A confluence of bullish technical indicators on XRP’s weekly chart is mirroring setups that preceded significant rallies in late 2024 and mid-2025. This pattern emerges amid a broader context of XRP’s struggle to maintain upward momentum, following a recent rally and subsequent pullback.

What to Know:

- A confluence of bullish technical indicators on XRP’s weekly chart is mirroring setups that preceded significant rallies in late 2024 and mid-2025.

- This pattern emerges amid a broader context of XRP’s struggle to maintain upward momentum, following a recent rally and subsequent pullback.

- The alignment of these indicators could signal a potential shift in XRP’s trajectory, influencing institutional and high net worth investor sentiment.

XRP is showing signs of a potential bullish resurgence, with technical indicators aligning in a way that historically preceded substantial price rallies. Investors are watching closely to see if XRP can break its current pattern of short-lived gains and establish a more sustained upward trend. The confluence of these factors could set the stage for a significant move.

Aligning Bullish Pattern for XRP

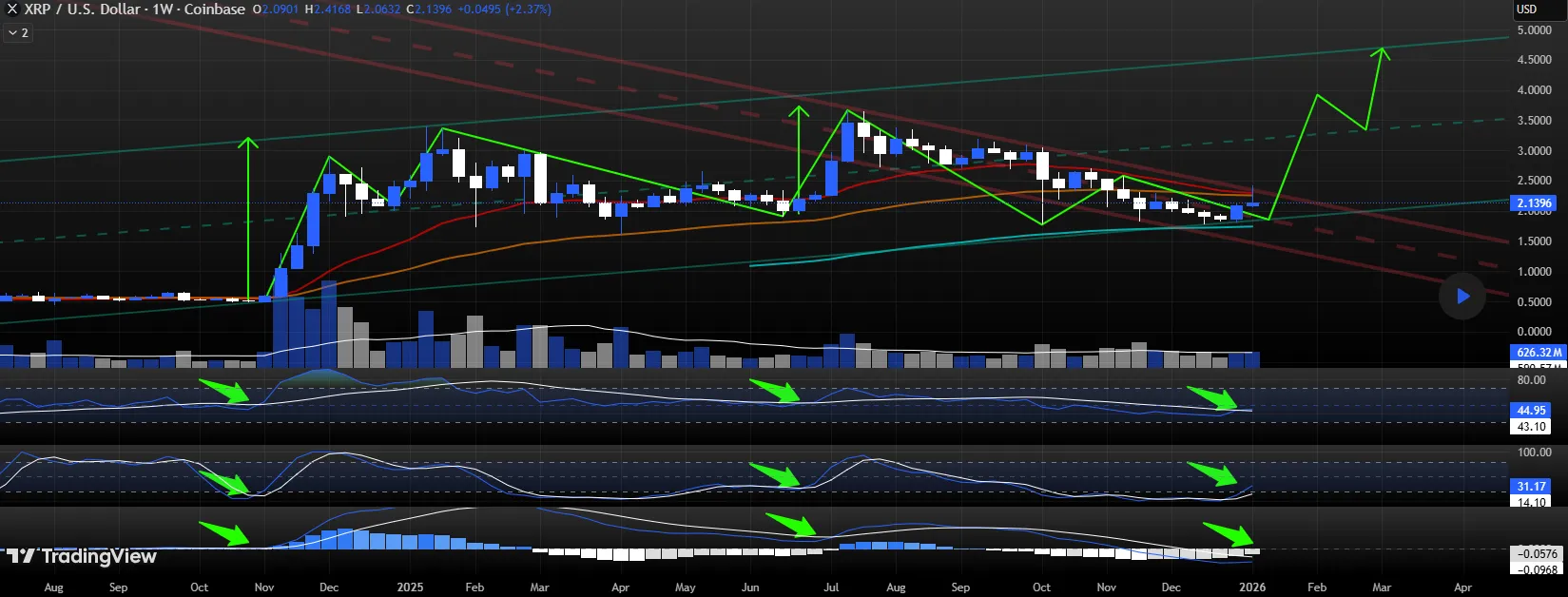

Analysis of XRP’s weekly chart reveals a convergence of bullish signals across multiple oscillators. The analyst Cryptadian pointed out that similar conditions preceded the nearly 400% rally in November 2024 and the 64.5% surge in July 2025. The simultaneous crossover of these indicators suggests a potential shift in market momentum.

Specifically, the analysis highlights a Relative Strength Index (RSI) crossover, which, while not typical for a standard RSI, occurs when the weekly RSI is applied to a moving average or when comparing RSIs with different time periods. This crossover indicates increasing buying pressure.

MACD and Stochastic RSI Crossover

In addition to the RSI, a bullish Stochastic RSI crossover is also forming. This crossover occurs when the faster %K line crosses above the slower %D line, signaling a shift in momentum. On the weekly chart, the %K line at 30.73 has crossed over the %D line at 13.9, indicating a potential increase in buying interest.

Furthermore, a Moving Average Convergence Divergence (MACD) crossover appears imminent. The receding red bars on the histogram suggest that bearish momentum is waning. As the MACD and signal lines converge, a crossover could confirm a shift towards bullish momentum.

Historical Parallels and Potential Price Targets

The analyst emphasizes that the simultaneous crossover of these three oscillators on the weekly timeframe has historically preceded significant uptrends for XRP. The previous occurrences of these crossovers led to substantial price increases, suggesting that a similar move could be on the horizon.

Notably, a repeat of this pattern could see XRP break out of its current descending channel and potentially reach new all-time highs. XRP has been trading within this wedge since its July 2025 peak, and a breakout could signal a significant shift in market sentiment.

XRP also trades within a broader ascending channel, and the late 2025 correction brought it down to its lower support trendline. If historical patterns hold, XRP could rally towards the top of this channel, potentially reaching a new all-time high around $4.7.

Market Structure and Institutional Implications

For institutional investors, these technical signals provide valuable insight into potential entry and exit points. The alignment of multiple indicators increases the confidence level in a potential trend reversal. However, it’s crucial to consider broader market conditions and regulatory developments before making any investment decisions.

The potential for XRP to break out of its descending channel and reach new all-time highs could attract significant institutional interest. Increased liquidity and trading volume would further validate the bullish outlook. However, regulatory clarity and the resolution of ongoing legal issues remain critical factors for sustained institutional adoption.

Conclusion

The confluence of bullish technical indicators on XRP’s weekly chart presents an intriguing opportunity for investors. While historical patterns suggest a potential for significant price appreciation, it’s essential to approach the market with caution and consider broader market dynamics. Institutional investors should closely monitor regulatory developments and market structure to make informed decisions.

Related: XRP Signals Turn Positive, Derivatives Data Shows

Source: Original article

Quick Summary

A confluence of bullish technical indicators on XRP’s weekly chart is mirroring setups that preceded significant rallies in late 2024 and mid-2025. This pattern emerges amid a broader context of XRP’s struggle to maintain upward momentum, following a recent rally and subsequent pullback.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.