XRP is potentially nearing a significant breakout, influenced by extreme market conditions related to a major crypto options expiry. The broader crypto market context involves large Bitcoin options expiries that typically compress prices, followed by sharp directional moves.

What to Know:

- XRP is potentially nearing a significant breakout, influenced by extreme market conditions related to a major crypto options expiry.

- The broader crypto market context involves large Bitcoin options expiries that typically compress prices, followed by sharp directional moves.

- This matters for XRP and Ripple because post-expiry, liquidity dynamics suggest incentives to push XRP higher, with 2026 shaping up as a pivotal year amid growing institutional interest.

XRP is currently navigating a period of consolidation, but according to market analyst Zach Rector, this may be the prelude to a substantial breakout. Rector points to the confluence of a historic Bitcoin options expiry and favorable liquidity dynamics as potential catalysts. He suggests that while short-term volatility may test market participants, the overall setup favors a strong upside move for XRP as we approach 2026.

XRP Faces Historic Options Expiry Pressure

The crypto market is bracing for the largest Bitcoin options expiry to date, with over $23 billion in notional value set to expire. These events tend to force prices into tight ranges as market makers maneuver to maximize profits from both long and short positions. This dynamic has contributed to the frustrating consolidation observed in Bitcoin and altcoins like XRP. Once these contracts expire, the artificial pressure should ease, potentially paving the way for significant directional movements.

Liquidity Data Shows Incentive to Push XRP Higher

Rector highlights that liquidity maps across major exchanges indicate a greater incentive to push XRP upward rather than downward. A move towards the $2.50 level would trigger substantial short liquidations, outweighing the long liquidations that would occur from a brief dip towards the $1.60-$1.70 range. This imbalance suggests that while a downside liquidity sweep is possible, any such dip is unlikely to be sustained.

Consolidation Nearing Its End

The extended consolidation XRP has experienced since late November is viewed as a deliberate holding pattern orchestrated by market makers ahead of the options expiry. Rector believes that the price has been kept within a tight range to maximize profits, rather than due to any fundamental weakness in XRP. A decisive move back above $2.50 would signal that the local bottom is in place, and XRP is poised to trend higher as the market looks toward the new year. As of the time of writing, XRP is trading at $1.87, reflecting a 1.15% increase over the past day.

