Bitcoin’s price decline has triggered significant ETF outflows, exacerbating market-wide liquidity issues. XRP’s price is closely tracking Bitcoin’s losses, indicating a broader liquidity crunch affecting major altcoins.

What to Know:

- Bitcoin’s price decline has triggered significant ETF outflows, exacerbating market-wide liquidity issues.

- XRP’s price is closely tracking Bitcoin’s losses, indicating a broader liquidity crunch affecting major altcoins.

- The market’s stabilization hinges on Bitcoin’s ability to absorb selling pressure and rebuild investor confidence.

The cryptocurrency market is facing a severe liquidity test, with Bitcoin leading the downturn and impacting assets like XRP. This synchronized liquidity shock is causing a repricing of risk across the digital asset ecosystem. Investors are closely watching how these dynamics unfold, especially with the emerging regulatory landscape.

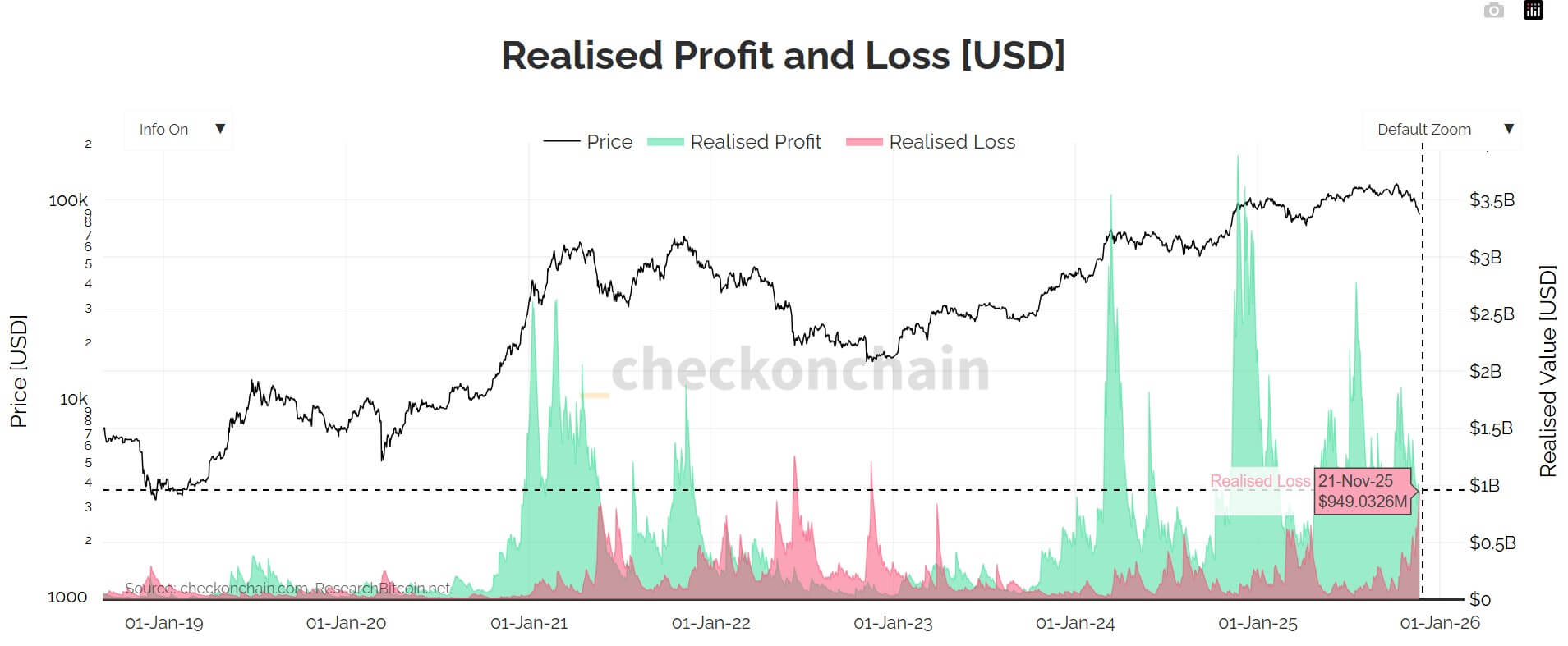

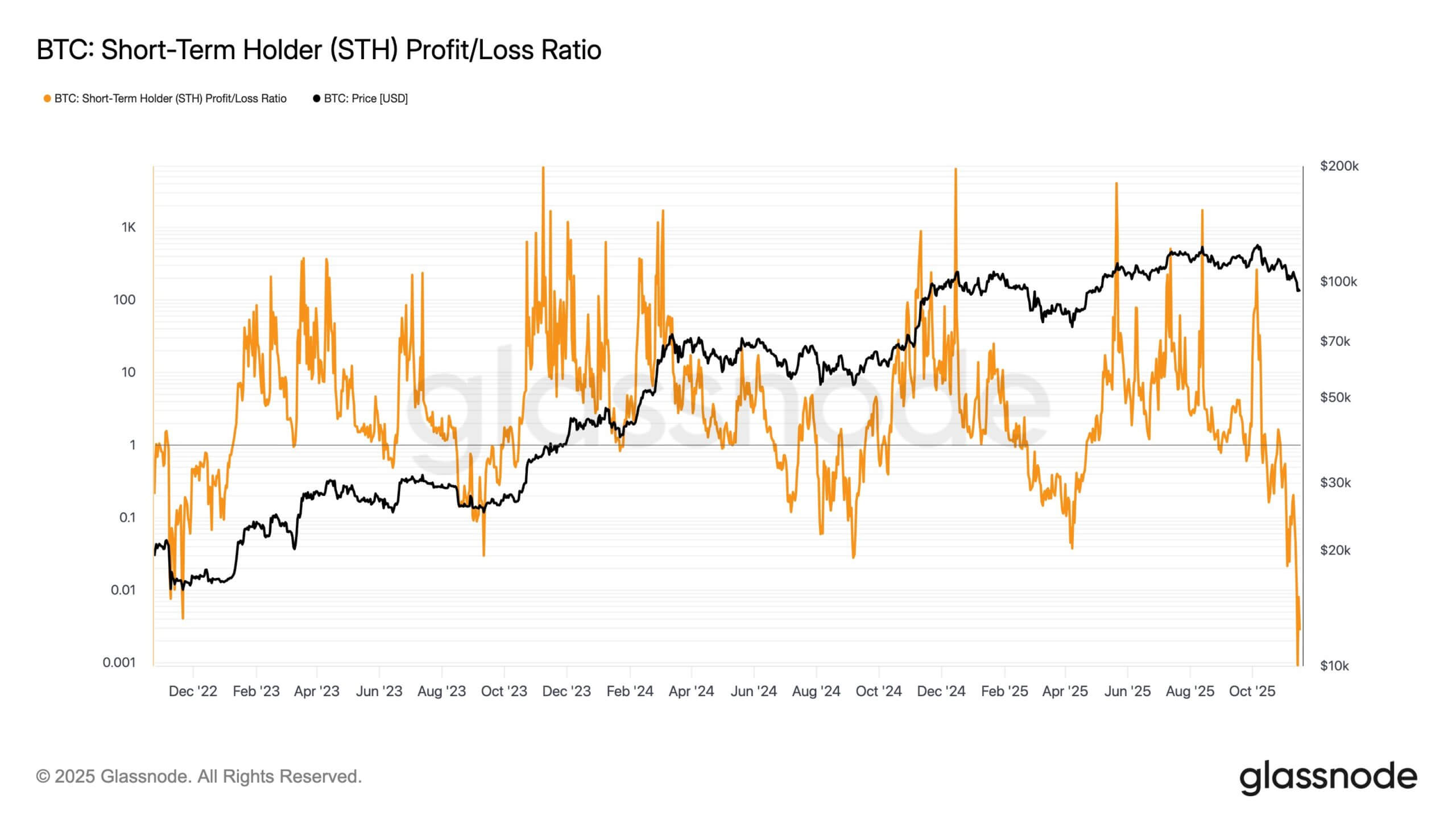

The market downturn began with a gradual pricing correction that quickly turned into a liquidity event. Data indicates that short-term Bitcoin holders are primarily driving the selling pressure. This behavior mirrors the classic late-stage fear that typically defines significant market drawdowns.

