XRP balances on exchanges have plummeted, with over 1 billion tokens withdrawn in the last three weeks, signaling a potential supply squeeze. This reduction in exchange supply coincides with increased demand from new XRP spot ETFs in the US, which could exacerbate scarcity.

What to Know:

- XRP balances on exchanges have plummeted, with over 1 billion tokens withdrawn in the last three weeks, signaling a potential supply squeeze.

- This reduction in exchange supply coincides with increased demand from new XRP spot ETFs in the US, which could exacerbate scarcity.

- Market analysts are increasingly pointing to a potential supply shock for XRP, driven by ETF demand, institutional accumulation, and token burns.

XRP is currently exhibiting notable dynamics as exchange balances decline substantially, even as new spot ETFs begin to attract inflows. This combination of reduced supply and growing demand suggests a tightening market structure. The implications for institutional investors revolve around potential price appreciation due to scarcity, but also increased volatility should liquidity become constrained.

Declining Exchange Balances

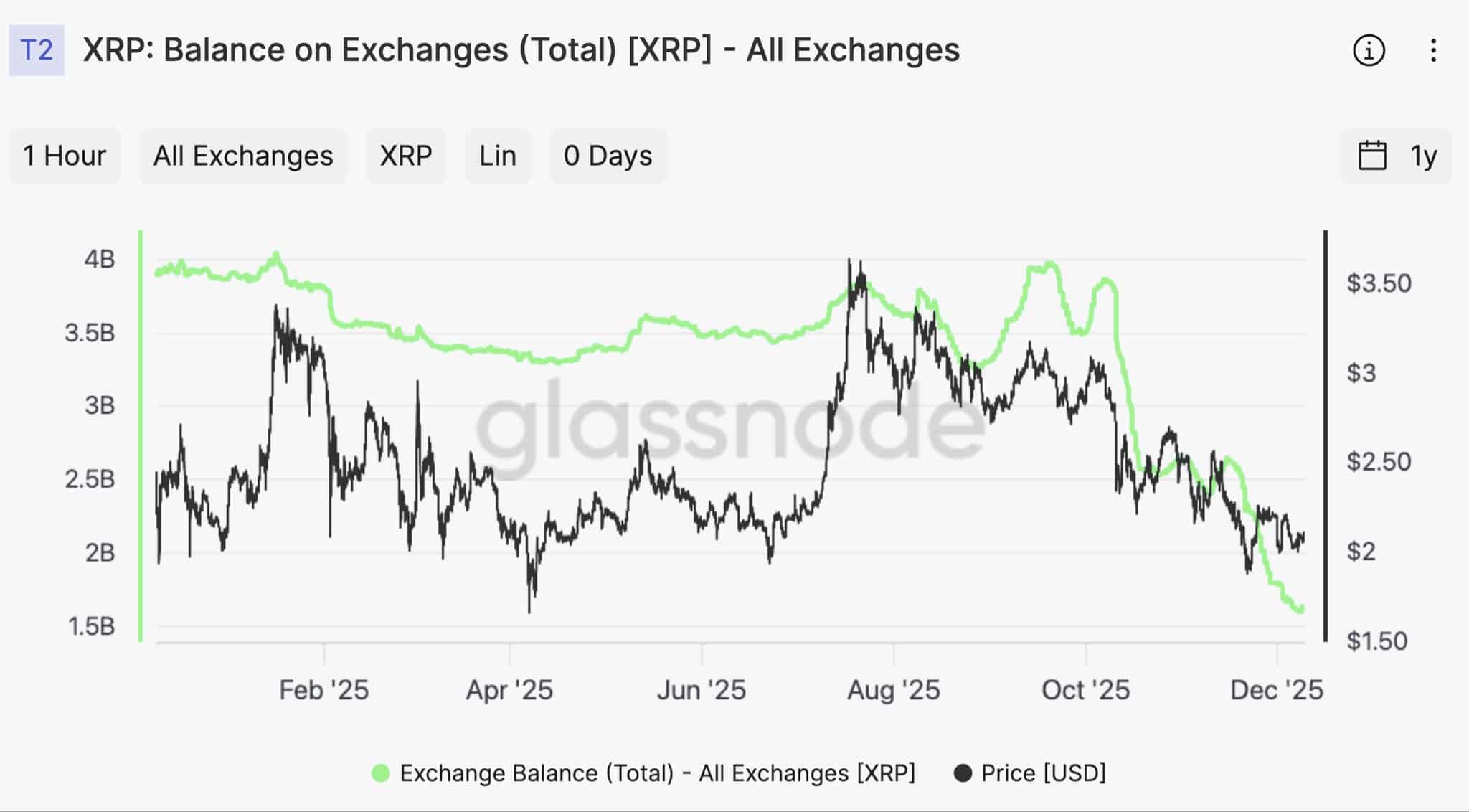

Recent data indicates a significant decrease in XRP held on exchanges, with over 1 billion tokens withdrawn in the past three weeks alone. This sharp decline follows a broader trend where exchange reserves have fallen from over 3.5 billion XRP in early November to around 1.5 billion currently. Such a dramatic reduction suggests a shift in investor behavior, with holders moving XRP off exchanges, likely into cold storage for longer-term holding.

This trend has implications for market liquidity, potentially making it more difficult for large institutional players to accumulate or distribute XRP without significantly impacting the price. The move toward self-custody also reflects a maturing market as investors prioritize security and control over their assets.

ETF Demand and Supply Dynamics

The timing of these withdrawals is particularly noteworthy, coinciding with the launch of XRP spot ETFs in the United States. These ETFs have quickly amassed nearly $1 billion in assets under management, signaling strong institutional and retail interest. As these ETFs acquire XRP to meet investor demand, they further reduce the available supply on exchanges, potentially exacerbating any existing supply-demand imbalances.

The ETF effect is a well-known phenomenon in traditional markets, often leading to price appreciation as the underlying asset becomes scarcer. We saw this play out with gold ETFs in the early 2000s, and Bitcoin ETFs more recently. If XRP ETFs continue to attract inflows, the resulting supply squeeze could drive prices higher.

Supply Shock Narrative