ETF Activity Strengthens the Bullish Case

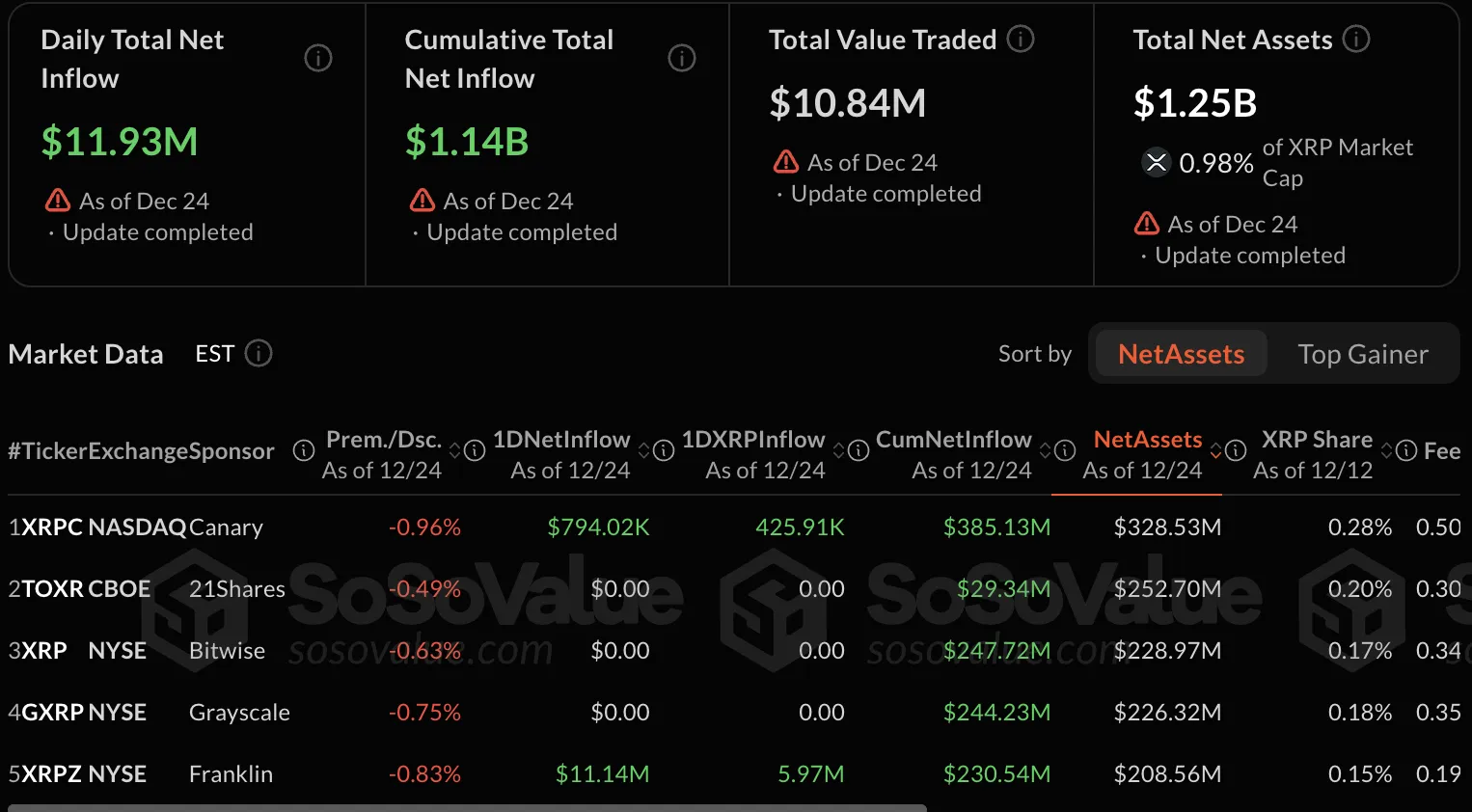

Beyond short-term price action, the record-setting activity in the ETF market is a key structural tailwind for XRP. The U.S. ETF industry has witnessed historic inflows, and XRP ETFs have been notable within this trend.

-

U.S. ETFs attracted $1.4 trillion in net inflows in 2025, a historic record

-

ETF trading volume reached $57.9 trillion, also a new high

-

XRP’s spot ETF from Canary Capital set the day-one volume record

Moreover, XRP ETFs have recorded some of the strongest inflows of the year, even as Bitcoin and Ethereum ETFs have experienced outflows. This suggests growing institutional interest in XRP, which could support its price appreciation.

Why 2026 Could Be a Defining Year for XRP

Looking ahead to 2026, Rector posits that XRP is currently being accumulated at a valuation below its perceived fundamental value. He cites expanding ETF adoption, strategic institutional positioning, and an anticipated liquidity expansion as key factors that could provide significant tailwinds for XRP. According to Rector, the present weakness is more attributable to positioning and pressure from derivatives, rather than any long-term fundamental issues. These factors suggest that XRP could be gearing up for a substantial move as market dynamics shift.

In summary, while near-term turbulence is expected, the consolidation phase for XRP appears to be nearing its end. Traders should closely monitor volatility around key levels, with a potential downside sweep followed by a sharp recovery aligning with a bullish breakout thesis. As we move closer to 2026, XRP may be setting the stage for a much stronger move, driven by favorable market conditions and increasing institutional interest.

Related: XRP ETF Crosses $1.25B, Signals Muted Impact

Source: Original article

Quick Summary

XRP is potentially nearing a significant breakout, influenced by extreme market conditions related to a major crypto options expiry. The broader crypto market context involves large Bitcoin options expiries that typically compress prices, followed by sharp directional moves.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.