XRP has emerged as one of the most closely watched cryptocurrencies during the current bull cycle. However, a recent warning has crypto analysts split on whether the XRP rally is nearing its peak or still has room to run.

XRP has emerged as one of the most closely watched cryptocurrencies during the current bull cycle. However, a recent warning has crypto analysts split on whether the XRP rally is nearing its peak or still has room to run.

Analyst Cautions on XRP’s Peak Timing

Some market observers have sounded alarms that the XRP bull market may be approaching its zenith, drawing comparisons to past surges that ended in dramatic downturns. One such voice, known online as STEPH IS CRYPTO, highlighted XRP’s performance during earlier cycles. According to his analysis, history could be repeating itself, with a potential peak likely within the next one to two months followed by a steep correction.

In previous cycles, XRP’s price experienced significant volatility. During the 2018 bull run, the token reached a high of $3.40 but plunged to below $0.30 by the end of that year. Similarly, in April 2021, XRP climbed to nearly $2 before slipping under the $0.50 level again.

His prediction comes at a time when XRP is already down from its recent high of more than $3.65 in mid-July and currently trades under $3. This wary outlook stirred lively debate among XRP supporters, many of whom argued that current market dynamics and adoption were not fully accounted for in the historical comparison.

Performance chart of XRP highlighting key price movements during previous market cycles.

Contrary Views See Significant Upside Potential

Other analysts are taking a distinctly optimistic stance. One crypto influencer, known as Gordon on X, predicted a “monumental run” for XRP that could push the asset’s value to nearly $6 in the near term.

Meanwhile, crypto trader Javon Marks went even further, forecasting a potential surge beyond $9.60. This ambitious projection relies on technical analysis using Fibonacci extensions, placing the 1.618 level at $9.63 and the 2.618 extension beyond $123 — an outcome that remains highly speculative as of now.

Supporting the bullish case are macroeconomic factors and institutional developments. A shift in U.S. monetary policy—including the potential for interest rate cuts as soon as next month—could encourage greater investment in high-risk assets like cryptocurrencies. Lower rates reduce borrowing costs and often lead to increased liquidity in financial markets.

Spot XRP ETF Could Fuel Further Demand

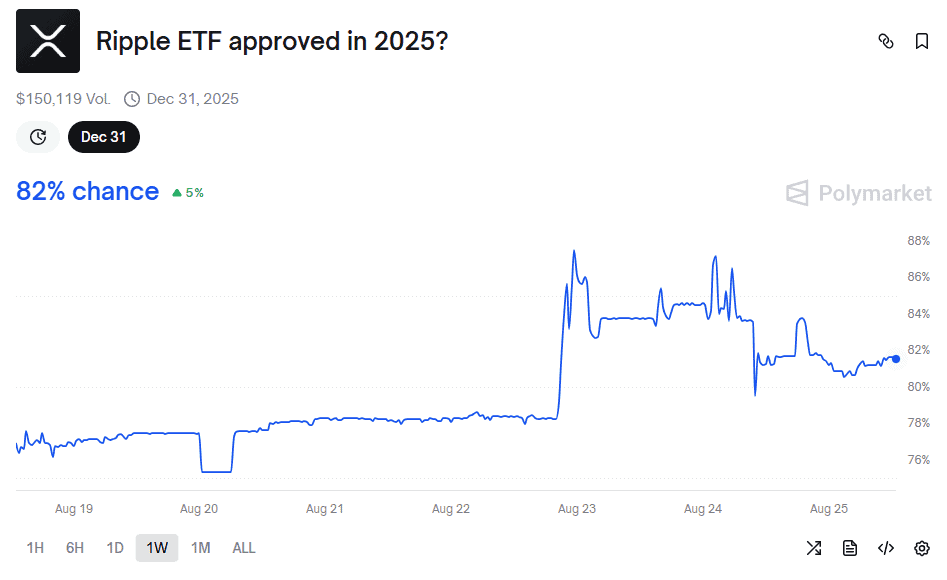

Adding to the momentum is speculation around the approval of the first spot XRP ETF in the U.S. financial market. A green light would enable investors to gain direct exposure to XRP through a regulated fund, potentially drawing in new institutional capital. According to Polymarket, the probability of approval by year’s end currently stands at approximately 82%.

Such an ETF would be a major milestone, providing easier access to XRP for mainstream investors and adding legitimacy to its role in the broader financial ecosystem. As this scenario develops, traders and analysts alike will be keeping a close eye on regulatory updates and market reactions.

Potential approval of a spot XRP ETF could act as a catalyst for further price growth.

Related: XRP Price: $12M Max Pain for Bears

Whether XRP’s price will soon stage another breakout or face yet another correction remains to be seen. The debate underscores the complex mix of historical patterns, investor sentiment, and external market forces that continue to shape the trajectory of Ripple’s digital asset.

Quick Summary

XRP has emerged as one of the most closely watched cryptocurrencies during the current bull cycle. However, a recent warning has crypto analysts split on whether the XRP rally is nearing its peak or still has room to run.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.