Bitcoin’s recent price volatility is linked to ETF outflows and short-term holder capitulation, creating a liquidity crunch. XRP’s price decline reflects broader market fragility due to its thinner order books and retail-heavy investor base.

What to Know:

- Bitcoin’s recent price volatility is linked to ETF outflows and short-term holder capitulation, creating a liquidity crunch.

- XRP’s price decline reflects broader market fragility due to its thinner order books and retail-heavy investor base.

- The market’s recovery hinges on Bitcoin’s ability to stabilize and XRP’s profitability metrics, indicating when the liquidity crunch may find a floor.

The cryptocurrency market is facing a significant liquidity test, impacting major assets like Bitcoin and XRP. This downturn, marked by over $1 trillion in losses, reveals underlying structural weaknesses in the digital asset ecosystem. Understanding these dynamics is crucial for investors navigating the current market conditions.

The recent market downturn is characterized by Bitcoin’s liquidity drain, exacerbated by outflows from U.S. spot Bitcoin ETFs and panic selling from short-term holders. Data shows substantial realized losses among recent Bitcoin buyers, mirroring late-stage fear seen in previous market crashes. Unlike the 2022 crash, this capitulation is driven by demand exhaustion and leverage unwinding rather than credit contagion.

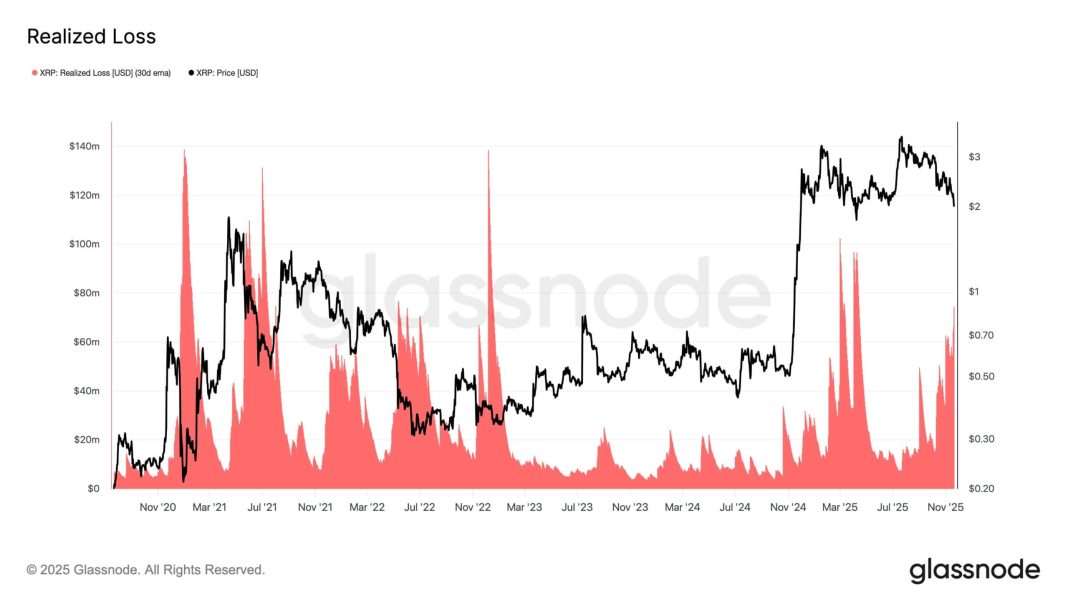

XRP’s performance is a key indicator of the broader liquidity crunch affecting the crypto market. Despite enthusiasm around new XRP ETFs, the token’s price has declined significantly, reflecting its vulnerability to market-wide liquidity constraints. On-chain data reveals a surge in XRP realized losses and a decrease in the percentage of circulating supply in profit, highlighting the severity of the capitulation.

The structural weaknesses of XRP, including thinner order books and a retail-heavy investor base, contribute to its heightened volatility. Technical indicators, such as the formation of a “death cross,” signal further potential downside pressure. The current market dynamic creates a feedback loop where Bitcoin price declines trigger ETF outflows, leading to further price drops and panic selling in altcoins like XRP.

In conclusion, the stabilization of the cryptocurrency market hinges on Bitcoin’s ability to absorb selling pressure and rebuild investor confidence. XRP’s performance serves as a critical gauge for assessing the market’s overall health and the potential for a recovery. Monitoring these key indicators will be essential for investors looking to navigate the current market turbulence.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

Bitcoin’s recent price volatility is linked to ETF outflows and short-term holder capitulation, creating a liquidity crunch. XRP’s price decline reflects broader market fragility due to its thinner order books and retail-heavy investor base.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.