XRP Ledger’s built-in decentralized exchange (DEX) is gaining attention as a potential catalyst for institutional adoption and liquidity.

What to Know:

- XRP Ledger’s built-in decentralized exchange (DEX) is gaining attention as a potential catalyst for institutional adoption and liquidity.

- Ripple’s strategic partnerships, like those with Hidden Road and GTreasury, could drive significant transaction volume through the XRPL, indirectly boosting demand for XRP.

- XRP’s role as a bridge asset within the XRPL’s DEX, facilitating trades between different assets, positions it uniquely in a multi-chain future.

The XRP Ledger (XRPL) and its native token, XRP, are once again in the spotlight as Ripple expands its reach into institutional finance. The XRPL’s built-in decentralized exchange (DEX) is increasingly viewed as a “secret weapon” that could drive adoption and liquidity. As regulatory clarity around digital assets improves, the XRPL’s unique architecture and Ripple’s strategic partnerships may position XRP as a key player in the evolving landscape of institutional crypto.

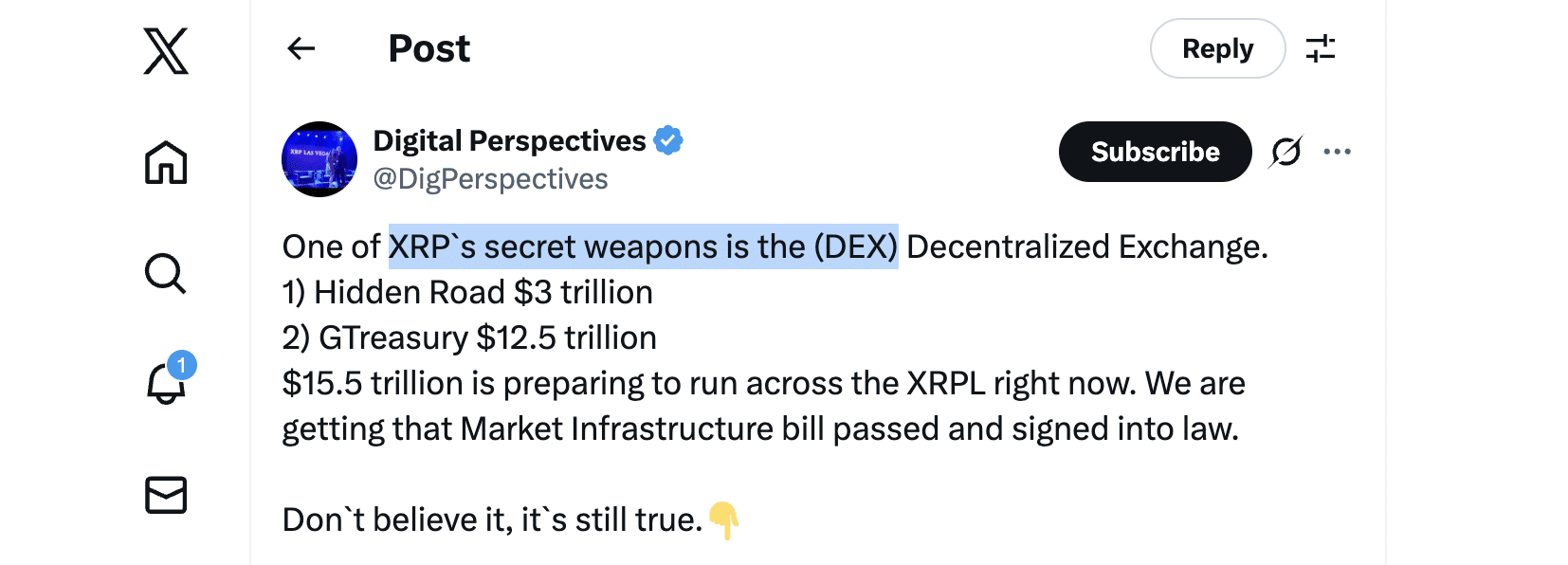

Brad Kimes of Digital Perspectives recently highlighted the potential impact of Hidden Road and GTreasury integrating with the XRPL. With Hidden Road processing $3 trillion and GTreasury handling $12.5 trillion annually, the combined $15.5 trillion in potential transaction volume is substantial. This influx of institutional activity could significantly increase demand for the XRPL’s core functionalities, including its DEX.

Ripple’s president, Monica Long, has emphasized the company’s vision of a multi-chain world, where XRP serves as the native asset of the XRPL, powering gas fees and reserve accounts. This aligns with the broader trend of interoperability in the blockchain space. The XRPL’s DEX, with its automated routing capabilities, could become a critical bridge connecting various digital assets and blockchains.

The XRPL’s DEX has a unique feature: it automatically routes trades that lack direct liquidity through XRP. This “auto-bridging” mechanism positions XRP as a neutral intermediary, independent of Ripple’s payment solutions. This is particularly relevant as developers build new applications on the XRPL and connect it to other blockchain networks.

Ripple’s partnership with Hidden Road, which will transition its post-trade infrastructure to the XRPL, is a significant step towards institutional adoption. Similarly, GTreasury’s integration provides Ripple with access to the $120 trillion corporate treasury sector. While not all of this volume will directly translate into XRP usage, it exposes the XRPL’s capabilities to a vast and largely untapped market.

Crypto Eri has clarified that post-trade activities on the XRPL will involve the movement of RLUSD collateral, settlement flows, and data-related functions. This suggests that the XRPL could become a hub for institutional-grade financial operations, leveraging its speed, low fees, and built-in DEX. This is similar to how established exchanges use their native tokens to facilitate trading and settlement, driving demand and utility.

XRP’s role as a liquidity asset within the XRPL’s DEX is a key factor driving interest. As more projects are built on the XRPL and connected to other blockchains, the demand for XRP as a routing asset could increase substantially. This is not just about speed or low fees; it’s about the XRPL’s underlying design, which prioritizes interoperability and efficient asset exchange.

Looking ahead, the XRPL’s DEX could become a vital piece of digital asset infrastructure as Ripple targets institutional finance. Analysts are actively modeling scenarios to assess the potential impact on XRP’s long-term market price. These models consider factors such as transaction volume, DEX usage, and overall adoption of the XRPL by institutional players.

In conclusion, the XRP Ledger’s built-in DEX, combined with Ripple’s strategic partnerships and a growing focus on institutional adoption, presents a compelling case for XRP. As the digital asset landscape matures and regulatory clarity improves, XRP’s unique role as a bridge asset and facilitator of cross-chain transactions could drive significant value and utility.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP Ledger’s built-in decentralized exchange (DEX) is gaining attention as a potential catalyst for institutional adoption and liquidity. Ripple’s strategic partnerships, like those with Hidden Road and GTreasury, could drive significant transaction volume through the XRPL, indirectly boosting demand for XRP.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.