XRP, the digital asset native to Ripple, has officially earned its place among the world’s top 100 financial assets by market capitalization, signaling a major milestone for the cryptocurrency sector.

XRP, the digital asset native to Ripple, has officially earned its place among the world’s top 100 financial assets by market capitalization, signaling a major milestone for the cryptocurrency sector.

XRP Enters the Global Financial Elite

Cryptocurrencies continue making waves across global markets, with XRP now joining Bitcoin and Ethereum as representatives of the crypto industry within the elite club of top 100 financial assets worldwide. This positions XRP alongside traditional financial heavyweights and highlights the growing power of blockchain-based currencies.

In the past 10 months, the overall cryptocurrency market has experienced strong upward momentum. For XRP in particular, the journey has been impressive. Following the U.S. elections last November, the asset was trading below $0.60 with a total market capitalization hovering between $30 billion and $35 billion. Since then, XRP has shattered multiple resistance levels, peaking at an all-time high of $3.65 in mid-July.

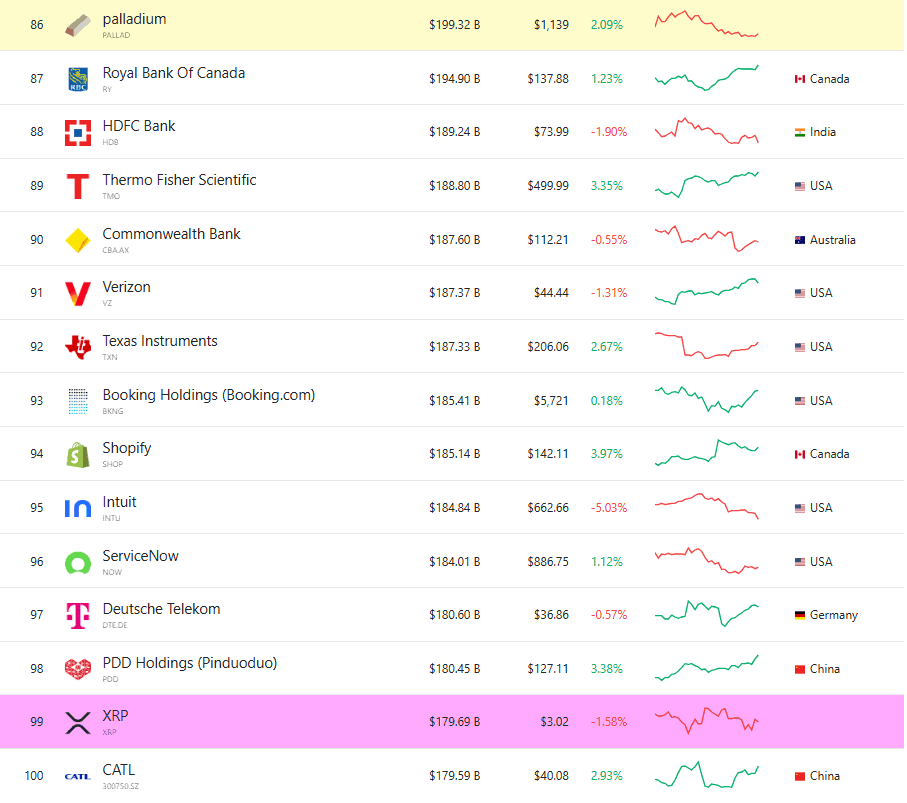

Although it has slightly cooled from those highs, XRP remains solid, currently priced just over $3. This price level translates to a market capitalization of approximately $180 billion, securing its position among major global corporations like Allianz SE, Accenture, Boston Scientific, and even surpassing the likes of Adobe, Pfizer, and Spotify.

Visual comparison of financial assets by market capitalization, including XRP. Source: CompaniesMarketCap

Ripple’s Expanding Ecosystem

Beyond price growth, Ripple’s broader strategy and ecosystem developments have contributed significantly to XRP’s market position. A pivotal moment came with the near-resolution to its multi-year legal battle with the U.S. Securities and Exchange Commission (SEC). The legal process took a major step forward when the Second Circuit approved a joint stipulation of dismissal filed by both Ripple and the SEC, reducing legal uncertainty for the token.

Ripple has also made decisive business moves. One standout acquisition was its purchase of prime brokerage firm Hidden Road for $1.25 billion. This deal significantly enhances Ripple’s infrastructure and institutional offerings. Further bolstering its ecosystem, Ripple launched a new stablecoin, RLUSD, at the end of 2024, tailored specifically for institutional adoption.

Adding to XRP’s legitimacy, various companies have begun accumulating the token in their treasuries. This shift suggests growing institutional confidence in XRP as a store of value and a strategic reserve asset.

Future Outlook and Regulatory Movement

Perhaps the next big milestone for XRP could be the approval of spot-based exchange-traded funds (ETFs) in the U.S. Currently, several futures-based XRP ETF products already exist, but a spot ETF would mark a new level of mainstream market adoption. Encouragingly, multiple recent ETF proposals have been updated to align with SEC regulations, signaling serious momentum on this front.

Related: XRP Price: $12M Max Pain for Bears

XRP’s entry into the top 100 global assets underscores how crypto is no longer a fringe element in finance—it’s fast becoming foundational. As Ripple continues to grow its technological reach, legal clarity, and institutional trust, XRP’s position on the global stage only looks to strengthen further.

Quick Summary

XRP, the digital asset native to Ripple, has officially earned its place among the world’s top 100 financial assets by market capitalization, signaling a major milestone for the cryptocurrency sector.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.