XRP fell to $1.70, mirroring a broader cryptocurrency market downturn led by Bitcoin’s decline. Market uncertainty, possibly influenced by geopolitical tensions and shifts in ETF flows, has contributed to the downturn.

What to Know:

- XRP fell to $1.70, mirroring a broader cryptocurrency market downturn led by Bitcoin’s decline.

- Market uncertainty, possibly influenced by geopolitical tensions and shifts in ETF flows, has contributed to the downturn.

- Negative XRP ETF net flows exacerbate the token’s price pressure, highlighting the impact of institutional investment on XRP’s liquidity and market performance.

Cryptocurrency markets experienced a significant downturn on Thursday, with Bitcoin leading the decline to multi-month lows. XRP, Ripple’s native token, was not immune to the selloff, dropping to $1.70, a level not seen since early October. This correction follows a period of relative stability and optimism at the start of the year, raising concerns about the short-term trajectory of the digital asset market.

XRP’s Rocky Start to the Year

XRP began 2026 with a surge, briefly exceeding $2.40 amid signs of market recovery and positive inflows into XRP-related ETFs. However, this momentum has faded in recent weeks, with growing geopolitical uncertainty and shifting market sentiment contributing to the current downturn. The initial enthusiasm surrounding XRP ETFs appears to have waned, adding downward pressure on the token’s price.

Broader Market Weakness Weighs on XRP

The overall weakness in the cryptocurrency market is a primary factor behind XRP’s recent decline. Bitcoin’s drop to $81,000 triggered a widespread selloff across altcoins, with many experiencing double-digit percentage losses. This correlation underscores XRP’s sensitivity to broader market trends and its role within the larger cryptocurrency ecosystem.

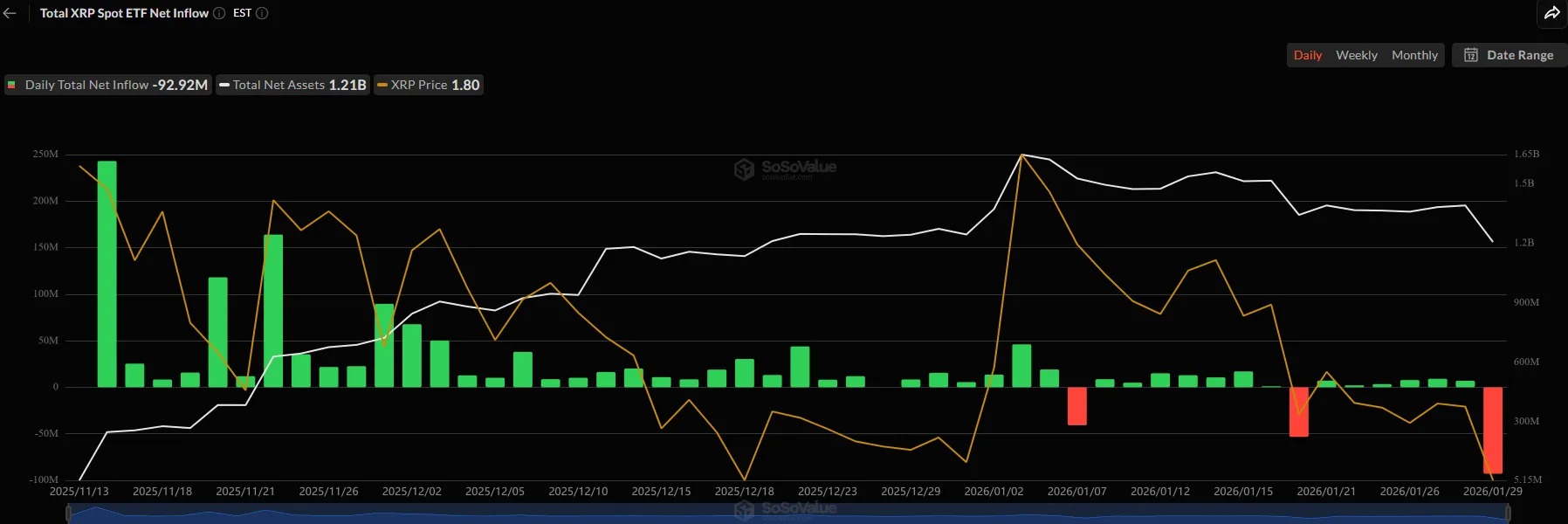

ETF Flows Turn Negative

XRP ETFs have experienced a significant shift in momentum, recording their worst single-day net outflow since the launch of the first fund in mid-November. On January 29, total net outflows reached $92.92 million, reducing cumulative net inflows from $1.26 billion to $1.17 billion. This reversal in ETF flows suggests a change in institutional investor sentiment toward XRP, potentially impacting its liquidity and price stability.

Analyst Perspective

CryptoWZRD noted that XRP’s price action remains vulnerable below $1.82, suggesting the potential for further volatility. A rebound above this level, however, could signal a shift in momentum and provide support for a bullish outlook. This technical analysis highlights the importance of key price levels in determining XRP’s short-term trajectory.

Implications for Ripple and the XRP Ecosystem

XRP’s recent price drop raises questions about the token’s near-term prospects and its role in Ripple’s broader ecosystem. While market corrections are a normal part of the cryptocurrency landscape, the negative ETF flows and broader market uncertainty could present challenges for XRP’s price recovery. The performance of XRP remains closely tied to developments in the ongoing regulatory landscape and Ripple’s ability to expand its cross-border payment solutions.

In conclusion, XRP’s recent decline reflects a confluence of factors, including broader market weakness, shifting ETF flows, and ongoing market uncertainty. While the short-term outlook remains uncertain, XRP’s long-term potential will depend on its ability to navigate regulatory challenges and capitalize on opportunities in the evolving digital asset landscape.

Related: Crypto Derivatives Data Signals XRP Liquidity

Source: Original article

Quick Summary

XRP fell to $1.70, mirroring a broader cryptocurrency market downturn led by Bitcoin’s decline. Market uncertainty, possibly influenced by geopolitical tensions and shifts in ETF flows, has contributed to the downturn.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.