Bitcoin’s price decline has triggered ETF outflows, leading to spot selling and further price drops. XRP’s losses are accelerating due to thinner order books and a more reactive retail investor base.

What to Know:

- Bitcoin’s price decline has triggered ETF outflows, leading to spot selling and further price drops.

- XRP’s losses are accelerating due to thinner order books and a more reactive retail investor base.

- Market stabilization depends on Bitcoin’s ability to absorb selling pressure and rebuild investor confidence.

The cryptocurrency market is facing a significant liquidity crunch, impacting major assets like Bitcoin and XRP. Bitcoin’s struggles are amplified by ETF outflows and panicked short-term holders, while XRP’s structural weaknesses exacerbate its losses. Understanding these dynamics is crucial for investors navigating the current market conditions.

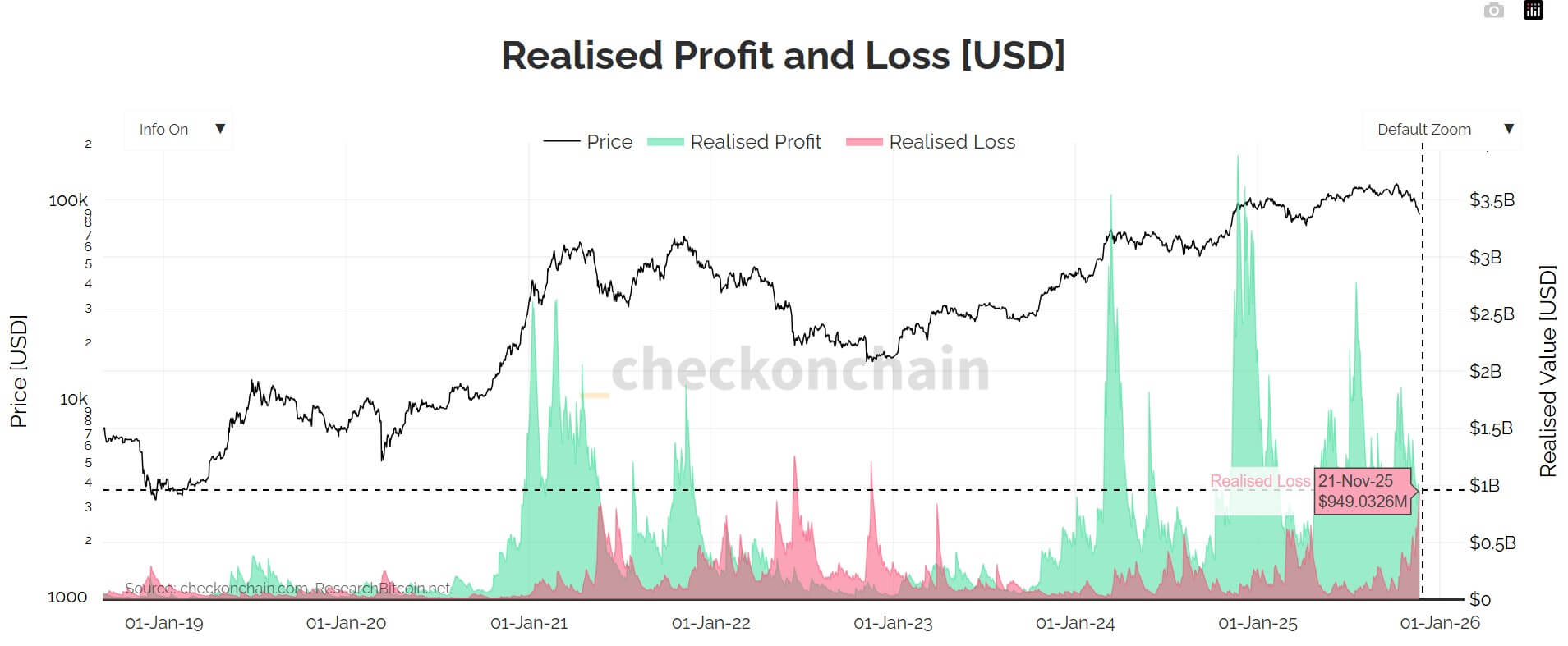

Bitcoin’s recent price drops have triggered substantial ETF outflows, forcing fund issuers to sell spot holdings. This selling pressure further drives down prices, creating a feedback loop of panic among short-term holders. Data indicates that recent buyers are aggressively selling into weakness, mirroring behavior seen during the 2022 bear market.

XRP’s market behavior reflects the broader liquidity issues, with losses closely tracking Bitcoin despite community enthusiasm for new XRP ETFs. The token’s realized losses have surged, indicating that capitulation has spread beyond Bitcoin investors. Only a little over half of the circulating XRP supply is currently in profit, creating overhead resistance for any potential price recovery.

Unlike Bitcoin, XRP lacks the institutional spot liquidity and ETF inflow support to cushion against high volatility. Its thinner order books make it more susceptible to large sell flows. Additionally, a more distributed retail holder base contributes to increased panic selling during market corrections.

The market’s stabilization hinges on Bitcoin’s ability to absorb selling pressure from ETFs and restore confidence among short-term holders. Until this feedback loop is broken, assets with weaker liquidity profiles, like XRP, will remain vulnerable. Monitoring XRP’s profitability metrics can provide insights into whether the market has found a floor.

As the market navigates these challenges, investors should closely monitor Bitcoin’s ability to stabilize and XRP’s performance as a gauge of overall market health. The current environment highlights the importance of understanding market dynamics and structural weaknesses in digital assets. A moderation in outflows or a return of spot demand is needed to break the current cycle and pave the way for recovery.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

Bitcoin’s price decline has triggered ETF outflows, leading to spot selling and further price drops. XRP’s losses are accelerating due to thinner order books and a more reactive retail investor base. Market stabilization depends on Bitcoin’s ability to absorb selling pressure and rebuild investor confidence.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.