XRP adoption is gaining significant momentum as Ripple develops new use cases for its blockchain, designed to bolster global payment efficiency and financial innovation.

XRP adoption is gaining significant momentum as Ripple develops new use cases for its blockchain, aiming to bolster global payment efficiency and financial innovation. The crypto asset’s underlying infrastructure, the XRP Ledger (XRPL), is making headlines for its ability to facilitate fast, low-cost transactions. This expansion is helping Ripple tighten its grip on the growing cross-border payments space, especially within enterprise and institutional sectors.

XRPL-Powered Global Payment Pilot Gains Traction

Ripple is moving ahead with its pilot project, harnessing the XRPL to enable seamless international transactions. Built with speed and reliability in mind, the XRPL’s transaction throughput and minimal fees offer an edge over legacy systems like SWIFT. The blockchain’s decentralized nature enables real-time settlement, a factor making it highly attractive to financial institutions exploring digital asset integrations.

The payment pilot utilizes XRPL for executing transactions across borders without the need for pre-funded accounts. By eliminating the frictions typically associated with traditional remittance flows, Ripple is showcasing how XRP streamlines liquidity and reduces costs dramatically.

Integration with RxERP Aims to Streamline Compliance

In a move that merges blockchain transparency with compliance demands, Ripple has integrated XRPL into RxERP—an enterprise-level resource planning solution tailored for financial institutions. The integration supports automated regulatory reporting, reducing manual workloads and increasing process accuracy.

As regulatory clarity around crypto evolves, solutions like RxERP stand as vital tools. They allow banks and asset managers to adopt blockchain tech without compromising compliance. Moreover, XRPL’s native capabilities, such as its built-in decentralized exchange (DEX), offer functionality beyond mere settlement.

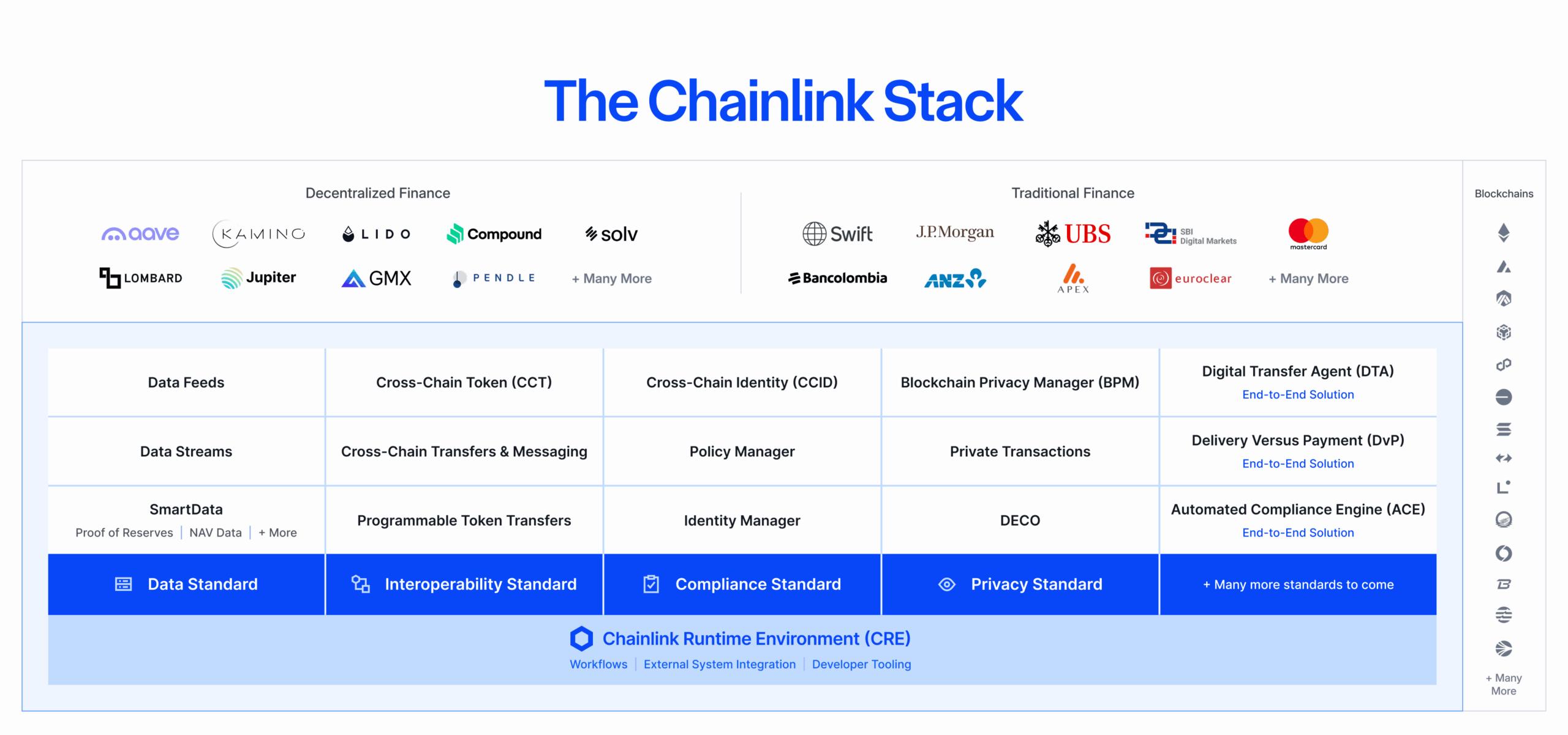

Chainlink’s Certifications Add Confidence to Data-Driven DeFi

As Ripple strengthens XRP’s presence across enterprises, another significant development from the crypto world underscores the growing role of oracles. Chainlink has recently achieved major security milestones, receiving both ISO 27001 and SOC 2 Type 1 certifications. These independent audits, conducted by Deloitte, evaluated core components including price feeds and proof-of-reserve mechanisms.

Architectural chart explaining Chainlink’s secure oracle data feeds and multi-layered services contributing to DeFi ecosystems.

Such certifications validate the security of blockchain oracles feeding critical external data into decentralized finance (DeFi) applications—a development complementary to Ripple’s push for institutional-grade infrastructure using XRP and XRPL.

Ripple’s Vision for Institutional Crypto Adoption

Ripple continues to position XRP as a utility-focused digital asset geared for mainstream finance. The company is advocating for broader adoption of tokenized value flows on public ledgers and sees real prospects in using XRP to settle treasury operations or issue stablecoins on XRPL.

Efforts to align with both enterprise requirements and compliance needs show Ripple’s intent to go beyond mere speculation. The integration of XRP into transaction systems and reporting infrastructures like RxERP reflects genuine product-market fit, further incentivizing adoption.

The Road Ahead for XRP and Blockchain Interoperability

As blockchain infrastructure matures, Ripple is emphasizing interoperability by supporting tools like the Cross-Chain Interoperability Protocol (CCIP), akin to Chainlink’s initiatives. Seamless cross-chain data sharing and liquidity routing are critical milestones for the crypto payment ecosystem to reach mainstream maturity.

Related: XRP Price: $12M Max Pain for Bears

These advancements illustrate XRP’s evolution from a transactional token into a multifaceted enterprise asset. With a rapidly expanding ecosystem and secure architectural backing, Ripple and XRP stand at the intersection of regulation, utility, and scalability.

Quick Summary

XRP adoption is gaining significant momentum as Ripple develops new use cases for its blockchain, aiming to bolster global payment efficiency and financial innovation. The crypto asset’s underlying infrastructure, the XRP Ledger (XRPL), is making headlines for its ability to facilitate fast, low-cost transactions.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.