowest levels since Nov 2024, when the price was ~$0.53.

Today, despite trading ~4× higher ($2.15), 41.5% of supply (~26.5B XRP) sits in loss — a clear sign of a top-heavy and structurally fragile market dominated by late buyers.https://t.co/H442fmg1nB pic.twitter.com/w814E90GgT

The recent price drop has caught many XRP investors off guard, particularly those who bought above $3.00 during earlier peaks. This widespread unrealized loss is weighing on market sentiment, increasing the risk of further downside as stop-losses and forced sales could intensify selling pressure. A decisive rebound above $2.70 is necessary to restore confidence and trigger a potential recovery.

The launch of spot XRP ETFs by firms like Canary Capital, Franklin Templeton, and Bitwise are highly anticipated. Canary Capital’s ETF had a record-breaking first day, and the market is hoping these ETFs will inject fresh capital and bullish momentum into XRP. The success of these ETFs could signal growing institutional interest and confidence in XRP’s long-term prospects.

Despite the current challenges, the introduction of XRP ETFs presents a promising avenue for renewed market interest and potential price appreciation. Investors should monitor regulatory developments and ETF performance closely. The ability of XRP to overcome its current price pressures and capitalize on the ETF momentum will be critical in determining its future trajectory.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP’s supply in profit hits a 12-month low, signaling potential downside risk. Upcoming XRP ETFs could be a catalyst for renewed bullish momentum. Analyst suggests a decisive rebound above $2.70 is needed for recovery.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.