XRP is showing signs of bullish momentum, fueled by increasing institutional interest and positive sentiment among derivatives traders. Recent data indicates significant inflows into XRP investment products, suggesting a belief among investors that the market has bottomed out.

What to Know:

- XRP is showing signs of bullish momentum, fueled by increasing institutional interest and positive sentiment among derivatives traders.

- Recent data indicates significant inflows into XRP investment products, suggesting a belief among investors that the market has bottomed out.

- Technical analysis points to a potential breakout pattern that could drive XRP’s price toward $2.65, contingent on maintaining key support levels.

XRP is garnering attention as its price shows potential for a significant rebound. This uptick is occurring against a backdrop of evolving regulatory clarity and growing institutional participation in the broader digital asset space. The confluence of these factors could position XRP for substantial gains, making it a focal point for investors and traders alike.

XRP analysts highlighted the potential to rebound to $2.65 as institutional demand increased and derivatives traders flipped bullish.

Altcoin Watch

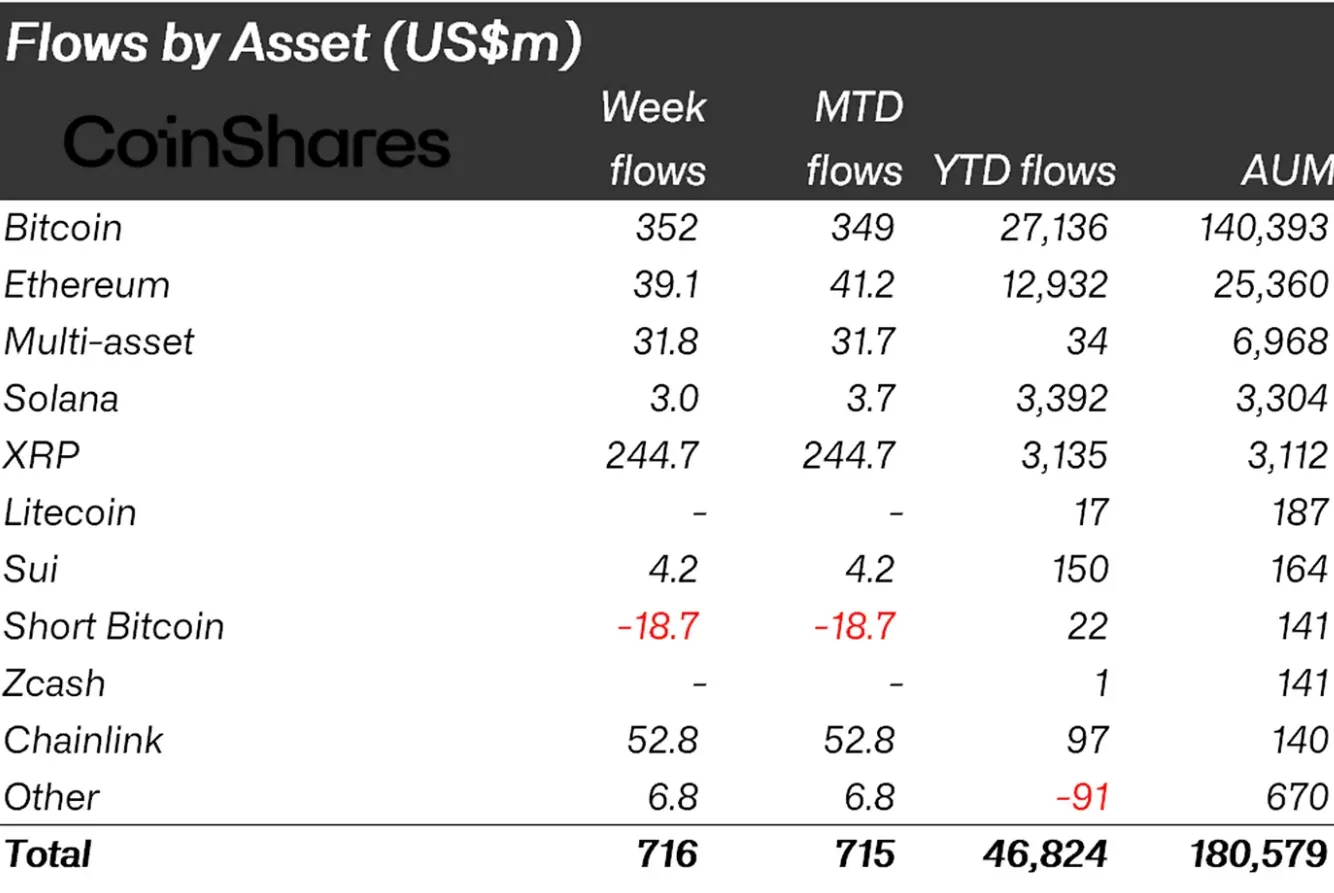

Institutional interest in XRP is on the rise, as evidenced by substantial inflows into XRP-linked investment products. CoinShares data reveals significant capital allocations into XRP ETPs, signaling a strong belief among institutional investors that the recent negative sentiment surrounding XRP may have reached its nadir. This level of inflow resembles the kind of accumulation that often precedes a notable shift in market narrative, a pattern we’ve observed in traditional assets following periods of regulatory uncertainty.

The performance of spot XRP ETFs further underscores this growing institutional appetite. The consistent positive flows into these ETFs, accumulating to nearly $900 million in AUM, demonstrate sustained demand from a diverse range of investors. This echoes the early days of Bitcoin ETFs, where steady inflows laid the groundwork for significant price appreciation as market participants gained confidence in the asset class.

