XRP saw a modest price increase alongside a notable surge in trading volume. Technical analysis suggests XRP is consolidating between $2.60 and $2.67. Traders should watch for a sustained break above $2.65 or a drop below $2.60 to determine the next price direction.

What to Know:

- XRP saw a modest price increase alongside a notable surge in trading volume.

- Technical analysis suggests XRP is consolidating between $2.60 and $2.67.

- Traders should watch for a sustained break above $2.65 or a drop below $2.60 to determine the next price direction.

XRP experienced a slight uptick recently, accompanied by a significant increase in trading volume, signaling heightened market activity. Despite this increased interest, momentum indicators suggest a potential period of consolidation for XRP in the near term. Investors are keenly observing whether XRP can sustain its current levels amid evolving market dynamics.

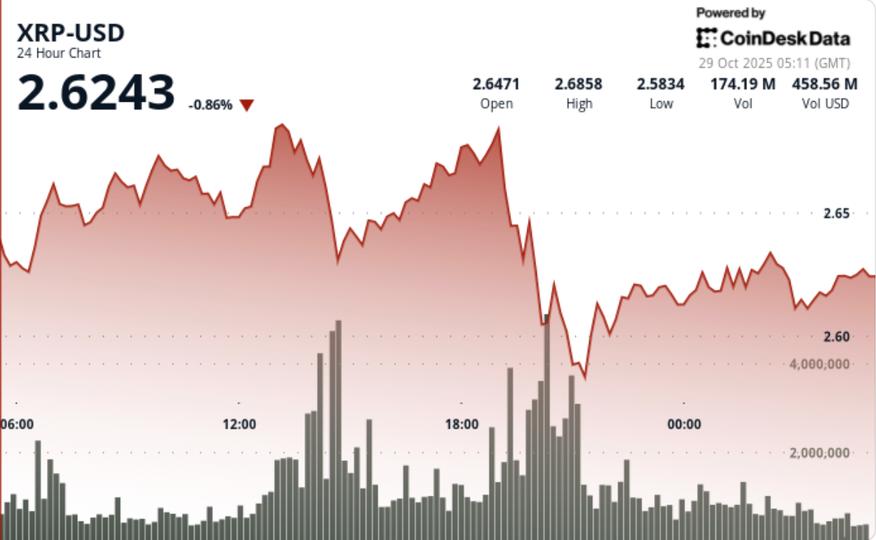

XRP’s trading range narrowed, oscillating between approximately $2.62 and $2.64 during the session. The token’s price action reflects controlled accumulation, indicative of strategic positioning rather than an aggressive breakout attempt. The $2.60 support level has proven resilient, holding firm against multiple tests.

A peak volume of around 167.3 million tokens, roughly 140% above the 24-hour average, coincided with a failed breakout attempt near the $2.68 resistance level. The rejection at this level confirms that resistance remains a significant hurdle for XRP. Chart patterns suggest consolidation between $2.60 and $2.67, potentially forming a base for a future move.

Looking ahead, the window for ETF decisions and potential institutional inflows remain critical factors to monitor. A sustained move above $2.65, coupled with renewed volume, could signal a bullish trend, targeting levels near $2.70-$2.90. Conversely, a break below the $2.60 support could lead to a retest of $2.55 or lower.

In conclusion, while XRP demonstrates resilience and growing interest, traders should remain vigilant, closely monitoring key support and resistance levels. The interplay between technical indicators, market sentiment, and upcoming regulatory decisions will likely dictate XRP’s next significant move in the cryptocurrency landscape.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP saw a modest price increase alongside a notable surge in trading volume. Technical analysis suggests XRP is consolidating between $2.60 and $2.67. Traders should watch for a sustained break above $2.65 or a drop below $2.60 to determine the next price direction.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.