XRP has demonstrated renewed bullish momentum, breaking through the $2.197 resistance level, signaling a potential continuation of its upward trend.

What to Know:

- XRP has demonstrated renewed bullish momentum, breaking through the $2.197 resistance level, signaling a potential continuation of its upward trend.

- A new DeFi protocol, Firelight, is set to integrate XRP into the DeFi space, offering holders the opportunity to earn yields and enhance the resilience of the DeFi ecosystem.

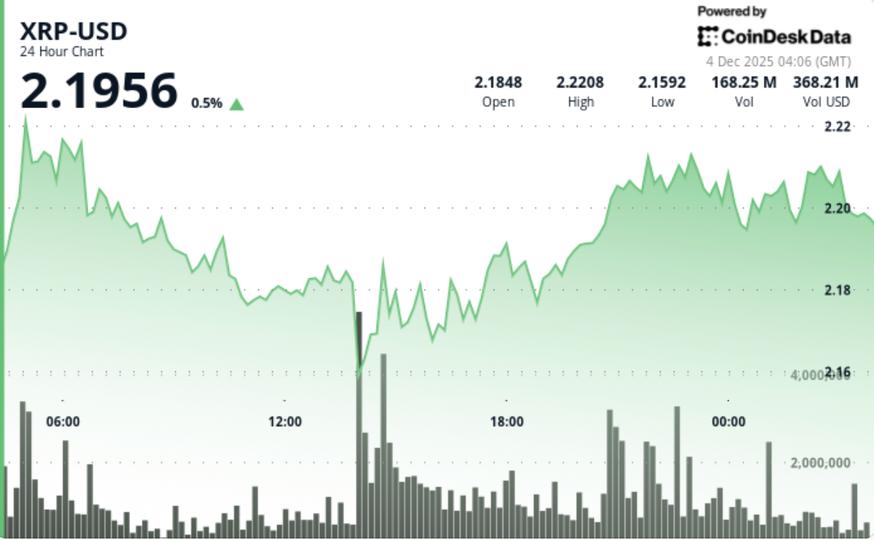

- Technical analysis suggests that maintaining structure above $2.204 is crucial for sustaining the breakout, with $2.22 acting as the next key resistance level to overcome.

XRP has shown strong signs of recovery, decisively breaking through the $2.197 resistance and indicating a resurgence of bullish sentiment fueled by institutional interest. This positive movement occurs amidst broader improvements in crypto sentiment and innovative developments within the XRP ecosystem. Investors are closely watching these developments for potential opportunities.

The introduction of Firelight, a new DeFi protocol built by Sentora and backed by Flare Network, marks a significant step in integrating XRP into the decentralized finance landscape. By leveraging Flare’s FAssets system, Firelight allows XRP holders to stake their tokens and earn rewards, offering a novel yield-earning opportunity. This integration not only enhances the utility of XRP but also contributes to the overall resilience of the DeFi ecosystem by providing on-chain protection against hacks.

From a technical analysis perspective, XRP’s ability to maintain its position above the $2.204 micro-support level is crucial for sustaining its upward trajectory. Overcoming the $2.22 resistance could pave the way for further gains, potentially targeting the $2.33–$2.40 resistance band. Volume confirmation remains a key indicator, with sustained prints above 600K per hour supporting another expansion leg.

Traders should closely monitor these technical levels and volume metrics to gauge the strength and sustainability of the current rally. While rising funding rates reflect growing bullish conviction, they also highlight the increasing leverage risk, underscoring the importance of prudent risk management. The developments surrounding XRP, coupled with positive undertones from potential Bitcoin ETFs, suggest a promising outlook.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP has demonstrated renewed bullish momentum, breaking through the $2.197 resistance level, signaling a potential continuation of its upward trend. A new DeFi protocol, Firelight, is set to integrate XRP into the DeFi space, offering holders the opportunity to earn yields and enhance the resilience of the DeFi ecosystem.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.