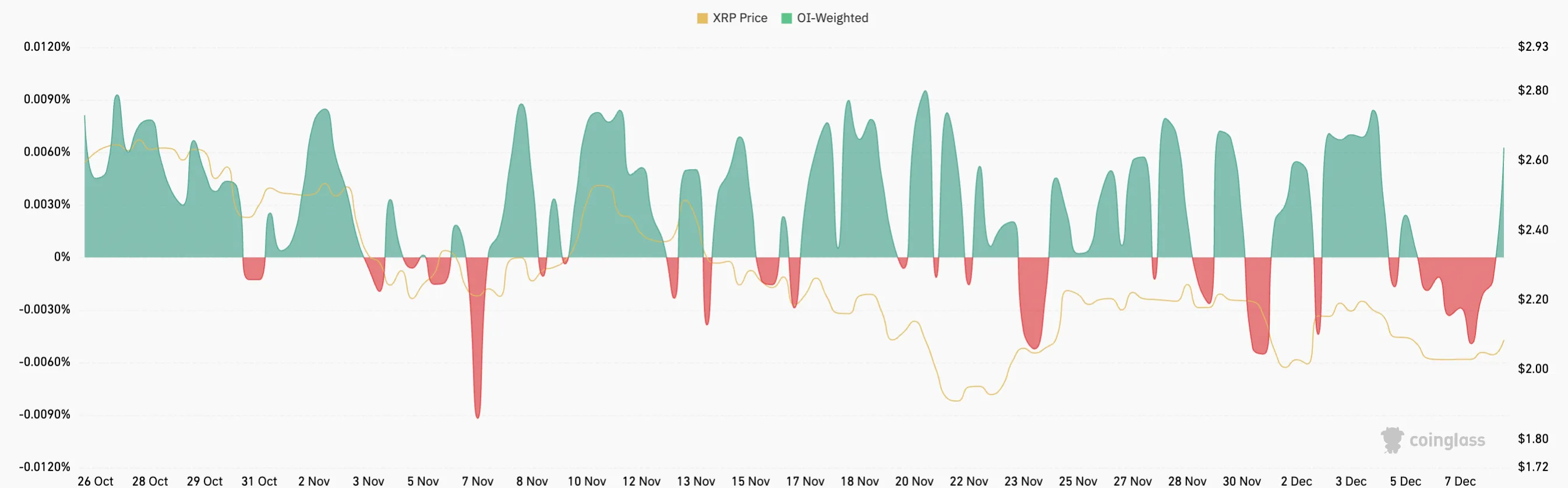

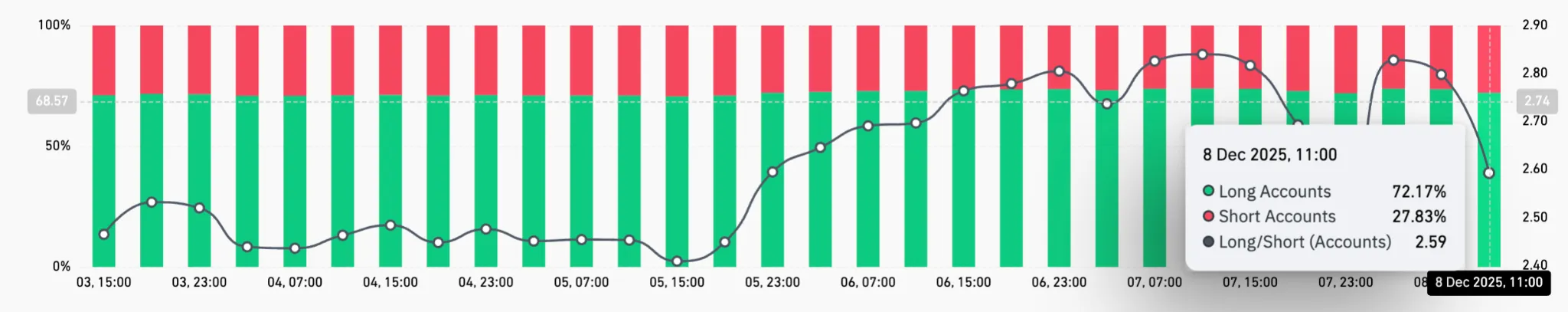

Derivatives markets are also reflecting a shift in sentiment toward XRP. Funding rates have turned positive, indicating that a majority of traders are now taking long positions. This bullish bias is further reinforced by the long/short ratio on major exchanges like Binance, where long positions significantly outweigh short positions. While high leverage introduces liquidation risks, the overall picture suggests increasing confidence in XRP’s potential upside, similar to the build-up in bullish derivatives positioning we’ve seen before Ethereum rallies.

From a technical analysis perspective, XRP is currently trading above a symmetrical triangle pattern, a formation that often precedes a significant price movement. A decisive break above the upper trendline of this triangle could trigger a rally toward the $2.65 level, representing a substantial gain from current prices. However, it’s crucial to monitor key support levels, as a failure to hold these levels could invalidate the bullish outlook.

The confluence of rising institutional demand, positive derivatives sentiment, and a potentially bullish technical pattern suggests that XRP could be poised for a significant upward move. While the digital asset market remains inherently volatile, the current setup presents a compelling case for further gains, provided that key support levels are maintained and the broader market conditions remain favorable.

In conclusion, XRP’s current market dynamics reflect a shift toward bullish sentiment, driven by increasing institutional participation and positive developments in the derivatives market. The potential breakout from a symmetrical triangle pattern could further amplify these gains, positioning XRP as a noteworthy asset for both institutional and high-net-worth investors seeking exposure to the digital asset space.

Related: Ripple Price: XRP Aiming for $2.5?

Source: Original article

Quick Summary

XRP is showing signs of bullish momentum, fueled by increasing institutional interest and positive sentiment among derivatives traders. Recent data indicates significant inflows into XRP investment products, suggesting a belief among investors that the market has bottomed out.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.