Several analysts have begun to highlight the possibility of an impending supply shock for XRP, driven by a confluence of factors. These include not only ETF demand but also ongoing token burns, increasing utility of the XRP ledger, and potential institutional accumulation. If these factors continue to reduce the circulating supply of XRP, while demand remains steady or increases, a significant price appreciation could occur.

However, it’s important to note that the supply shock narrative is not without its skeptics. Some argue that the circulating supply of XRP is still relatively large, and that increased selling pressure from early holders could offset any potential scarcity.

Historical Context and Market Parallels

To understand the potential impact of a supply shock, it’s helpful to look at historical examples in other markets. The launch of Bitcoin ETFs, for instance, led to a significant reduction in Bitcoin available on exchanges and a subsequent price rally. Similarly, in traditional commodities markets, supply disruptions have often resulted in sharp price increases.

While past performance is not necessarily indicative of future results, these examples suggest that a sustained reduction in XRP supply, coupled with strong demand, could have a significant impact on its price. Investors should, however, remain aware of the unique characteristics of the XRP market, including its regulatory status and the potential for further token releases.

Regulatory and Macro Considerations

The regulatory environment surrounding XRP remains a key factor to consider. While the legal clarity gained from Ripple’s partial victory in its case against the SEC has boosted investor confidence, ongoing regulatory scrutiny could still impact market sentiment. Additionally, broader macroeconomic conditions, such as interest rate policy and inflation, could also influence the demand for XRP and other crypto assets.

Institutional investors should carefully weigh these factors when assessing the potential risks and rewards of investing in XRP. A diversified portfolio and a long-term investment horizon are essential for navigating the inherent volatility of the crypto market.

In conclusion, the declining XRP balances on exchanges, coupled with growing ETF demand, suggest a potential supply squeeze that could drive prices higher. While regulatory and macroeconomic factors remain important considerations, the current market dynamics appear favorable for XRP. Institutional investors should closely monitor these developments and carefully assess their risk tolerance before making any investment decisions.

Related: Binance CEO Hack Exposes Crypto Risks

Source: Original article

Quick Summary

XRP balances on exchanges have plummeted, with over 1 billion tokens withdrawn in the last three weeks, signaling a potential supply squeeze. This reduction in exchange supply coincides with increased demand from new XRP spot ETFs in the US, which could exacerbate scarcity.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.