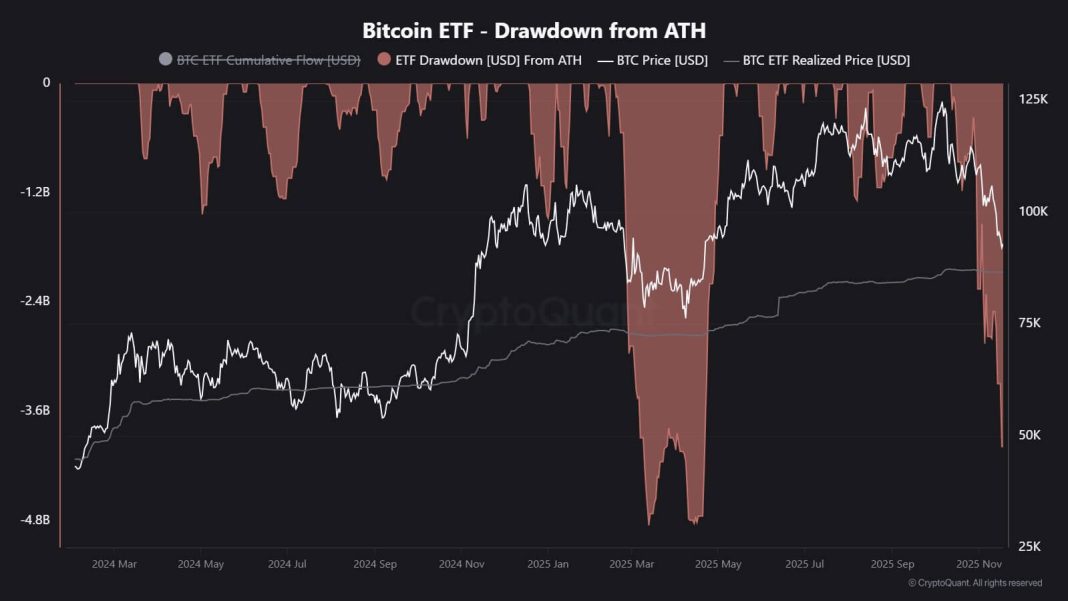

US spot Bitcoin ETFs faced renewed selling pressure, recording substantial outflows that erased previous capital inflows. November is on pace to become the worst month on record for ETF redemptions. The scale of these redemptions has resulted in a significant liquidity shock.

XRP has emerged as a barometer for the secondary effects of the liquidity crunch. The capitulation has severely impacted the profitability profile of the XRP network. Macro liquidity constraints and pressure from the Bitcoin downturn are overshadowing any potential bullish narratives specific to the XRP ecosystem, even with the launch of XRP ETFs.

The current market structure is characterized by a pernicious feedback loop. A decline in Bitcoin price triggers increased ETF outflows, which necessitates spot selling by fund issuers, forcing prices lower. As market-wide liquidity declines, altcoins like XRP realize larger losses due to thinner order books.

The cryptocurrency market’s stabilization hinges on Bitcoin’s ability to absorb selling pressure from ETFs and rebuild confidence among short-term holders. Investors should monitor XRP’s profitability metrics as a gauge for broader market recovery, keeping a close eye on regulatory developments and potential catalysts.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

Bitcoin’s price decline has triggered significant ETF outflows, exacerbating market-wide liquidity issues. XRP’s price is closely tracking Bitcoin’s losses, indicating a broader liquidity crunch affecting major altcoins. The market’s stabilization hinges on Bitcoin’s ability to absorb selling pressure and rebuild investor confidence.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.